- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Rejection error: IND-031-04 (AGI or PIN)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejection error: IND-031-04 (AGI or PIN)

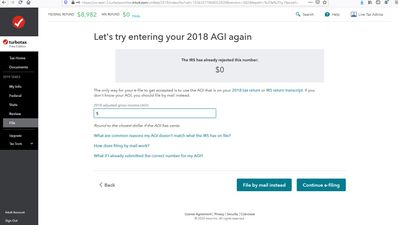

So you are saying I don't need AGI not even to do online returns. Why am I getting error message defined in my previous and also first message then? When I try to click to fix the error, I'm being asked for AGI. Here is the proof:

Yes I have access to the printer but in my case this is not relevant because printer is for people who can be physical mailing.

Income is from job, although this makes it harder because that section is not filled on credit report (e.g. name of employer) but I can repeat again: income is from job. Don't have W2 or any tax document but have credit report.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejection error: IND-031-04 (AGI or PIN)

Sorry yes you do need the 2018 AGI to efile. But since it is rejecting you will have to physically print and mail your return this year. You will not be able to get it to go through.

When did you file last year's 2018 return? Was it Accepted last Year? I can't remember, have you tried using zero for the AGI?

If you can't find the AGI or if it keeps rejecting you will have to mail your return. I would just give up and stop wasting time and driving yourself crazy and mail it to the IRS and state. Why don't you want to mail it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejection error: IND-031-04 (AGI or PIN)

If you are unable to get your 2018 AGI from an IRS Transcript either mailed to you or online, and your 2018 Tax Return is not available to you, and you do not want to pay $50 for a full return from the IRS, then you are going to have to mail in your 2019 return.

If you are unable to put your 2018 AGI on your 2019 e-filed return, the IRS will not accept it. It is a security method to deter people from filing returns that are not theirs. You will need to mail in your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejection error: IND-031-04 (AGI or PIN)

The prior answer is not telling you to request anything. It's telling you to print out the tax return you already tried e-filing and sign it and file it by mail instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejection error: IND-031-04 (AGI or PIN)

I assume return 2018 was filed last year yes. If so, it was in March I believe. No idea if it was accepted. I don't have ANY tax information of any kind. Regarding your question related to zero: if you are referring to doing the return for 2019 then yes, as image file shows in my previous message, 0 agi was rejected. I cannot mail it. Those are 1000+ envelopes. Only one return can be mailed in one envelope. Besides this, I don't have a single W2 or whatever needs to be attached. Impossible to get those.

You didn't mean it seriously, did you? Hopefully not. Why on the world would someone, regardless if related to IRS or not, deter anyone to fill returns that are not their? This is against any human logic. Is this why AGI is not accepted? If they require such security preventation then IRS should delete both restrictions to obtain online transcript: full account number and incoming verification sms. This way AGI can be obtained using transcript.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejection error: IND-031-04 (AGI or PIN)

What are you talking about? It's only 1 envelope for your 1040 tax return. And just a couple pages. And 1 envelope to mail a state return. What do you think you need to mail?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rejection error: IND-031-04 (AGI or PIN)

@Susanne123 In my humble opinion it would probably be best for you to seek out a local tax professional to assist you in completing your 2019 tax return. It may be that the TurboTax tax preparation software is just not correct for your personal situation.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sseger03

New Member

alex_garzab

New Member

DavidRaz

New Member

doubleO7

Level 4

keenerbp

New Member