- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Recently married

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recently married

I recently got married, and we're trying to get our taxes to be as close to $0 when we file our taxes next year. When we use the IRS calculator to estimate taxes, it had said we would be getting $1,800 back as of now. How do we make it so our employers take less taxes from our paychecks so we don't end up getting a big refund? My salary is $55,000, my husband's is $60,030. I have a per diem job making $17/hour and I work about 10-20 hours a month. We live in CT.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recently married

The very last step in the IRS calculator provides information for new W-4s for both jobs -- with the assumption that you want to end the year with no refund and no balance due.

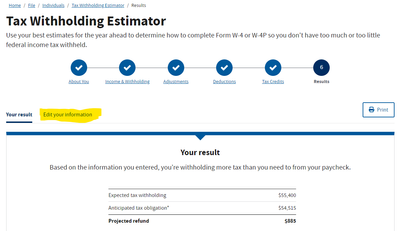

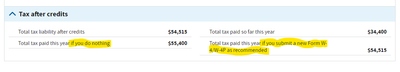

I made up some numbers and entered them into the calculator. The refund amount that it estimated I would get if I didn't change anything at all was $885. (The estimated tax liability was $54,515 and my fictional people were on track to have withholdings of $55,400.)

But, by making the changes recommended in the two W-2s below (one for each job), my fictional people would be on track to have $54,515 withheld -- resulting in an even-dollar return.

Go back to the IRS calculator, and -- on the Step 6 screen -- click on the link to Edit Your Information

Then, scroll to the bottom -- you should see a summary of what your tax withholdings would be with and without changes to your W-4s.

Thank you for participating in this event!

-- KimberW

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jlfarley13

New Member

sacap

Level 2

user17557017943

New Member

kruthika

Level 3

shrivatsk

New Member