- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

You'll just list the payer as IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

You'll just list the payer as IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

File it as Interest Income only.... I personally looked into this. The Number you are all searching IS NOT an EIN and this is a notice that THE IRS PAID YOU INTEREST INCOME!!! that number you are all reading is an internal number the IRS uses and has NOTHING to do with EIN numbers. You were paid interest income FROM the irs due to a delay in a tax refund or similar. The notice is telling you this and instead of receiving a actual 1099 from a business entity, the IRS sent you that notice. Their mistake for the last 10+ years is they keep placing that number that "resembles" an EIN and the poor sap that owns that EIN is paying the price for it by getting THOUSANDS of inquiries into their business. As of today, January 17, 2021, the number in question was issues to another business entity who incorporated in 2019, thus IMPOSSIBLE for that entity to be the one in the notice from 2011. It is a crying shame the IRS has not stopped using that number which has caused THOUSANDS of google searches over the last decade looking into the issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

Where do i list on my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

More assistance and details on form 1099-INT has been provided by clicking here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

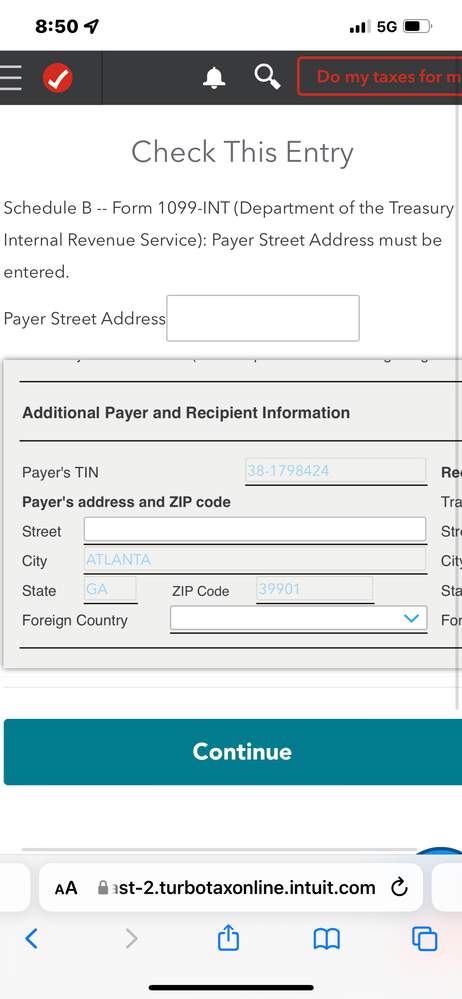

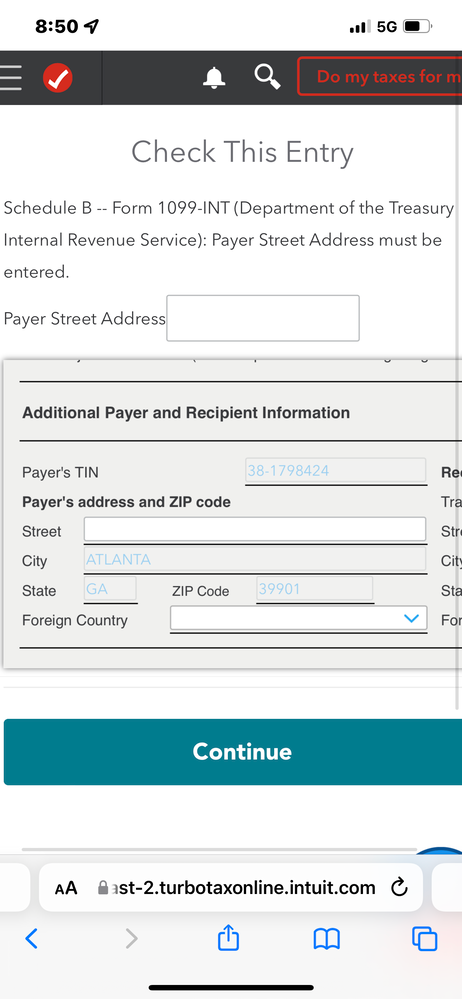

TurboTax wants an street address, but there is none on the form. What address do I put in the address line?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

You may need to clarify where you are at in the interview that is asking for an address. Entering a form 1099-INT in TurboTax does not ask for payer's address.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

I am having the same issue. It only gives city state and zip on the form. Turbo tax keeps stopping me from filling until I give it a street address smh. Here’s a photo. Ppl need to stop saying this is not happening.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

It’s doing it to me too, so yes it actually does require it. Smh.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

This does not affect your return calculations. Try entering any 3 or more random letters/numbers in the box above the form that reads "Payer Street Address."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

I can't believe turbo tax won't let you file without street address for the irs which isn't on letter 6419. I am afraid to enter something random.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

Here is an official address to enter for the IRS: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

There are literally four different IRS offices where I live here in Atlanta and when I talked to a TurboTax live representative they told me to just enter a street address from one of those so I did and they excepted it now fingers crossed. Honestly this is really stupid because you’ve got their TIN number and you clearly see it’s the IRS so what’s the issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

Thank you for the info, I am concerned to put a different address because my letter came from Austin, TX 73301.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-INT from the IRS listing interest paid or credited with the payer's Federal I?dentification Number but not listing the business name. How do I find out

Good luck! I just talked to the irs on the phone and the nice lady that helped me confirmed there was no street address for the center that my 1099-INT form came from. So maybe this is a tt programming error? Like a part of the form that can't be left blank to e-file but the info that needs to be entered doesn't exist 🤷♀️

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

soccerdad720

Level 2

Janeen228

Level 1

SueWilkinson2

Returning Member

erin-lynn-mcintosh

New Member

damianvines

Level 2