- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Yes or No Question for virtual currency transaction for 2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes or No Question for virtual currency transaction for 2021

I purchased ATOM with US Dollar $ . I didn't sell, just holding but it seems I received rewards by staking.

* My answer to the IRS question is still " NO " , right?

* Do I have to report the rewards I received as income? If so, where should I report?

Thank you so much!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes or No Question for virtual currency transaction for 2021

How is staking taxed?

The IRS has not issued explicit guidance on how staking is taxed. However, most tax experts agree that rewards will be taxed as income at the time of the receipt based on previous IRS guidance on mining taxes.

this would go on schedule 1 line 8Z

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes or No Question for virtual currency transaction for 2021

@Kiki if ATOM is a virtual currency, your answer to the question is 'yes'.

the question asks if you had a transaction - and a 'transaction' is a "buy' or a 'sell'.

you state your PURCHASED ATOM, so that is a transaction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes or No Question for virtual currency transaction for 2021

I am still confused. Below is what the IRS says in Frequently asked Question. I would appreciate any advice. I just don't want to make any mistake that may lead to so much headache later.

Q5(a). The 2021 Form 1040 asks whether at any time during 2021, I received, sold, exchanged, or othe...

A5(a). If your only transactions involving virtual currency during 2021 were purchases of virtual currency with real currency, you are not required to answer “yes” to the Form 1040 question, and should, instead, check the “no” box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes or No Question for virtual currency transaction for 2021

If you only bought crypto in 2021 then you will answer NO for 2021 ... last year the 2020 question was worded differently ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes or No Question for virtual currency transaction for 2021

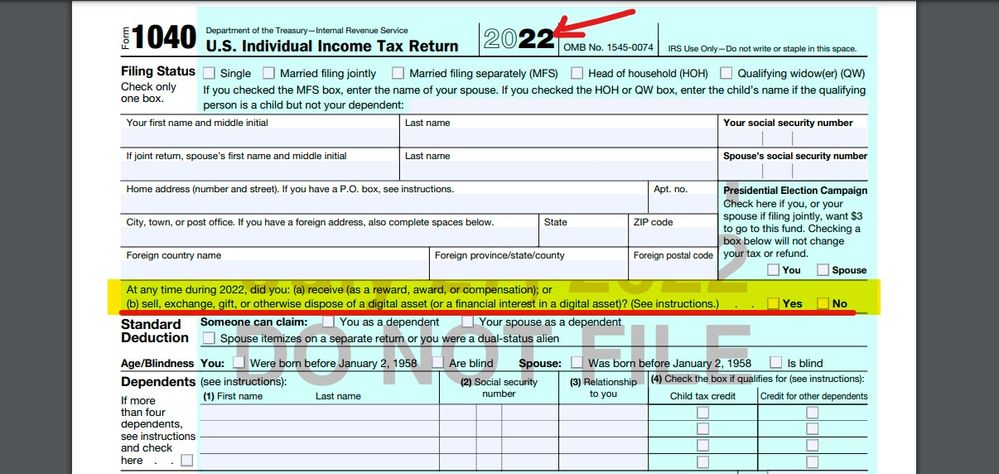

@Critter-3 and the language in the 2022 draft changes it again.....

https://www.irs.gov/pub/irs-dft/f1040--dft.pdf

"(b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Yes or No Question for virtual currency transaction for 2021

Of course ... they are still trying to figure out this crypto situation ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

brian94709

Returning Member

asdfasdf4

Returning Member

patamelia

Level 2

patamelia

Level 2

Ch747

Level 1