in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: WT - How did you delete the Worksheet? - Re: Sale includes a disallowed wash sale loss (code W)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

Same issue. I am about to scream. Will not take any number I put in. Does not allow you to put any cents .xx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

I have one wash sale of 0.12. So if I remove the 0.12, it clears the TurboTax error, but the entry will no longer be coded as having a wash sale. Won't this be an issue with the IRS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

I actually bought a hard copy of TurboTax Premier - Windows for $100!! Installed it and updated it, and the same issues occurs with wash sales. I can delete the "0." and it continues to the next page, however when i redo the smart scan at the end, all the same "0."'s reappear when reviewing the errors. I feel like TurboTax is responsible if i get audited. My taxes are already so dam complex, this is just something i shouldn't have to deal with.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

Unreal. The best advice seems to be to delete the auto upload and do it manually. The problem with that is I waited until it was available to auto upload because i didnt want to do it manually. I wanted it auto to make sure all info was correct. I could have filed manually a week and a half ago. Probably my last file with TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

I used @AnnetteB6 answer to solve the blank when zero work around. I read in another post that this issue has been reported to TurboTax.

I don't know how to mark this as Best Answer but it is the best answer.

Thanks Annette

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

I'm running into this same issue. And Wash Sale Loss Disallowed is greater than $.49 so the work around suggested will not work for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

Update: Annete's answer actually worked for me! I deleted the one entry I had less than $0.49 and it worked for me. I left the other entries above $0.49.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

That's great to hear and thanks for letting me know.

I've began using TurboTax in 2005 and this is the earliest I've used their tax software. I've found several glitches that needed work arounds which happens when software is just released. No matter how much testing is done it's almost impossible for Intuit to find every bug prior to releasing the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

So I had to build a list of the transactions with issues and go back to the work sheet and edit each of them.

for the wash sale.

Highlight the amount, hit delete key and then continue.

This fixed the issue, it took a long time but its done.

Please have it fixed for next years returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

Annette,

You are the 4th expert who has suggested this fix, and I have to throw in my lot with the two other guys on this thread because I also tried the fix and it won't work.

Guys, I don't blame you for being upset. I am told that Tax Act does not round up the individual entries, only the summaries, and this solves the problem. Perhaps you should try them.

Best of luck,

prof.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

WT,

I am having the same problem. Give me instructions on how to delete the worksheet. Are you using the desktop version or online version?

Thanks,

prof

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

I'm using the online version.

Go through the review process and write down the transactions that is having issues.

Then go back to the income part of the taxes and edit the 1099 interest.

When you edit it will list all the sales transactions.

you need to locate the ones that were flagged in the review.

find the ones and just delete the wash $ amount and then click the continue or done button at the bottom.

load the next page and answer the question and click done.

Then find the next sales transaction that had issues and do the same.

once your done try the review process again.

Hope that helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

To delete the worksheet, it depends if you are using TurboTax Online or TurboTax CD/Download.

For TurboTax Online, follow these steps:

- From the left menu, select Tax Tools.

- Select Tools.

- Scroll to Delete a Form.

- Scroll to your import, Form 1099-B or supporting schedules Form 8949 for each category and individually select Delete and Delete Selected Form and Continue.

For TurboTax CD/Download, go to the Forms Mode. Open the screen for Form 1099-B and in the lower left cover of that window, select Delete Form.

If you are not having blanking out the wash sale work and you do not want to re-upload or otherwise alter what was originally sent to you, then you can edit the Wash Sale amount for less than $1.

In TurboTax Online:

- Click Federal from the left menu.

- Scroll down to Stocks, Mutual Funds, Bonds, Other and Review.

- Click the Review button by the stocks that need correction.

- Click the pencil icon next to the stock transaction at Review your sales.

- Continue through the next screens until you again are at Review your sales and reach Now we'll walk you through entering your sale details. Scroll down and check the box for I have more info to enter that I don't see here.

- When testing this, I was able to enter amounts less than $1 in this area.

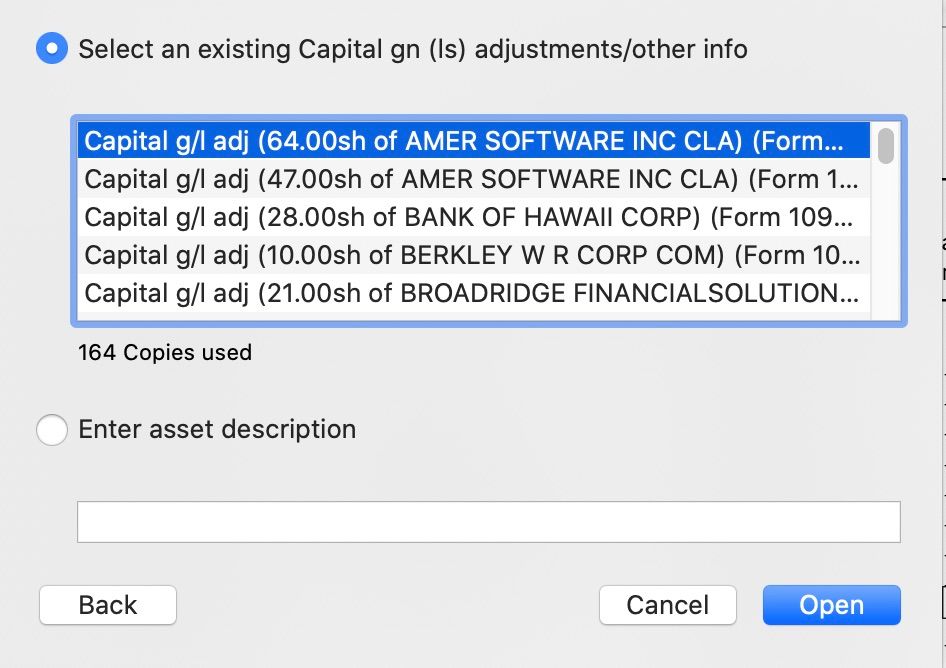

In TurboTax CD/Download, before correcting the Wash Sale, try using the "Capital g/l adj" page. instead.

To find this form, follow these steps:

- From the Forms Mode, click Open Form.

- In the Search box, enter Capital gn.

- Under Form 1099-B Worksheet, select Capital gn(ls) adjustments/other info and Open Form.

- A new window will open: Step 1: Add Capital gn (ls) adjustments/other info. Scroll to find the sheet for Capital g/l adj and select Next and Finish.

- In Part III Specific Adjustments, scroll down and check the box next to Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all)

- Click on the box where an amount should be. Then, a + will occur to the left.

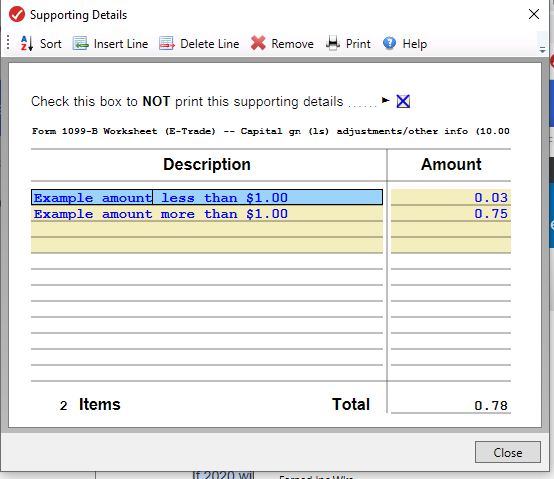

- Click on the + Icon to open up the Description and Amount Worksheet and list your amounts here with the pennies.

- If you are entering a summary amount, you could instead enter the adjustment in Part II of this same form if nothing is adjusted in Part III. The same procedure would be used. The code used would be W.

- In Part III Specific Adjustments, scroll down and check the box next to Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all)

Screenshot for The Part II Alternative:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

When I follow your instructions for the downloaded version of Turbo Tax, I get a screen that gives me two options, one to look up the specific 1099B sheet for the stock transaction I want to edit to remove the wash sale error, and the other to enter asset description. If I chose the first option the program takes me to the specific transaction. It will allow me to change the sales and purchase costs but it will not allow me to change the wash sale amount. Should I be using the second option? Here's a screen shot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all) shows 0 the amount is .15 but doesn't work. No value works, What should I do?

Why am I being charged over 1000.00 on my refund

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RandlePink

Level 2

RandlePink

Level 2

karunt

New Member

johnba1

New Member

kbrew87

New Member