- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

To delete the worksheet, it depends if you are using TurboTax Online or TurboTax CD/Download.

For TurboTax Online, follow these steps:

- From the left menu, select Tax Tools.

- Select Tools.

- Scroll to Delete a Form.

- Scroll to your import, Form 1099-B or supporting schedules Form 8949 for each category and individually select Delete and Delete Selected Form and Continue.

For TurboTax CD/Download, go to the Forms Mode. Open the screen for Form 1099-B and in the lower left cover of that window, select Delete Form.

If you are not having blanking out the wash sale work and you do not want to re-upload or otherwise alter what was originally sent to you, then you can edit the Wash Sale amount for less than $1.

In TurboTax Online:

- Click Federal from the left menu.

- Scroll down to Stocks, Mutual Funds, Bonds, Other and Review.

- Click the Review button by the stocks that need correction.

- Click the pencil icon next to the stock transaction at Review your sales.

- Continue through the next screens until you again are at Review your sales and reach Now we'll walk you through entering your sale details. Scroll down and check the box for I have more info to enter that I don't see here.

- When testing this, I was able to enter amounts less than $1 in this area.

In TurboTax CD/Download, before correcting the Wash Sale, try using the "Capital g/l adj" page. instead.

To find this form, follow these steps:

- From the Forms Mode, click Open Form.

- In the Search box, enter Capital gn.

- Under Form 1099-B Worksheet, select Capital gn(ls) adjustments/other info and Open Form.

- A new window will open: Step 1: Add Capital gn (ls) adjustments/other info. Scroll to find the sheet for Capital g/l adj and select Next and Finish.

- In Part III Specific Adjustments, scroll down and check the box next to Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all)

- Click on the box where an amount should be. Then, a + will occur to the left.

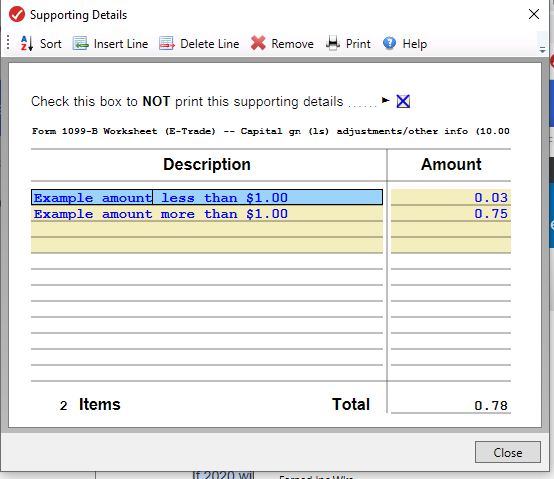

- Click on the + Icon to open up the Description and Amount Worksheet and list your amounts here with the pennies.

- If you are entering a summary amount, you could instead enter the adjustment in Part II of this same form if nothing is adjusted in Part III. The same procedure would be used. The code used would be W.

- In Part III Specific Adjustments, scroll down and check the box next to Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all)

Screenshot for The Part II Alternative:

February 17, 2021

1:27 PM