- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where is the unemployment $10,200 tax break

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the unemployment $10,200 tax break

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the unemployment $10,200 tax break

The software program is up to date and will calculate your unemployment correctly. Just enter your 1099G and the program will calculate how much--if any--of your unemployment is taxable on your federal return.

Enter your 1099G in Federal>Wages & Income>Unemployment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the unemployment $10,200 tax break

@briankeithbel wrote:

How can you tell if Turbo Tax is including the $10,200 unemployment tax break?

The unemployment compensation exclusion was updated across all TurboTax platforms, online and desktop, on 03/26/2021.

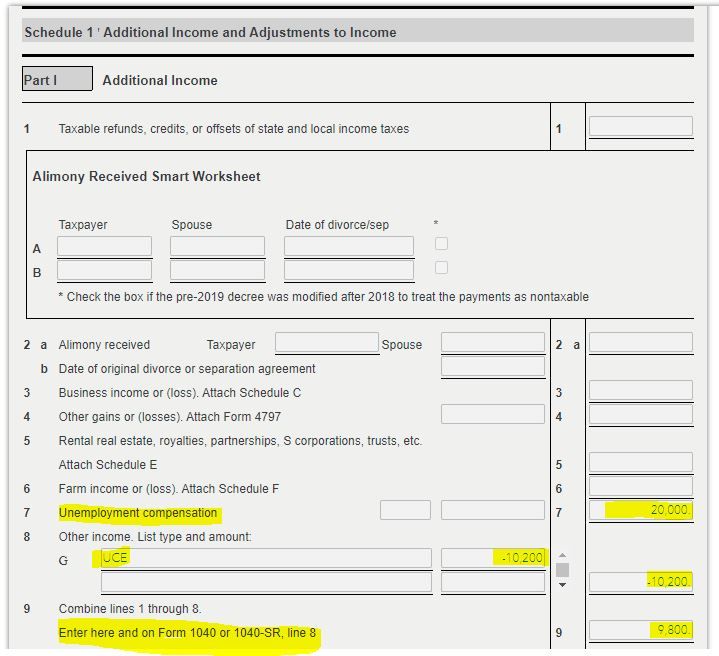

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the unemployment $10,200 tax break

What if my TurboTax 1040 (filed March 9, 2021), did not and currently as of (April 25, 2021 - in which I also still have NOT received my Refund, approaching week 11 of waiting), neither of these in TurboTax show/reflect this "UCE/Unemployment Compensation Exclusion", so what do I have to do in order to obtain it and thus, hopefully additional Refund $$$? I've never had to create/file and "Amendment" before. Thank you in advance, for any additional guidance/direction/help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the unemployment $10,200 tax break

Here is why you do NOT amend your return for unemployment:

Please read this very recent news from the IRS:

And...if you are still waiting for your refund and you had unemployment on your tax return, the IRS might just recalculate your refund before they issue it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Ivy12

New Member

1949jimi

New Member

jsredmond

New Member

jcbose

Level 3

Holidayinn98

Level 1