- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will the Digital Downloads of Turbo Tax Update for $10,200 Unemployment Exclusion?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

JamesG1 - you're a little behind in the conversation.... The IRS has already provided guidance, H&R Block and TurboTax have updated their online version, H&R Block has updated their thick client version but we're all waiting for TurboTax to update theirs, as promised to do back on Thursday.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I have been using TurboTax since 1997 and this wil be my last year...,.paid for a desktop software and yet they have not updated for those on unemployment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I have been using TurboTax since 1997 and this wil be my last year...,.paid for a desktop software and yet they have not updated for those on unemployment. I am a disabled senior on unemployment I want my tax refund which TurboTax is delaying by not getting the software update

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Help with manually updating your software has been provided by clicking here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Hi I know everyone believes the online version has been updated but my daughter’s has not. Am I looking for an update button, page refresh or something to trigger the update? I had thought it would update automatically. I’ve confirmed her AGI is below 75K and her unemployment is approx. 15K. Any direction would’ve appreciated. TIA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@Erilflynn wrote:

Hi I know everyone believes the online version has been updated but my daughter’s has not. Am I looking for an update button, page refresh or something to trigger the update? I had thought it would update automatically. I’ve confirmed her AGI is below 75K and her unemployment is approx. 15K. Any direction would’ve appreciated. TIA

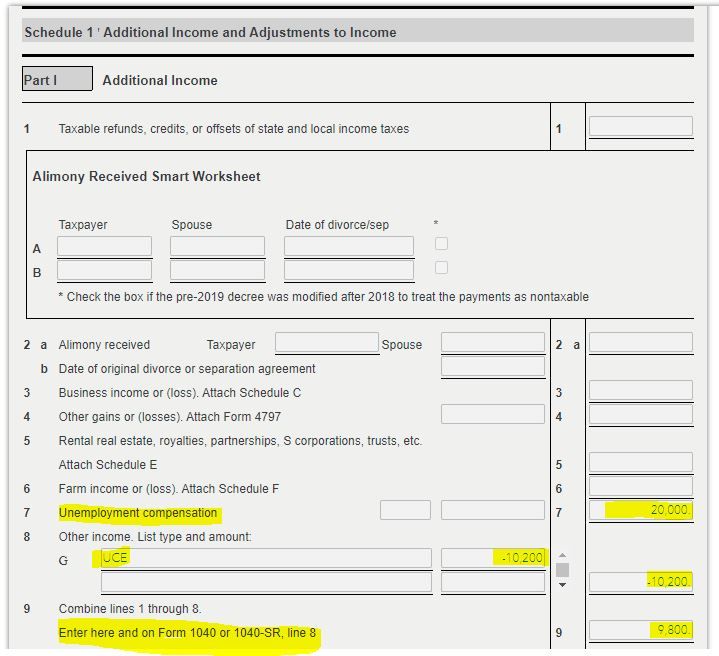

Look at the Form 1040 Schedule 1 Line 7 for the unemployment compensation received and on Line 8 for the UC exclusion. The amount from Schedule 1 Line 9 flows to Form 1040 Line 8

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Is there a manual update for iMac Desktop/CD? Just curious! I plan to wait for TurboTax to get this update done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

The Line 8 Schedule 1 exclusion is blank

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@Erilflynn wrote:

The Line 8 Schedule 1 exclusion is blank

If the UC is entered on Line 7 and Line 8 is blank when using the TurboTax Online editions, then delete the Form 1099-G for the UC and re-enter. Assuming the 2020 AGI is less than $150,000

Click on Tax Tools on the left side of the online tax return

Click on Tools

Click on Delete a form

Delete the Form 1099-G for unemployment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

It is insane that the customer has to manually update this program but..,,

is there a manual update for the Mac version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@EA12 wrote:

It is insane that the customer has to manually update this program but..,,

is there a manual update for the Mac version?

Why do you need to manually update? No, there is not a manual update for a Mac.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

I don’t want to manually update.

I want TT to release an update for the MAC desktop software version to solve the problem and allow everyone to file their taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Thank you. I will try that. Obviously I don’t click on amend a return or you would have mentioned that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

@EA12 wrote:

I don’t want to manually update.

I want TT to release an update for the MAC desktop software version to solve the problem and allow everyone to file their taxes.

TurboTax is not going to release a Mac manual update.

If you describe the problem you are having someone will be able to help you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Exclusion of up to $10,200 of Unemployment Compensation

Intuit updated their Pro Series software for this issue last week. Is there some reason the consumer product has not updated? The programers obviously have the needed information.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kat271

Returning Member

davekro

Level 3

astral101

Level 3

bhoward1963

Level 2

howjltx

Level 3