- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will the $10,200 of unemployment tax exemption go into effect?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

I wish people would check their software first, or go through this forum before asking the SAME question over and over again. The online software was updated on 3/19. The Desktop software was updated on 3/26 and then in April again. Open your app, go through the updates, and check. This has been answered multiple times and announced. Just a little Google search will give you that answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

Been reading and watching - JUST updated TT AGAIN and I am up to date but I keep reading that TT updated as of March 26th for unemployment compensation - BUT there is no place for me to enter the info from our 1099G - BOTH Federal and State tax was withheld from the 1099G and the gross amount is under 10,200 so WHERE do we enter this and get our taxes reclaimed. Currently, we owe taxes so getting this money reclaimed will help a lot.

Every time I go to enter 1099G it says to answer the question NO if for Unemployment, but then takes me no where.

It is now April 12th why isn't my program updated, I am using desktop home and business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

You can call TurboTax and speak with an agent. TurboTax customer service/support does not have a single phone number but has many different phone numbers based on the type of platform used. So that we can direct your call to the best person/department to help you:

- Click on this link: https://support.turbotax.intuit.com/contact/

- Select your TurboTax platform.

- Ask your question / state your problem. Do NOT use the word "refund' or you will get a phone number for tax refunds.

- Click Submit.

- On the next screen, choose the Call option and follow the instructions. You will be given the approximate wait time.

You'll get a toll-free number to a TurboTax expert who is specially-trained to handle your particular issue.

As an alternative, you can go into Forms Mode check to see if Form 1099-G has been started. If so you can finish entering the information, or you can create the 1099-G.

- Go into Forms Mode by clicking on the Forms icon in the top right of the blue bar.

- In the Forms in My Return list on the left, click Form 1099-G and the form will appear on the right.

- If Form 1099-G does not appear in the list, above the Forms in My Return list on the left, click on Open Form. [It takes a few seconds to open.]

- In the Search window, type 1099-G.

- Double-click on the form in the results list.

- If there is a form in the return already, it will appear in the window that pops up - click to open it.

- If there is no form 1099-G, you will see the screen Add Form 1099-G. Enter the Payer's (state's) name and click Add Form.

- Enter the information from your form. Don't worry about the exclusion. TurboTax will take care of this automatically.

- To return to the interview, click on the Step-By-Step icon in the top right of the blue bar.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

There is more than one place to enter the 1099-G ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

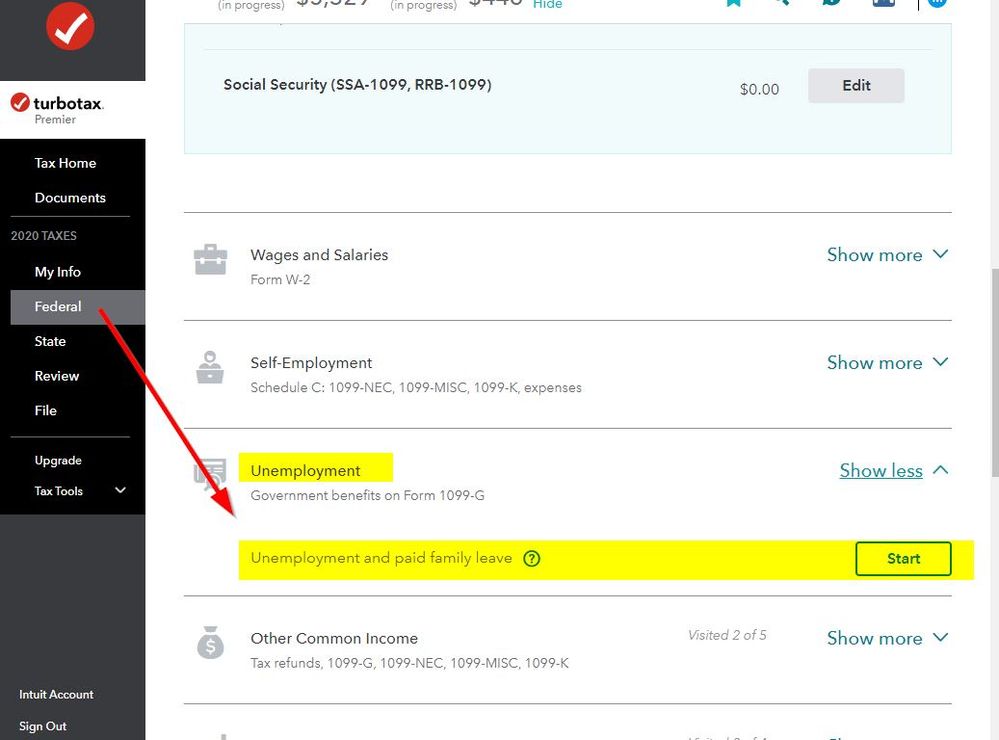

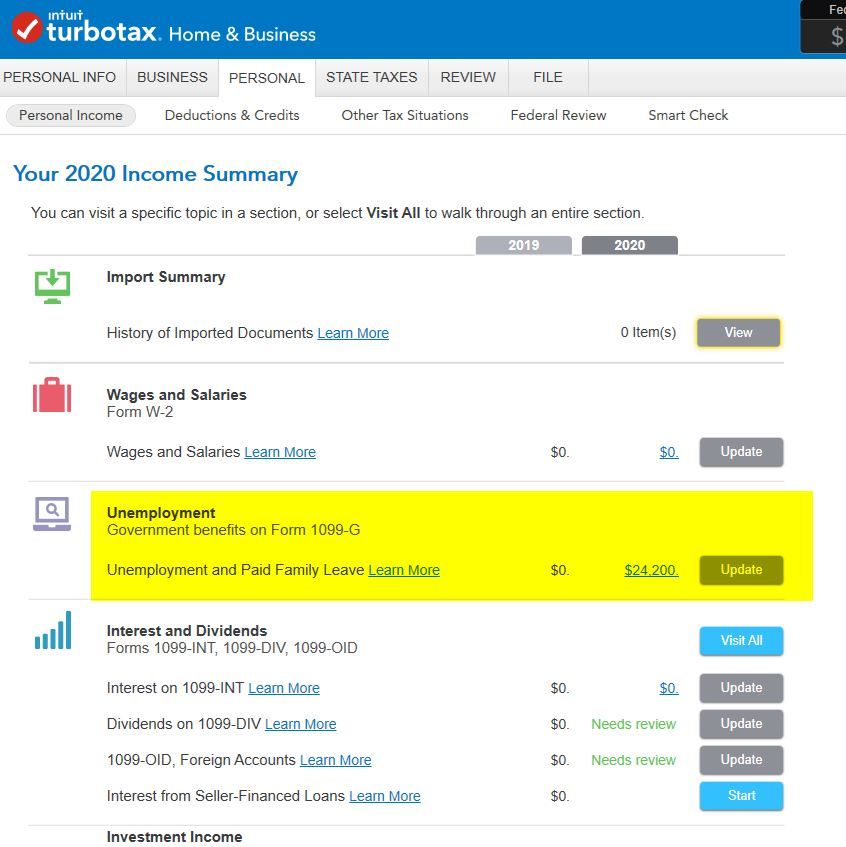

Enter a 1099G for unemployment under

Federal on left

Wages & Income at top

Unemployment - Click the Start or Update Button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

Hi. Hope this helps anyone concerned about whether the $10,200 unemployment tax credit has been updated in the Turbo Tax software. We purchased the Turbo Tax download/desktop version. Before we e-filed, we wanted to make sure we had received the $10,200 credit. We called Turbo Tax and spoke to a very knowledgeable agent. She remote logged onto my computer and showed me where I could see the credit on our return. Again, this is for the download/desktop version. Click on your Turbo Tax icon on your desktop. When Turbo Tax opens up for you, go to the banner at the top and you'll see File, Edit, View, Format, etc. Click on "View," then click on "Forms" and a list will pop up. Click on "Schedule 1" and look on Line Item #8 of that form, and you'll see the $10,200 credit. It's called "UCE" and it'll show a negative $10,200. Hope this is helpful to someone!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

Turbo tax used to be a great product. Now it doesn’t work with Macs most of the time, slow to update for changes to Mass., you spend hours on the phone for customer service, the price of state filing has increased to $25 ( H&R Block is $20) overall the product is no longer the tax program of choice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

Agree

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

But did you have something to input there for unemployment? I had taxes withheld for Fed & State and am under the 10200, which after updating many times my software has nothing there. I went into those forms and tried to override and enter in my numbers but when I went to run the error check it rejected due to override.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

I have been doing taxes for 30 plus years and when I go into my program, desktop home and business and go to the 1099G my screen has choices, none of which is for unemployment. Then at the bottom it says something like don't worry just answer NO if it is for unemployment compensation, we will ask you later.............ahhh no it does not, I go thru all the error and get read to file checks and nothing. I am fully updated and TT tells me I have the latest updates. I need to reclaim the taxes that were withheld. We are owing now, but those taxes cut what we owe in half. I did the override and input my information but when doing error checks the program rejects my overrides and won't let me proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

@SeaLady321 Unemployment has its own separate place up right under Wages. Scroll up.

You can type unemployment into the search box at the top of your return and hit find. It should give you a Jump To link to take you right to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

I have Home & Business too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

I've updated software today to the latest versions and followed the steps outline to get to schedule 1 line 8 and there is no UEC or - $10,200 amount. Any other suggestions? Thanks in advance for your help. Using downloadable version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

I also have Home and Business. Mine was updated end of last moth. The State may not be updated, I don't know, I got the over 65 deduction so it didn't matter. If I hadn't I would be looking for the State update before submitting State. You can still complete the FED and wait on the State for the adjustment.

If you are not getting the Schedule 1, line 8 deduction, you need to see the rules regarding the deduction. You may have made more income than allowed, or have another reason they didn't give it to you. The Federal Taxes have been updated for each of TT apps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the $10,200 of unemployment tax exemption go into effect?

You don't have to do anything special to get it. It is automatic. Just enter your 1099G. If the exclusion doesn't show up you may need to update the Desktop program. If updating doesn't help or you are using the Online version then delete the 1099G and re enter it.

If you have unemployment you can exclude up to 10,200 if your income is under $150,000. Your unemployment compensation will be on Schedule 1 line 7. The exclusion will be on Schedule 1 Line 8 as a negative number. The result flows to Form 1040 Line 8.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17525168329

Level 1

TR2022

Returning Member

av95

New Member

J1Professor

New Member

feuerbright

Level 1