in [Event] USAA Employees: Got tax questions? Ask a TurboTax Tax Expert!

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will schedule 1-A be available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

Schedule 1-A is available in TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

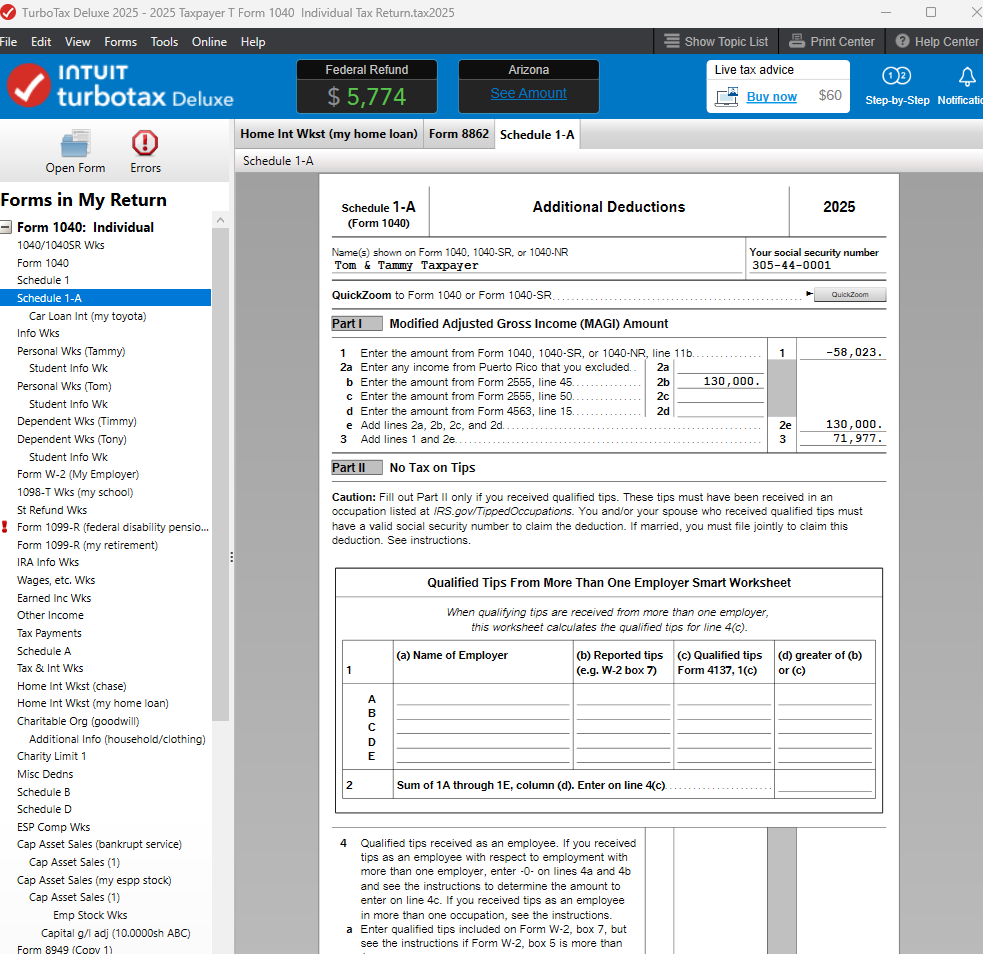

IRS Schedule 1-A is generated when the taxpayer reports:

- No tax on tips,

- No tax on overtime,

- No tax on car loan interest, or

- Enhanced deduction for seniors

In TurboTax Online, view the entry by:

- Selecting Tools down the left side of the screen,

- Selecting View Tax Summary

Note the entry Additional Deductions (Schedule 1-A).

In TurboTax Desktop, select FORMS in the upper right hand corner of the screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

Turbotax is also not generating a Schedule 1-A form for me either despite qualifying for everything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

Form 1-A is available. I used it for Tips and it works. I'm using Windows desktop. Turbotax says its avaialble for all platforms. If it's not working, check your entries. If you have desktop, you can review the Schedule in forms mode. Not sure about online. You may have to pay any fees before you can review or print it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

It's not available in my turbo tax deluxe and it does not show up in the forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

Go to ONLINE at the top of the page and 'Check for Updates'.

If your program is updated, step through the interview sections for Schedule 1-A deductions (W-2 entry for no tax on tips/ OT, Vehicle Loan Interest Deduction) to create the form in your return.

In FORMS, choose 'Open Form' and type in '1-A' to view the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

I'm having the same issue as the original poster. I'm using the desktop software and checked for updates - "my software is up to date". Schedule 1-A captured my overtime, but not my tips. The software won't let me type in a number manually into the form. Any hints?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

@slepore8 Did you have tips reported on your W-2 in box 7? If so, the calculation is done by the software in Part II of the Schedule 1-A.

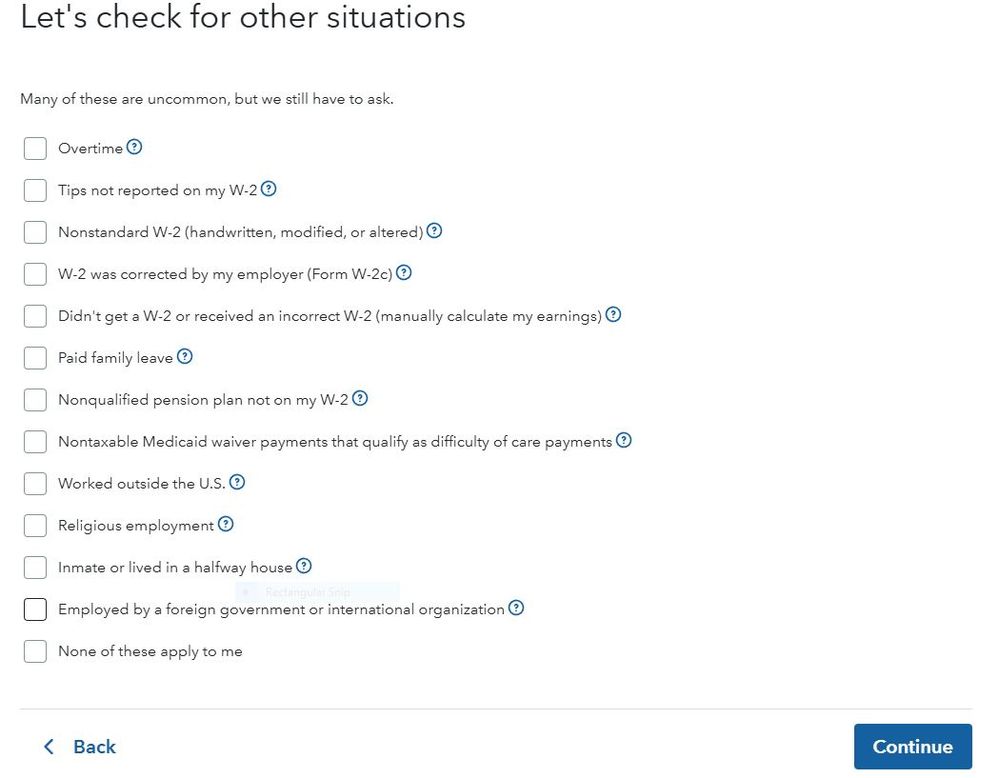

If you did not report tips to your employer you should have checked the box Tips not reported on my W-2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

Box 7 is blank. My tips were included in box 1 so were already taxed for social security taxes. My employer noted my tips in box 14 which I understand is just a general memo field and does not feed into schedule 1-A. Should I still check that box "tips not reported"? They were reported - in box 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

According to TurboTax's tax form availability matrix (https://form-status.app.intuit.com/tax-forms-availability/formsavailability?albRedirect=true&product...), this form should be available for e-file in the desktop windows software, however, I have the software with the latest updates, and it shows that the form is not finalized and cannot be submitted. Unfortunately, it doesn't have a date. TurboTax, can you fix your matrix please!

Rich

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

@richlux The Schedule 1-A has been available in TurboTax for two months or longer. You need to make sure you have the latest software update. Click on Online at the top of the desktop program screen. Click on Check for Updates.

If you show as being updated and still have this issue, then use a manual update if you are using a Windows based computer. See this for a manual update - https://ttlc.intuit.com/turbotax-support/en-us/help-article/update-products/manually-update-turbotax...

Or, save the tax return, close the TurboTax program. Close and re-start your computer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will schedule 1-A be available?

@DoninGA Thank you so much! I had rebooted my computer and did the check for updates multiple times, but that didn't fix it. Downloading the manual update finally fixed it. I'm having a similar issue with TurboTax Business, where the availability matrix says the forms are available, but the software says they aren't. It says that the 1065 Partnership Form p1-4 and p5-6 along with Schedule B-1 and Schedule K-1 are not available yet. Is there a manual update for the Business version? The one that fixed the Deluxe version did not fix this.

Actually, I found it: https://ttlc.intuit.com/turbotax-support/en-us/help-article/update-products/manually-update-turbotax... and it fixed that problem also.

This is a little concerning. I'm worried that I won't get future updates since the "Check For Updates" feature kept telling me that there were no updates even though there clearly were :(

Thanks again,

Rich

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BarbaraH0617

New Member

keithfin

New Member

rfisher71

Level 3

RZN8-E8SZ-EKUE-R95M

Returning Member

guy-ragault

New Member