- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will form 8582 be ready?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

Everyone go to Marylandtaxes.gov and ifile your state taxes for free.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

It would be best to contact support to address your situation over the phone. Please follow the steps to contact support below.

What is the TurboTax phone number? - Intuit

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

I have done this 3x already and they said someone is working on it. It’s been 4 days and nothing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

@AkinaLO DOZENS of posters on this thread have already said that they spent 30 minutes+ on the phone with TurboTax and they can't do a thing about it until the form is fixed. We just need to know when that will happen. No other tax prep company is having this issue...but TT has all of our info for the past ten years. And in some cases, people have already paid and can't submit yet. We need it to be fixed NOW.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

If you live in Maryland then file your federal taxes with Turbo Tax then go to Marylandtaxes.gov and i-file your state taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

Please quit posting the same advice over and over. Some of us have already paid to file our fed and state tax with TT and cannot file EITHER federal or state returns until this error is corrected...unless we want to start at square one with a different tax program. I have hours of time invested in filling out my return and would rather not start over. TurboTax needs to be much more responsive than this or risk losing tons of customers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

I paid as well. I went back in and deleted my state return, filed my federal return and then went to the state site. You can either use the work-around to get your taxes filed or continue waiting for help that may never come. It's a free world and I can post any reply that I would like if I feel it is helpful. If you feel it is not, or it's too much and you'd rather wait to make them do something, then that's your prerogative. Inevitably that sounds like a YOU problem. It's either useful information to you or it's not and can be ignored. Fin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

The form still states that it is unavailable. Is anyone else still having this issue?

2/9/2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

There is no way to delete the state return if someone is using the online version of TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

I just got off the phone with TT support. "We're working on it" - SS/DD as we used to say in the Army. I'm considering buying the H&R Block software. It can import previous TT files as well as Quicken data for schedule C. Unless they resolve this by the weekend, I may have to resort to this and start over with returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

Yes there is. I used the online version. If you go out and come back in, it will state for you to finish your state taxes, there is a trashcan icon on the far right. Just delete that return and then file that return another way, if you want to, and request a refund. I just did it. Or you can continue to wait. In life, there are choices and TT does not seem to be too concerned about this issue and the inconvenience that this has caused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

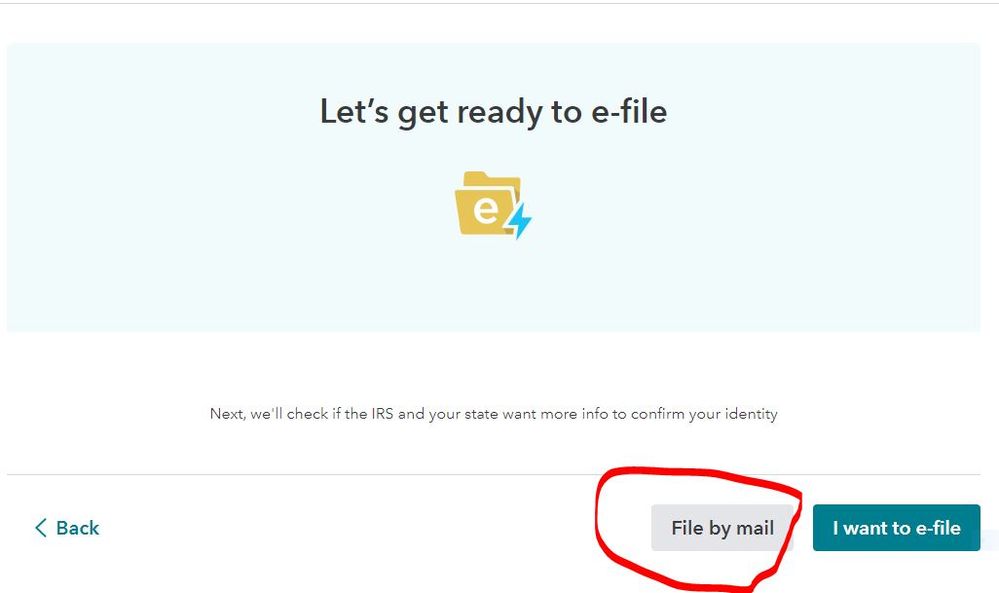

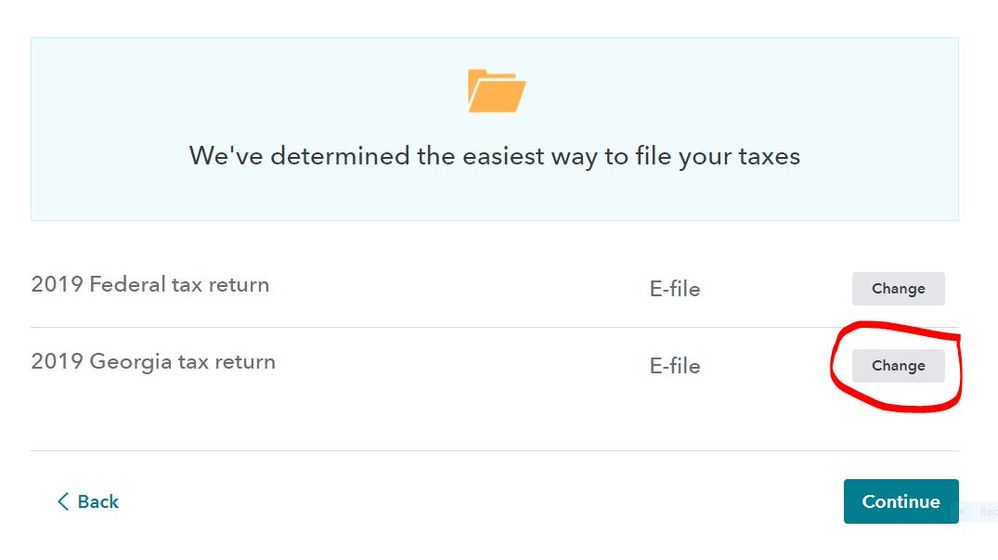

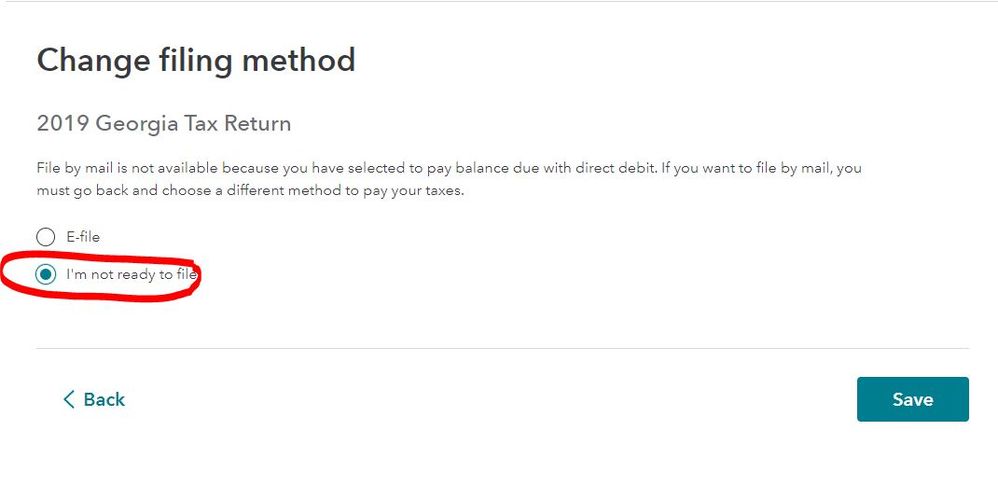

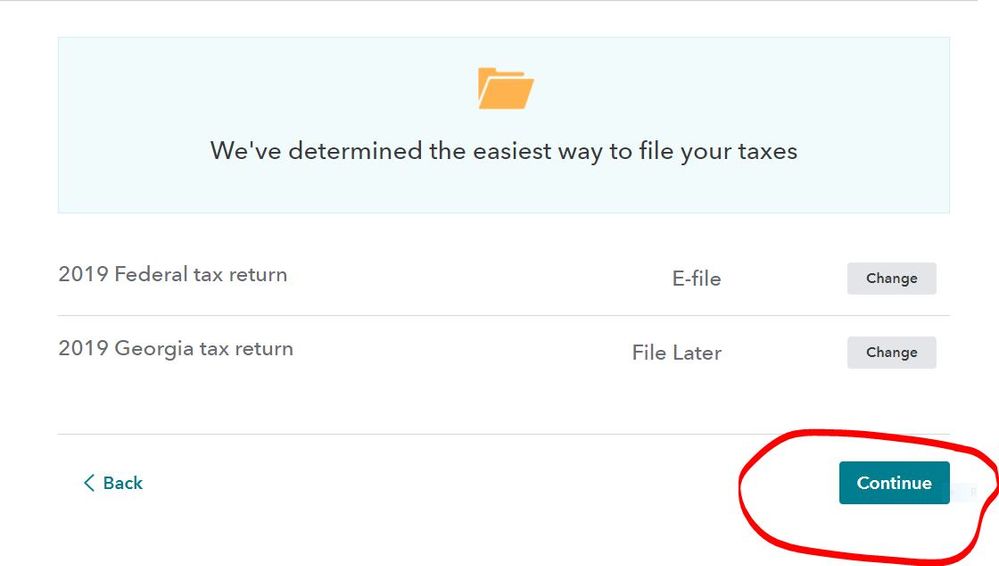

@jimr63 You can e-file your federal tax return without e-filing the state return at the same time. You can change to file by mail for the state return and after the federal return has been e-filed and accepted by the IRS you can go back and change the state return to e-file from mailing.

Go to the File section of the program and on Step 3 click on Revisit. Then change how you want to file the tax returns. See these screenshots (even though the screenshots are for 2019 the procedure is the same for 2021)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

Thanks to "DoninGA" instructions above I was able to bypass filing my state return for now and at least get my federal return filed. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

Yes, I have had my taxes completed since 1/31/22, I have talked with 2 reps as well. I was told that even though the IRS is saying the form is available for e-file, it still is not populating. The last rep told me that TurboTax is not given a date although the IRS is saying it will be available in February. But I too need my return ASAP, in order to pay bills and my state taxes from last year, which I am waiting on my return in order to do so. I am hoping by tomorrow 2/10/22 it will be resolved because I am ready to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8582 be ready?

Thank you for this information! I can definitely wait on my state 😁

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

linlina970806

New Member

yosemite798

Level 2

candd2

New Member

ytischler

Level 3

nhkyn

Level 1