- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Thank you! I appreciate your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Hi Everyone,

You don't have to wait for an update. I found the question was asked and answered in the Turbotax community. Here is the link:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Thanks for that link. It doesn't work for me and I replied why it doesn't work over there.

Someone previously wrote that the TT engineers are working on a fix for this weekend. I guess I'll wait...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Sorry that didn't work. What I actually did was I entered the amount for the designated period directly on the Schedule SE form during the review of the Federal taxes - it said I have an error and I should fill-in that amount on the designated line so I just input it manually, but it forced me to take the deferral.

Then I saw the answer I provided a link to. When I went to the Tax Relief related to Covid-19 section, I responded to the prompt that I didn't need more time to pay the tax. That should do it (it worked for me as I had that amount on line 18 completed), but if it takes you to the next screen asking how much you want to defer, it already should have a zero and you click continue and that should do it. So maybe the glitch is it won't input the number when done through the tax relief for covid-19 section - but if you input it manually, it should work - at least it worked for me. If this doesn't work for you, hopefully they will fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

I was having the same problem as everyone else with line 18. I didn't want my taxes deferred either and after some reading and experimenting I found the solution that worked for me.

Something is screwed up with line 18 and with that covid relief section. If you manually enter a number on line 18 you won't be able to adjust the deferral amount under the covid section where the fix is.

To not have your taxes deferred you have to answer YES to the question "Do you want more time to pay self-employment taxes" under that covid section in deductions and credits. This doesn't make any sense because it's the opposite of what you want to do. You can then put a dollar amount in that section that was earned between that time period and then go to the next question where it ask you for the amount you want deferred. I choose $0. After I did that I was able to complete the smart check with no problems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

yeah, im glad this worked for you. unfortunately, for people who are getting refunds, this doesn't work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

For anyone already calculated to receive any federal refund, I wanted to share my process with this issue.

After reviewing multiple threads on this problem, I decided to enter an amount into line 18. I took my amount in Line 3, divided by 12 to get a monthly amount, and then multiplied by 9 to get an approximate amount for the time period requested. Once I entered that amount into Line 18 and clicked continue, my federal refund amount increased slightly. I'm not sure why this happened. I don't think its because it's deferring any amount for me because the software already informed me I was not eligible to defer because I was receiving a refund. It has now cleared all the reviews, but I'm still waiting to file to see what all of these threads tell me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

yeah, dont file until they fix it. even though it says we arent eligible, for some reason all of us are having the same problem that its automatically deferring anyway once we enter an amount on line 18.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

You're right. It now says im deferring $30. It's not a huge deal but I'd still rather not defer; do you know how I can remove the amount I entered into Line 18?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Left sidebar Tax tools > tools > delete a form > delete Sch SET.

That'll get rid of it for now, but its still going to prompt you at the end to enter it.

I think that is what turbotax is trying to fix. so for now just delete the form and wait until a solution is reached [hopefully] lol

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Amount actually deferred has nothing to do with the amount entered into line 18 of the SE form. What you want to do is delete Schedule 3, and make sure you don't have one. Schedule 3 is the form that tells you how much you are choosing to defer. If you get rid of it, then you won't be choosing anything to defer, and that gets you out of the whole thing. I was able to file my taxes with an amount entered on line 18 of the SE form without deferring anything. The key is making sure you delete Schedule 3, if it exists.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Deleting schedule 3 does nothing, it just reappears.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Yes I thought about putting zero as well, but I'm afraid to delete the form and mess things up. I think I'll wait until after Saturday and see if the fix comes through that @dialface mentioned. Since the IRS isn't accepting returns until Feb. 12 anyway, I figure I'll wait for the bug fix and if that doesn't happen then try deleting schedule SE or Schedule 3, not sure which one would be least disruptive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

Hi everyone,

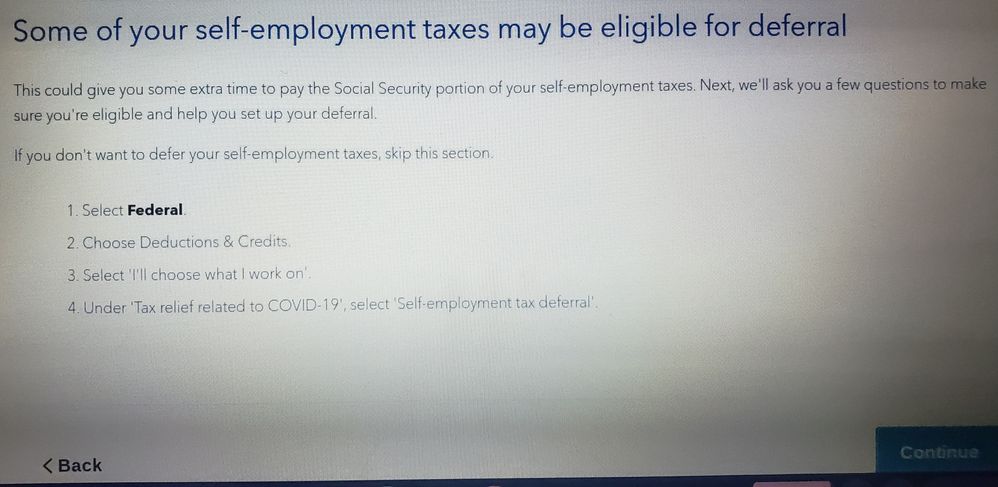

After reading through everyone's comments about the "Line 18" issue, that I was also stuck on, here's what I did and didn't have to delete forms or defer anything upon filing:

I looked at what my Line 3 had and because all of that amount was made between the March and December dates, I entered that full amount on Line 18. That's it.

When I got to the "Review" section, it asked me again if I'd like to defer, but if I didn't, I could just skip/"continue." So, I did, and I even reviewed my entire set of forms afterwards and no deferment happened. (I've attached the photo I took of that screen)

I hope everyone is able to do this, as well! ♡

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does it mean to say "Sch SE-T Max deferral line 18 must be entered"?

WTH if I knew I had to research that much I'd have paid a tax officer instead of turbo tax. Been held off for an hour trying to solve that.

What is the answer for that in a fast, for-dummies way? If you can't offer a hassle free service don't advertise it as such!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tax_right

Level 1

RehbergW

New Member

salvadorvillalon54

Returning Member

flcastro-x

New Member

eastend19

Returning Member