- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax Updates on Unemployment Tax Relief

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

It depends what state you are in. My state was updated on April 2 to reflect the unemployment benefits exemption. Unfortunately NC decided to not follow the federal forms and is taxing entire unemployment received. Other states have not decided yet. Just sign in to TurboTax everyday to see if the state you live in has been updated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

What state(s) are you referring to?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Maryland. Not ready yet. Tried to file federal and skip state but the website doesn’t actually allow you to skip state. So now I’m stuck with not filing either. Oh and already got charged!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Please see the following TurboTax Help article: How is my state taxing unemployment income?

It contains the latest information on how unemployment will be taxed in your state and whether our calculations currently support the way unemployment income is treated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

I used online software on 4/3/21, it seems still not correct, even more high number than other online provider.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

The federal return in TurboTax has been updated with the changes in unemployment benefits.

Please see the following TurboTax Help article: How is my state taxing unemployment income?

It contains the latest information on how unemployment will be taxed in your state and whether our calculations currently support the way unemployment income is treated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

I’m aware federal is ready. Cannot file that without filing state. Website does not allow it like it says.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

@Jones0802 wrote:

I’m aware federal is ready. Cannot file that without filing state. Website does not allow it like it says.

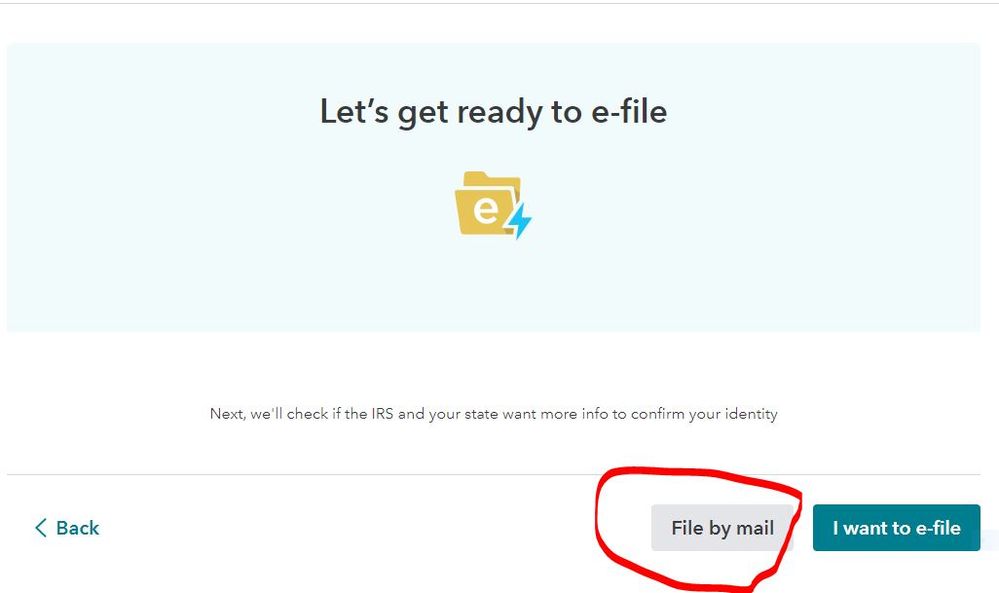

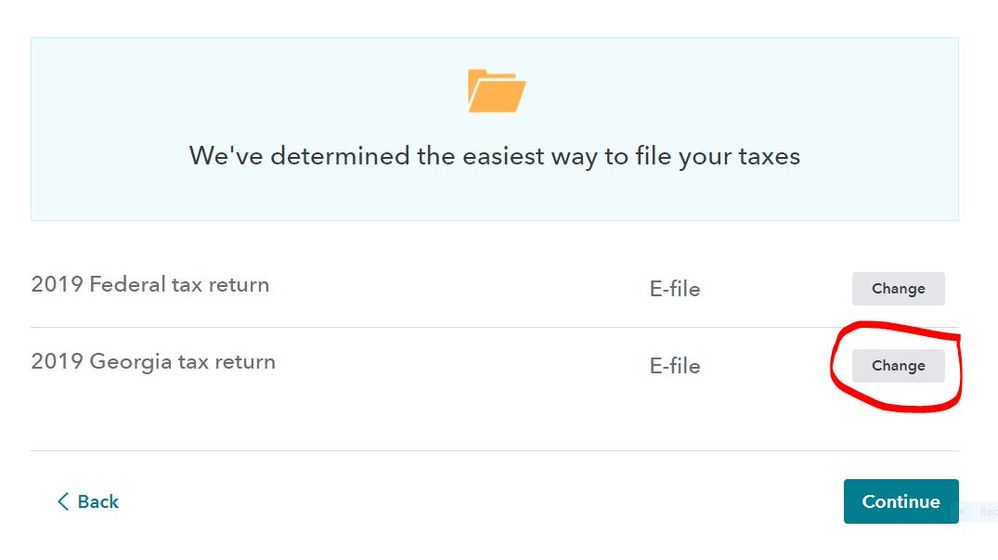

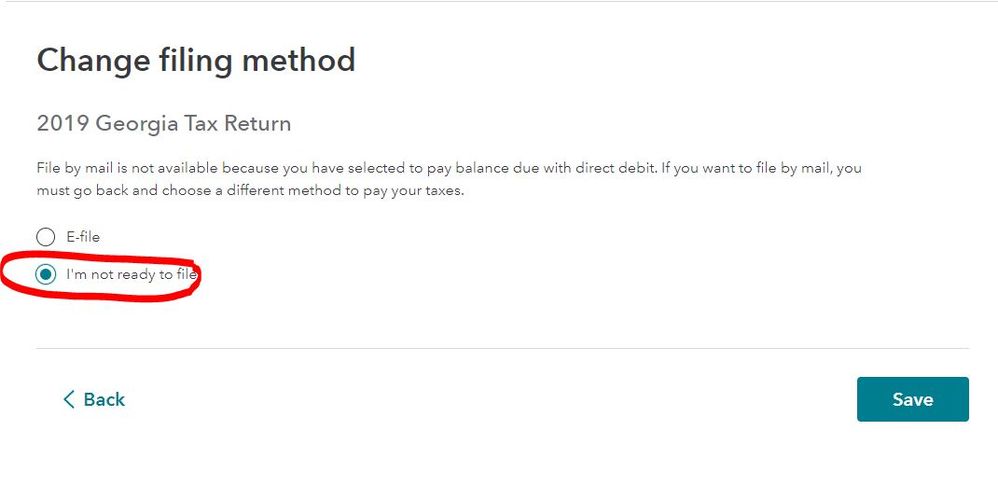

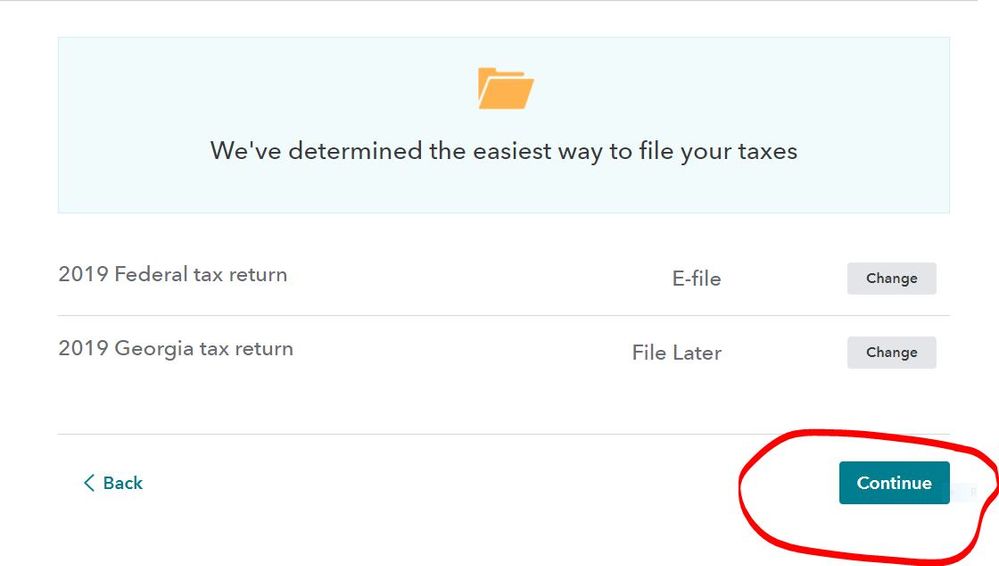

In the File section of the program on Step 3 you can change how the state tax return is filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

TurboTax calculations have not been updated for Maryland. If you haven’t filed your return, you can either:

- Wait for TurboTax to be updated with your state changes, or

- File your return now and potentially amend later if they do not follow the federal guidelines.

You can e-file your federal return now and then e-file your MD return once the federal return has been accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

My thinking is that Maryland utilizes Federal AGI as the starting point. I am assuming that there will be no need to amend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

I am still having an issue with the federal unemployment update. it is not updating when signed on, or if i go back thru the income section. Anyway to manually update ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

Turbo Tax not updated yet wi the Unemployment tax relief. When will that happen?

09AP21

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

It has been update for a couple of weeks now. I ended up removing the software and reloading it and then it worked just fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

The Desktop program was updated on March 26. Try updating your program. How to update

https://ttlc.intuit.com/community/installing/help/how-do-i-update-turbotax-cd-download/00/26038

If updating doesn't help then delete the 1099G and re enter it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020: TurboTax Updates on Unemployment Tax Relief

I am still waiting for the online version of Turbotax to be updated to reflect the American Rescue Plan. It has not been as of 4-10-2021.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Solar Eclipse

Level 3

Mary625

Level 2

jcrouser

New Member

user17558684347

Level 1

user17558059681

New Member