- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Turbo Tax Disaster Distributions Notifications

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

No, you will not receive another 1099-R. On the Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, there is a chart that says to fill out lines 12-15 and 23-26 as applicable. You can see from the lines that another form is not needed, just your 1/3 income for this year and any repayment information. Your program should have retained the 8915-E information.

@Asmith8707

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

The form still isn't available. I was expecting to finally be able to file today and I still can't. It is past the 3/24 date we were given.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

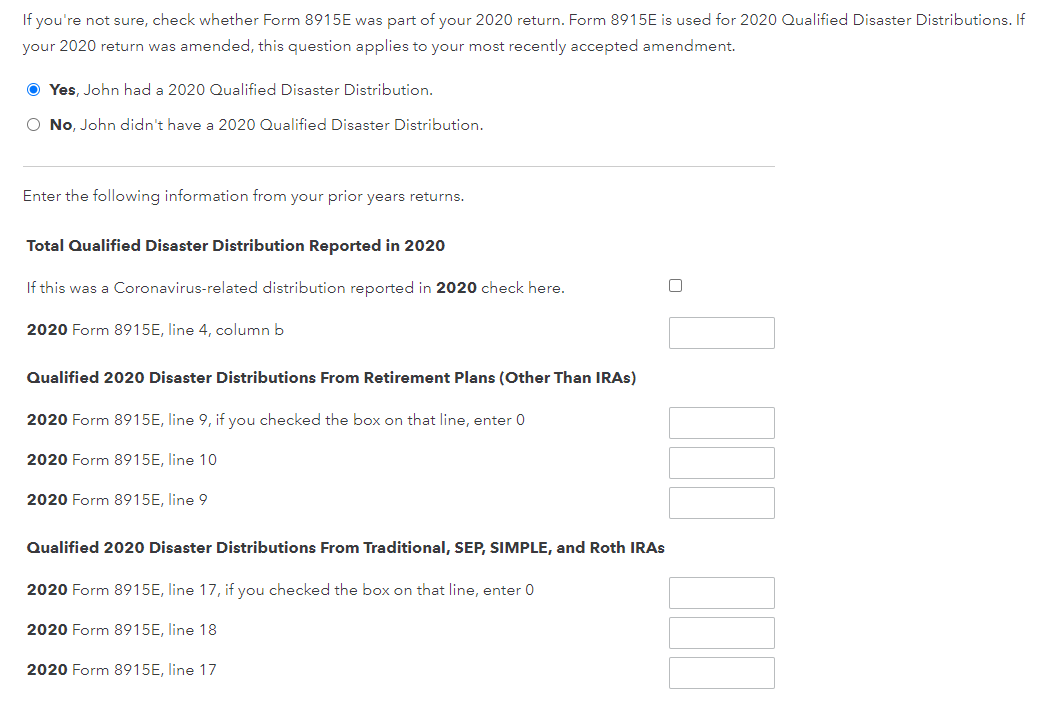

The form 8915-F is available for both e-file and paper file. Use the following steps to enter your COVID disaster distribution. Do not enter any FEMA code because this does not need one. Be sure to have your 2020 return available to complete the sections shown below.

- Wages & Income > Retirement Plans and Social Security >

- IRA, 401(k), Pension Plan Withdrawals (1099-R) > Start, Revisit or Update > Continue

- Answer Yes 'Have you ever taken a disaster distribution before 2021?

- Answer Yes, You had a 2020 Qualified Disaster Distribution

- Complete the Information using your 2020 Tax return > Continue

- Enter any amount you may have repaid in 2021, if applicable

- Finish the entry for your spouse if applicable or just click Continue

- Complete any additional retirement questions as you move through this section

- Continue until you have finished and returned back to the Wages & Income Screen.

- Do NOT stop and change sections without completing it.

@mcgaffmr

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

- When will the update for this form be available on home and business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

@jefffulton8 wrote:

- When will the update for this form be available on home and business

It was included in a software update released on 03/24/2022.

Update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

I am filling this out, it's 3/26/2022, and the amount still not showing up in income and when I preview my forms an 8915F isn't being generated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

@supert009 wrote:

I am filling this out, it's 3/26/2022, and the amount still not showing up in income and when I preview my forms an 8915F isn't being generated.

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer No when asked if you received a Form 1099-R in 2021, if you did not receive the form

Answer Yes when asked if you took a disaster distribution

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

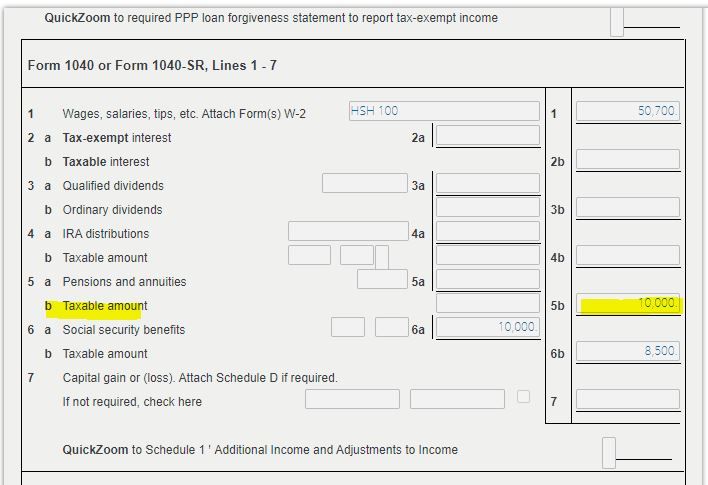

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

IRS's site says its AVAILABLE now!!! 3/28/22.

Why isn't it updated on TT????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

@pplb wrote:

IRS's site says its AVAILABLE now!!! 3/28/22.

Why isn't it updated on TT????

The Form 8915-F was included in the TurboTax online editions in the early evening of 03/23

The Form 8915-F was included as a software update for All the TurboTax desktop editions on 03/24

If you are using the desktop editions, update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Enter a 0

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

i got the update and its still not working.....here's my responses to a "solution" i got from TT a few minutes ago and it still doesn't automatically populate the 1040 line b even when the correct amounts from 2020 are added to the 8915'......see my responses in RED

On Mar 28, 2022, at 8:51 AM, TurboTax + Mint Communityyou are using the desktop editions, update your software. …did that

Click on Online at the top of the desktop program screen. Click on Check for Updates….did that….there were updates but i don’t know what was updated….i had to install and restart.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -Click on Federal….i didClick on Wages & Income…i didScroll down to Retirement Plans and Social Security…i didOn IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button….the button said UPDATE, not start or revisitOn the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R…there was no such question…..and we did not get….we did get 1099’r’s in 2021 for withdrawals we actually made from our IRA’s in 2021, not related to anything, and that amount does show up on 1040 and elsewhere, but we did not receive any 1099-r’s for the distribution we took in 2020 that we elected to spread over 3 years, 2020-2021-2022.

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?…answer was yesAnswer Yes when asked if you took a Qualified 2020 Disaster Distribution...answer was yes

Check the box that this was a Coronavirus-related distribution reported in 2020….answer was yes

In the box 2020 Form 8915-E, line 4, column b - Enter a 0…we entered $0

If the 2020 distribution was from an IRA account2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17….correct amounts were entered from 2020 8915

Do not enter anything in the other boxes, leave them blank (empty)…we left this blank

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA….the 1/3 for 2021 was NOT automatically populated on 4b….the only amount that was populated was the actual 2021 distributions via 1099-r’s from our IRA’s….

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

@pplb Since you already had entered a Form 1099-R, when you went to the section for the Form 1099-R and entered Update, the following screen would have shown the form you already entered. Any taxable amount from that form would be on Line 4b of the Form 1040 if the distribution was from an IRA.

Continuing past that screen you would have been asked about Disaster Distributions or repayment in 2021, you answered Yes. Then the next screen asked if you tool a 2020 Qualified Disaster Distribution, you answered Yes.

You checked the box for a Coronavirus-related distribution reported in 2020.

You entered 0 for the line 2020 Form 8915E, line 4, column b

You entered the 1/3 of the distribution from 2020 for an IRA in the box for 2020 Form 8915E, line 17, if you checked the box on that line, enter 0

And you entered the 1/3 of the distribution from 2020 for an IRA in the box for 2020 Form 8915E Line 17

Absolutely no other boxes have an entry, correct?

If you did this then both the taxable amount from the 2021 Form 1099-R you entered and the 1/3 amount of the 2020 distribution from an IRA will be entered on Line 4b of the Form 1040.

On my test return I entered a 2021 Form 1099-R for an IRA with $10,000 taxable. I entered in the section for reporting 1/3 of the 2020 distribution in both boxes for Line 17 an amount of $30,000

On my 2021 test tax return I have the amount of $40,000 on Line 4b of the Form 1040.

Please go back and review your entries for the 2020 distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

I did an update on 3/27 and it was not released yet. I have used TT for numerous years so very familiar with how to do updates.

Super disappointed with TT this year and seeing updates are coming in at different times.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

@T93TKS wrote:

I did an update on 3/27 and it was not released yet. I have used TT for numerous years so very familiar with how to do updates.

Super disappointed with TT this year and seeing updates are coming in at different times.

The Form 8915-F was included in the TurboTax online editions in the early evening of 03/23

The Form 8915-F was included as a software update for All the TurboTax desktop editions on 03/24

If you are using the desktop editions, update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

Click on Forms. In Forms mode click on Open Form at the top left of the program screen. Type in 8915-F. The form will be listed in the result

Windows software - Version 021.000.0543

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Enter a 0

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

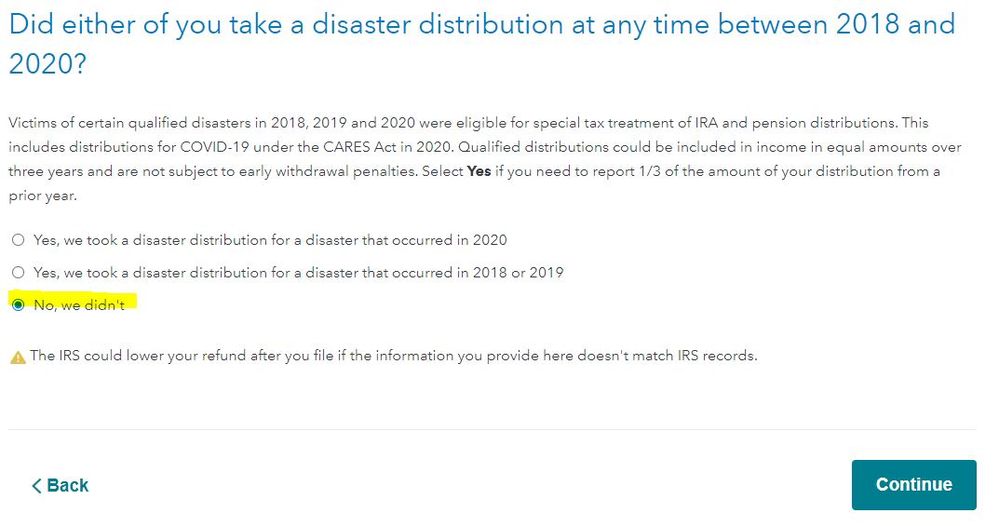

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

Screenshots from the online editions, however the desktop editions are similar -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Disaster Distributions Notifications

this fixed it! thank you so much!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

officialcarlernestbsantos

New Member

ryan-j-delahanty

New Member

jhvanden

New Member

AWillis2026

New Member

taxun

Level 2