- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Take responsibility, turbotax and stop screwing your customers

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

A tax company saying they were unaware that a health care TAX credit had to be submitted... that's rich. Unlike the people who aren't receiving their return due to a serious oversight during a pandemic that's killed the economy. But it's just the customer's problem.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

Where did you see that?

Nobody says that if you received a 1095A that is does not need to be reported. If you walk through the interview for deductions and credits, the medical section will indeed ask all about the 1095A form.

The *mandatory* question that everyone was asked about medical insurance is not longer there because Congress changed the law and the IRS changed the regulations that required medical insurance and required the question to be asked of everyone.

Perhaps if you skipped the medical section then you missed the question, which is why TurboTax suggests that you walk through the entire interview so you do not miss something.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

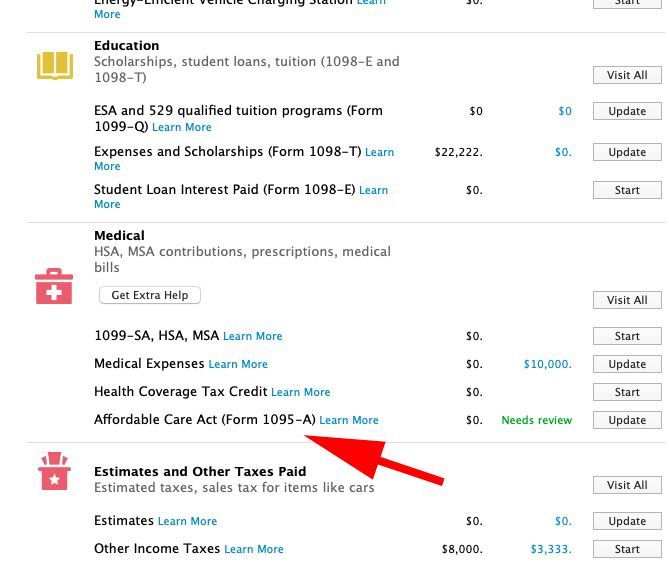

I didn't "see" that anywhere. It was confirmed by the IRS and Turbotax reps on the phone that back in Jan, apparently the IRS hadn't told turbotax they had to "prompt" all filers for the health care tax form. So walking through step-by-step (which I did) accomplished nothing. When I spoke with Turbotax today, the rep said this was an error on the part of IRS, and there was nothing they could do to assist me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

and that once the IRS told them to update this prompt on their software, they did. But a lot of people got screwed who filed early.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

In March the no longer mandatory question was put back into the program so everyone needed to answer it to move onto the FILE tab. So even though the question was not in the earlier versions the 1095-A itself told you it must be reported on the return just like any other tax reporting form. When you signed up for the marketplace insurance you agree that you would report the 1095-A on the return even if you were otherwise not required to file a return. Failure to follow those explicit instructions OR to ask where to enter the information in the TT program BEFORE you filed is not the DIY program's fault. After all you signed the return stating that it was correct and complete when you filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

Of course I have seen posts from those who filed after the change in March that missed or misunderstood the question ... again not a program flaw.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

It is not an error on anyone part since it was an act of Congress, the TCJA (Tax Cuts and Jobs Act) that removed the mandated questions that took affect in 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

The 1095- A was either mailed to you or you had access online ... failure for you to get the form is not a TT issue either ... page 1 of 7 told you what needed to be done ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

And what exactly do you think TT can do for you ? Once you have filed all your issues are with the IRS and TT cannot intercede on your behalf. All you can do is follow the IRS instructions and wait for them to process the return.

You may want to contact a Taxpayer Advocate in your area. See this IRS website for Taxpayer Advocate in your area and a toll free number - http://www.irs.gov/Advocate/Local-Taxpayer-Advocate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

I received my letter after filing, and yes that is a form I should have remembered. But let's get real here -- most people don't know wtf their doing on their taxes, it's not malicious and it's not stupidity - it's just reality. That's why they pay companies and accountants to help them complete their taxes. Otherwise, they would do them alone, for free. Had the appropriate prompts come up, I would have thought "oh yeah, I need that, whoops!" That's the whole point of the service, to help ensure people complete the taxes correctly and completely. Obviously, people knew there was as issue with how this was instituted, because once it was brought up by the IRS, the software prompt was updated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

My issue was purely that I asked turbotax to to issue a partial refund for their filing "deluxe" services, because as a result of the software and it's missing prompt, after sending in those updated forms, I still have not been able to receive my refund due to the pandemic. The IRS has communicated this is affecting TONS of people.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Take responsibility, turbotax and stop screwing your customers

Sorry ... but refunding of the TT fees is not going to happen ... this was not a program flaw since the ability to enter the form was in the program you just didn't find it.

Next year ... if you qualify then use one of the 10 IRS FREE FILE options to file a fed & state return for free ... you just need to wait until they open usually about mid January.

https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17628882651

New Member

xsf4Him

New Member

MARIAVLOPEZ1995

Returning Member

harrisonmatson89

New Member

TotalHassle

New Member