- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Submitted Federal online and rejected 20 minutes later! QCD errors so that say will be fixed ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

Using the CD version on computer, did all the entries and all the forms were scanned and verified correct. Was told all was great and I could efile Federal tax.

Well that didn't go so well, 20 minutes later get email "ACTION REQUIRED: Your tax return was rejected by the IRS". And that was about all it said- no help!

Then I start up Turbotax and dig around and find message that there are problems in Qualified Charity Distribution (QCD) and the issue is being resolved in a release scheduled for March 3. After that I have to go in and redo the 1099Rs. Notice scheduled for March 3, how do I know if that really gets fixed on March 3rd??

Also, I looked at the actual forms. I see no problems on how it handled the 1099R as a QCD, I do know how it is suppose to work and it looks correct, it did not add that QCD into the income- just as it should do.

Then did this really get rejected by IRS? I doubt it as it happen so quick and the message part of rejection that was suppose to be from IRS was blank, said no message?

Then if Turbotax knows of the problem why do they not catch it on review or especially while trying to Efile?

Now am I going to have to redo state taxes, they are done and going in on paper, will I have to amend the state form?

Then getting any help and an actual person is next to impossible, they want a person to talk to computer that can't understand me, then started talking in Spanish. This product is going down hill, also nothing has changed in the last several years in this QCD area.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

I went in and did the 1040 manually and came up with same AGI as Turbotax, so why do they say it in error? Maybe what is in error is what they stored in data file and submitted to feds and not what is printed on form? I still doubt it ever got submitted to feds as it happened to fast and message that was suppose to be from Feds, just said no message.

Actually it had heading Line 1 "Customer Service Message", then Line 2 March 1, 2023, 9:20AM PST, and then line 3 was "none".

That was real meaningful!

Then on top of that how do I know if this problem will really be fixed in the March 3 release, they don't detail what is fixed in each update, only general information like Federal Update or State Update?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

This will be fixed on the March 3, 2023 update. To ensure the software is up to date, please follow the instructions here to update the software before finishing the return.

Please let us know if we can further assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

How will I know this has really been fixed? I did an update on March 1 prior to filing. That update could have been out there for weeks as I hadn't opened up Turbotax. However there is another update out there now March 2 (1 day later) which I haven't done. Is the update out there now the one I need, it's only March 2rd.

I would have got the most current update on March1, then less that 24 hours later on March 2nd they have another update available. Yet I am being told to wait, that there will be another update on March 3. That means they are releasing two updates in 2 days.

So question is will another update really be issued tomorrow different that the one issued March 2? Guess I could do the update put out today and see if another is issued tomorrow, guess I will do that.

Wish they would say what is fixed in updates and not just say Fed update and/or state updated.

UPDATE. Did the update and it did a Kansas with release date 3/1/2023 and Program Update dated 3/1/2023. I guess Program Update means Turbotax? Also, since they says 3/1/2023 they must have been released after I did my update on 3/1/2023 around 11AM CST? Or does that really mean the update I am suppose to have to fix things will come out late on 3/3/2023 and I should wait until 3/4/2023 to update and try again?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

Well it's the 3rd and no update?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

Well the 3rd come and gone and no update, wish Turbotax would get act together. Keep getting emails about how good they are doing, yet they allowed me to Efile knowing they had an error with QCD and said it would be fixed on 3/3/2023 and that didn't happen. If they know they got an error that will create filing problems and know it will so called be fixed on 3/3/2023- why even allow me to submit the Efile?

Then they stay silent and won't answer emails or phone calls.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

No it's not fixed and the 3rd has come and gone without an update as promised.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

Please follow the manual update as suggested by CarissaM above and try to file again. If this doesn't resolve the matter, please reach out to us directly using the Help Article here. This ensures you will get to the correct department as quickly as possible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

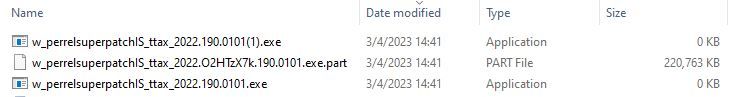

I have started Turbotax and it does not want to update. Also, I have tried to manually update from within Turbotax and it says I am current. I am on release that ends with 000 0457. It looks like you are wanting me to download a large 200+ MB file? What is this does it replace the whole program, will it still be deluxe with state and will I have to start all over? Shouldn't what I have update? The link she gave me has several options. I attempt to download the option TurboxTax 2022 Individual — R19 Not sure what the R19 is, guess release number? Anyway down load failed twice, the ended version number with 190 0101 that was trying to download. Has failed twice right at the end when it looks like all 216 mb are downloaded and it's done, the failed pops up. I can't put in the whole release numbers above as there is a editor that blanks it out saying it's a phone number. Maybe this won't work only putting in last few characters anyway they start out 022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

Below is what I see after the failed download, each time I tried same thing. I have cleared all files, rebooted and same thing. This was after a ccleaner ran, deleting all previous files downloaded, clearing out trash and then a reboot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

Please reach out to TurboTax Customer Support and request to speak to a tech support agent who can assist with this issue.

What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

On Sunday 3/5/2023, I gave up on the download suggested and waiting on a release for March 3. Started Turbotax, there wasn't any update, Turbotax loaded, checked for update via pull down and it said I was up to date. Last update I did was on March 2 and it said it was the March 1 update release.

I went ahead and edited the 1099-R that was a QCD, didn't change anything, just walked through the edits and hit continue each prompt.

Re submitted the Efile and about 15 minutes later it came back Accepted.

So what really fixed the issue? Could have been the update I did on 3/2/23 that was a 3/1/23 release date. I did the first Efile early on 3/1/23 prior to the release as Turbotax did not update when I started on 3/1/23. Or could have been a in house software error of Turbotax submitting data?

Anyway it got accepted. TurboTax should fix their forum so release number doesn't get blocked out as phone number and wouldn't hurt to put what has been fixed in releases. Also, add a place of known errors.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

We are happy to hear the update did allow things to go through.

Please let us know if we can further assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

Turbotax said Federal tax return accepted on 3/5/23. I do need to pay some more to the IRS. However, when I go to the IRS.GOV they don't show I owe anything. Today is the 22 of March, you would think, especially since I owe them, it would show that I efiled and owe a balance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Submitted Federal online and rejected 20 minutes later! QCD errors so they say and will be fixed soon.

@diverjer "I went ahead and edited the 1099-R that was a QCD, didn't change anything, just walked through the edits and hit continue each prompt."

FYI - When you edit or review 1099R entries it resets your answers to the defaults so you may have to answer them all again. Maybe that's why it got accepted. And be sure to go all the way to the end of the 1099R section. They are right unless you go back.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kimberly-franks

New Member

Angelgirl_59

New Member

user17607971256

New Member

danolson115

Level 1

jonesmichelle228

New Member