- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: State Taxes for Wages earned in one state while living in another state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

I moved to Michigan from Ohio on 4/30/2020 but worked the entire year for an employer in Ohio resulting in W-2 wages. Also, I had 1099-R earnings from a pension for the entire year. Do I report both types of wages on the reciprocity wages page even though it asks for W-2 wages?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

No. Report just the wages in this section.

In general, income is reported in the state of residence where it is received.

Sometimes, there is a difference in reporting between earned income and unearned income. Wages are earned. The pension income is considered unearned, even though you received it from working previously.

It is best to start by filing the part-year state return where you started 2020. Always end with the state of residence on December 31.

Therefore, complete the Ohio state tax return before completing the Michigan state tax return.

For more information, see: How do I allocate (split) income for a part-year state return?

For 2021, provide the Ohio employer with Form IT-4NR so that Michigan taxes are withheld going forward. Until this is done, both an Ohio return and a Michigan return would be filed in order to claim a refund for the Ohio tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

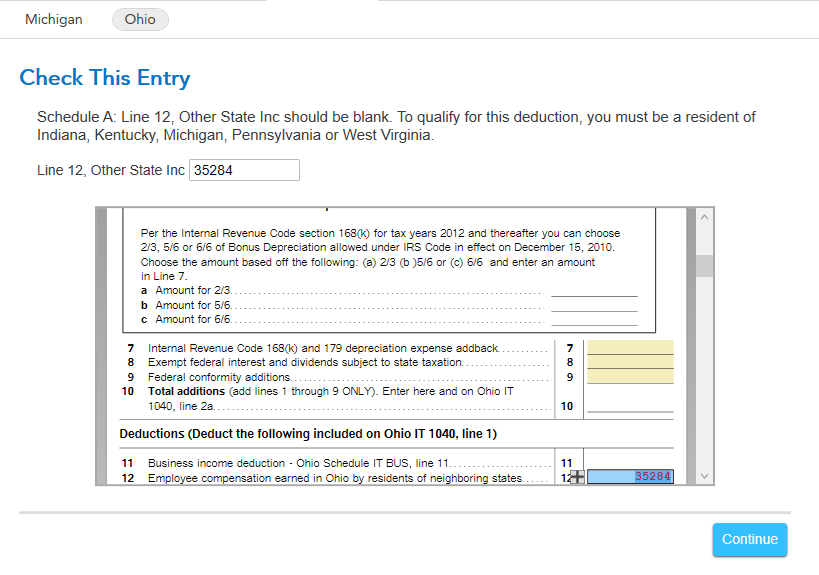

Thanks for the clarification of earned versus unearned income. However, the Ohio state tax page now says line 12 (Ohio State income) for Schedule A must be blank. Originally, it asked for the amount of wages earned in Ohio while a resident of Michigan. Suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

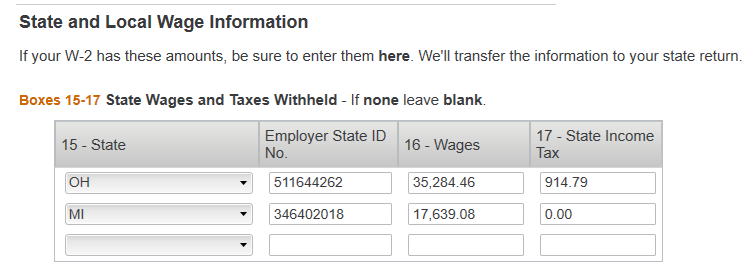

When you enter your wages from your W-2 in the federal program be sure you add a state to include both states. Enter the wages earned for each state for the period you lived that that state. Enter the withholding exactly as it appears because this is where your employer paid the state tax that was withheld.

This should being the page again about what wages were earned in OH while a MI resident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

When I added Michigan as a second state for a distribution of wages, I did not have a corresponding line on my W-2 and no Employer State ID number since there were no taxes deducted for Michigan at any time during the year. The federal part of TurboTax is asking for the Employer State ID number for Michigan.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

You can use the federal ID but do not put in the dash. This will eliminate the error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

When working on the Ohio state tax form, I am still getting the following message:

I have added Michigan as my state of residence but TurboTax isn't recognizing I'm a Michigan resident. Please advise.

Rich Kasch

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

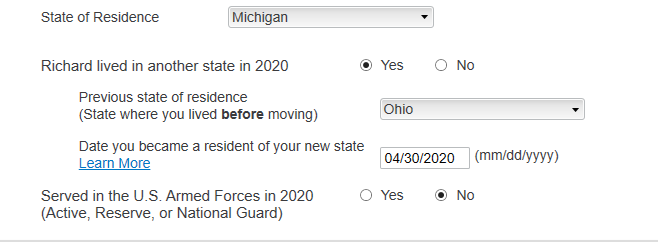

In TurboTax Online, click on My Info down the left side of the screen. Click Edit to the right of your name. Review the question Tell us the state(s) you lived in.

On the state tax returns, it sounds like you are part-year resident for each state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

Here's what I have in the Personal Info section about state of residence and previous state of residence:

That still creates the message I posted above when filling out the Ohio state income tax form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

If your W-2 shows only Ohio Wages and Tax Withheld, you could calculate the Ohio and Michigan portions of your income and make a second state entry line for Michigan (show Michigan income and $0 tax withheld).

Change the Ohio Wages amount to your Ohio-calculated amount. This should properly flow the correct amounts of wages for each state on your Part-Year Resident state returns.

Once you have edited your W-2 in your Federal return, go through the state interviews again.

Click this link for more info on How to Allocate Income for a Part Year Resident .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

This is the way I have the income distributed across Ohio and Michigan:

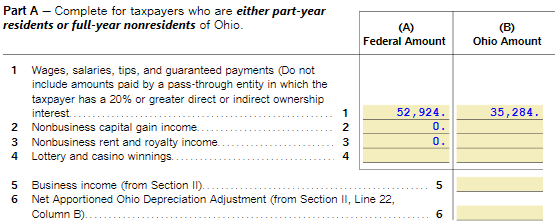

But this distribution was done before and I am still getting the messages detailed in my posts above. The wages for Ohio does flow to the state return, but it also fills in the line relating to income from another state, not recognizing I am a part-year resident. That's when the message says that line should be blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

Line 12, Other State Inc is $0. TurboTax is asking whether you received income from Michigan while you were a resident of OH. You did not receive any MI income while an OH resident even though you worked for a MI company.

You were a part-year resident and split your wages on your W-2 between MI and OH. OH will only tax the $35,284.46 listed on your W-2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Taxes for Wages earned in one state while living in another state

Sorry for any confusion in my explanation of the situation but I worked for an Ohio company for the entire year, was an Ohio resident through April, 2020 and then became a Michigan resident in May, 2020 for the rest of the calendar year. The income reported on my W-2 for Ohio (the only state listed on the W-2) represents a total for the period May through December, 2020 and that is confusing--I earned that money while a resident of Michigan, not Ohio. Is my W-2 incorrect? I did not tell my HR department to deduct Michigan income tax after I became a Michigan resident, planning to pay it when filing my 2020 returns.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rsherry8

Level 3

jstan78

New Member

TEAMBERA

New Member

girishapte

Level 3

bgoodreau01

Returning Member