- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: state tax refund for prior year being taxed, but I itemized that year using sales tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state tax refund for prior year being taxed, but I itemized that year using sales tax

My state adjusted a refund for a prior year (2016), resulting in a State Tax Refund 1099-G this year for a prior year (2016). Turbo tax is treating this as income. I did itemize in 2016, but took state sales tax deduction instead of state income tax (because of AMT, it didn't make a difference). As such, I shouldn't have to pay Federal Tax on the State Refund. On the State and Local Tax Refund Worksheet, Part VII, the refund for prior year shows up, and column D (Taxable Amount) is the refund amount. How do I indicate that in 2016 I used Sales Tax and therefore this should be zero?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state tax refund for prior year being taxed, but I itemized that year using sales tax

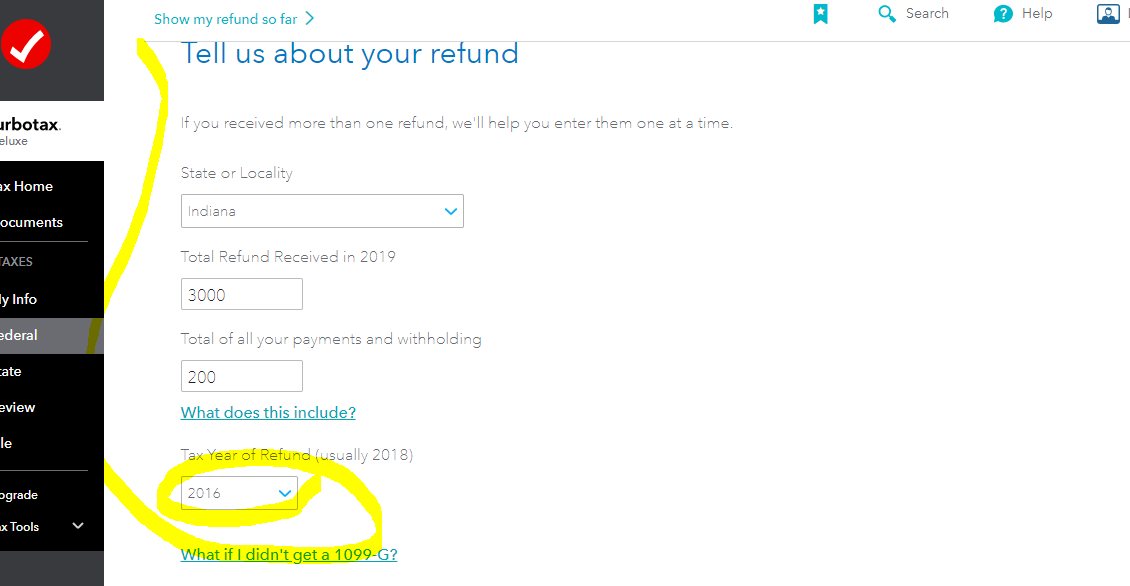

When you enter the 1099-G you have the option to report that it was for a prior year and make it tax free.

Enter the 1099-G, select 2016, the next screen asks for your payments, but you can enter anything to get past this screen, it doesn't matter.

(or you can look at your 2016 return and get that amount)

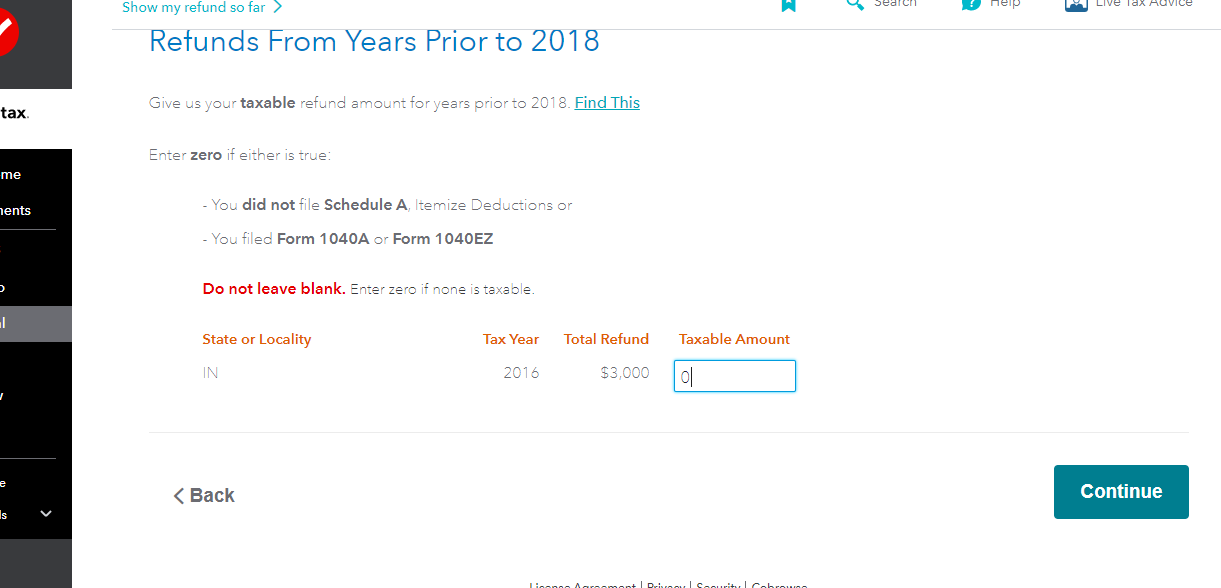

Next screen allows you to enter zero (0) for the taxable amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state tax refund for prior year being taxed, but I itemized that year using sales tax

When you enter the 1099-G you have the option to report that it was for a prior year and make it tax free.

Enter the 1099-G, select 2016, the next screen asks for your payments, but you can enter anything to get past this screen, it doesn't matter.

(or you can look at your 2016 return and get that amount)

Next screen allows you to enter zero (0) for the taxable amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state tax refund for prior year being taxed, but I itemized that year using sales tax

I'm having a similar problem in Turbo Tax Premier 2019 for Windows.

I received a state refund during 2019 for the 2017 tax year. I used the standard deduction in 2017 on my federal taxes so shouldn't have to pay taxes on this refund, yet Turbo Tax treats it as taxable.

Is there a way to get to a similar screen in the Windows version to report $0 of it was taxable?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

state tax refund for prior year being taxed, but I itemized that year using sales tax

If you used the Sales Tax deduction in 2017, do not enter the 1099-G so that it is not counted as income. This is an area that could be improved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

dlz887

Returning Member

johntheretiree

Level 2

Random Guy 1

Level 2

StPaulResident

Returning Member