- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: So did you file a return that said no one else could clai...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

Hi,

I am in the same situation. I inaccurately filed that my parents could claim me as a dependent but they actually can't due to my age and that I'm not a full time student. I am in the process of filling out the 1040-X form. I would like confirmation that to change personal information, I do NOT need to fill out 1-23 and that I only need to fill out my information, filing status, and Part III, correct? Thank you for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

Hi i accident can be claimed as a dependent on my tax return , is there anyway i can change that ? I understand i wont get a stimulus check if i have done so .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

I’m still trying to get the answer to that. Changing it in the program doesn’t trigger a 1040X for the IRS so do we need to change the dependent status if no one ended up claiming you? And how do we do that since the program isn’t triggering a way to amend?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

It depends. First, check the instructions linked below for Form 1040-X. The exemptions and dependents section is no longer applicable because there are no personal exemptions any longer. There is a note on Form 1040-X page 2: For amended 2018 or later returns only, leave lines 24, 28, and 29 blank. Fill in all other applicable lines.

Next, check 2019 Publication 501 Dependents, Standard Deduction, and Filing Information on page 4 and page 11 to determine if you are or are not qualified to be a dependent.

If you do qualify to be independent, then before anything is changed in your return, trigger the amendment. Click the link for instructions: How to amend (change or correct) a return you already filed.

- An amended return must be filed to not claim you.

- And you would also file an amended return. Form 1040-X with line 2 changed to the full amount of the standard deduction, $12,200, for singles. Your filing status of single is not changed. Changes to filing status would be addressed in the My Info section after triggering the amendment.

The tax returns for the federal and state should be sent certified mail. It will take 16 weeks for them to be processed.

Amended federal returns are not electronically submitted. Therefore, the paper copy can be edited by hand if necessary. Be certain to include an explanation.

2019 Instructions for Form 1040-X

2019 Publication 501 Dependents, Standard Deduction, and Filing Information page 4 Filing requirements for dependents; page 11 tests for qualifying child and qualifying relative

We are still waiting for IRS guidance regarding updating or providing direct deposit information for the stimulus payments and how they will be distributed to these type of accounts. We will have more information once the government finalizes the details.

In the meantime, you can visit the following links for the most recent updates:

TurboTax Corona Virus Tax Center Updates

[Edited 4/12/2020 | 3:13 PM PST]

@Hfischer05

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

Actually, a child over the age of 24 CAN be claimed as a dependent if they make less than $1,400 and pay less than 50% of their support. We had to say my son was able to be claimed as a dependent, even though we will not claim him as a dependent this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

My problem is that on the original 1040, there is a box where you can indicate that you can be claimed as dependent.

However, on the 1040-X, there is no such box. There is nowhere to indicate your dependency status.

Changing it on TurboTax doesn't make a difference since it doesn't change anything of the actual form that is to be printed and mailed.

Is stating that I do not qualify as a dependent in the explanation section on the second page of the 1040-X sufficient? Am I missing something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

Please lmk if you get this answer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

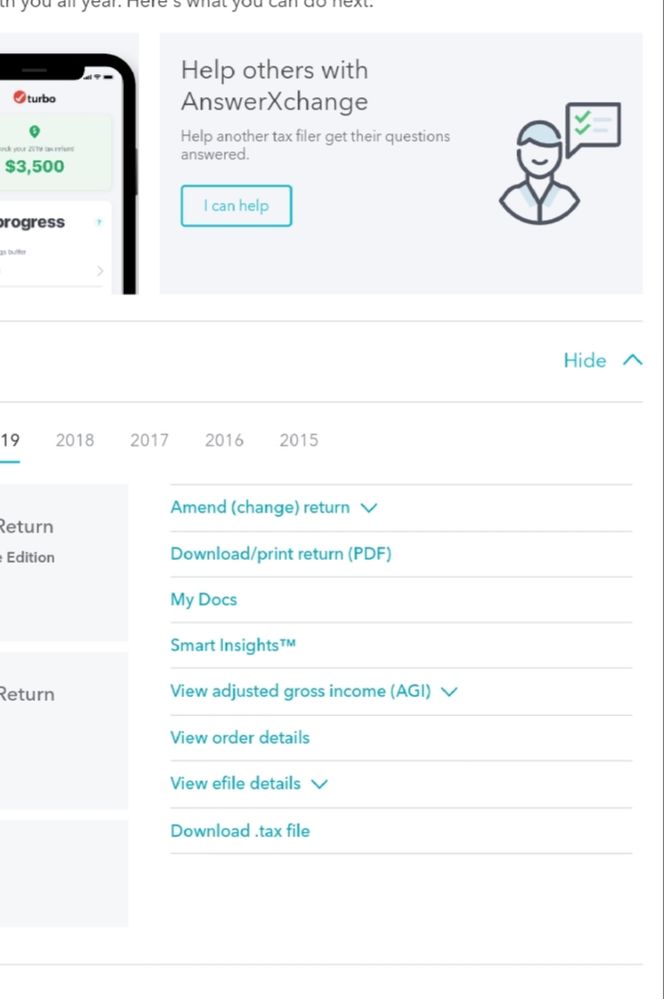

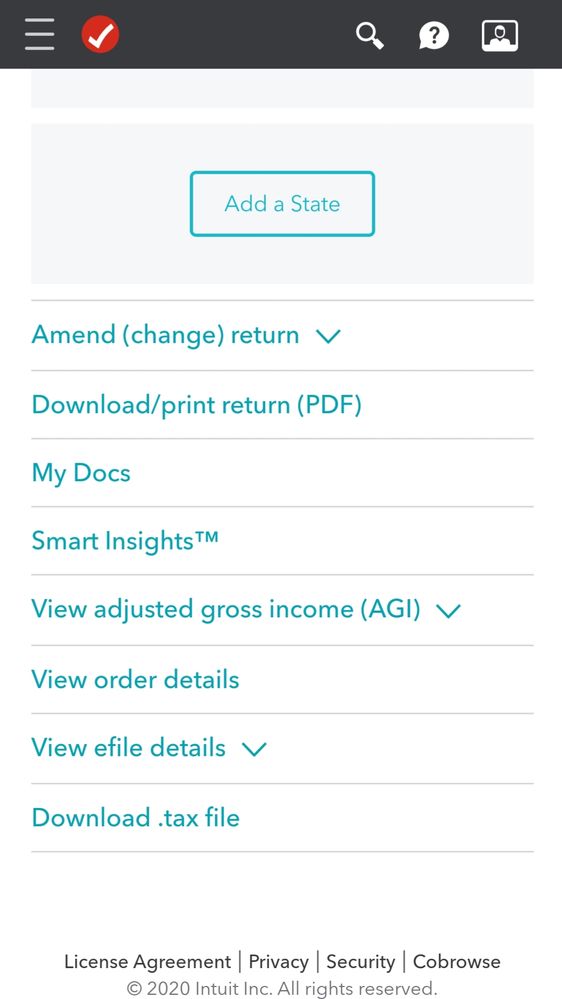

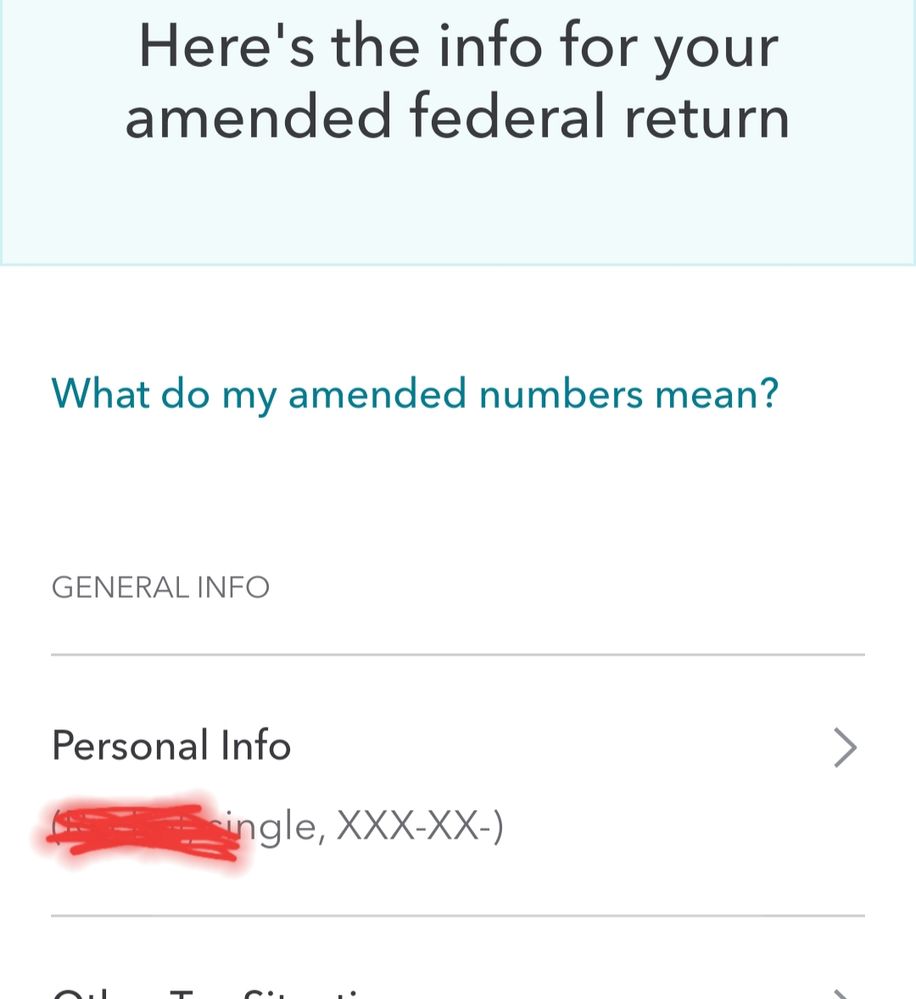

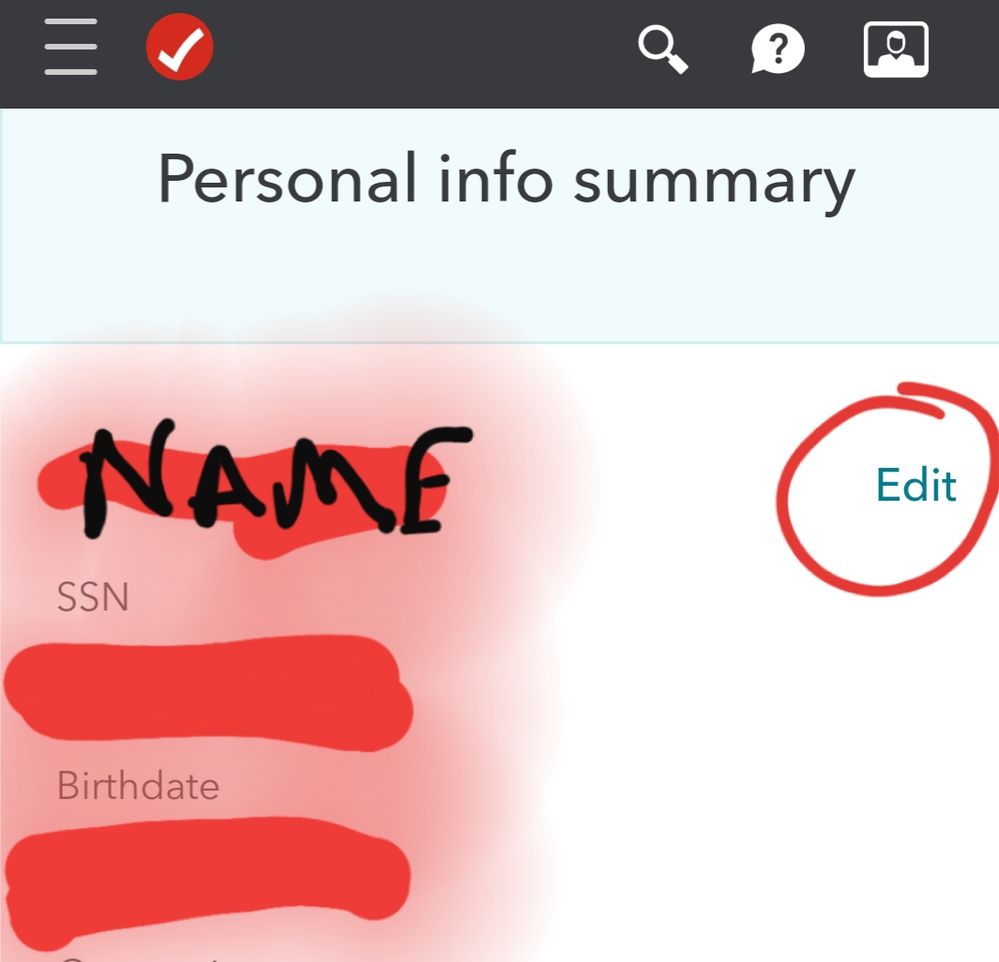

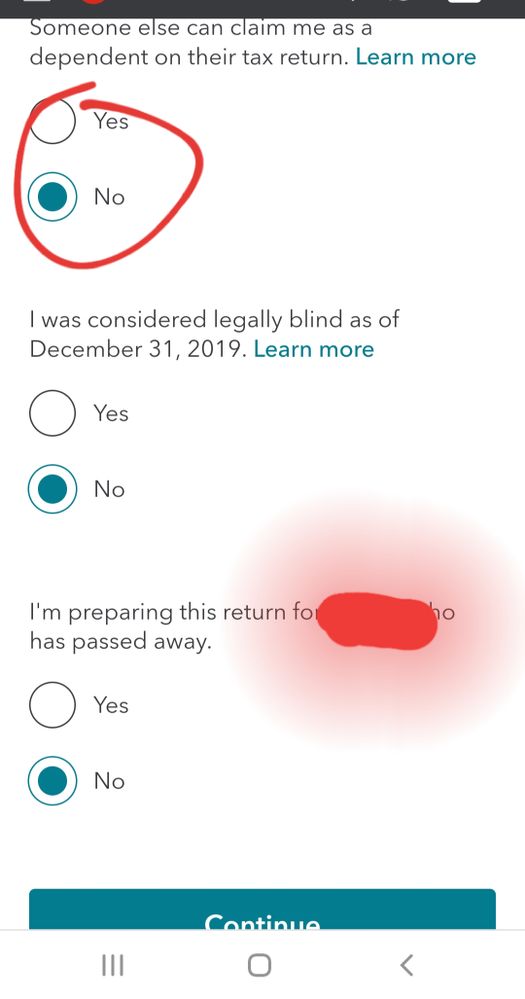

I just did this myself changing to non-dependent. Here's where you can get to the amend form for 1040x.

First screenshot is desktop site lower right corner, second is mobile version. Hope this helps!

Edit: for federal there is no box to check it uncheck, it'll just ask the reason why and I put changing as non-dependent. When you review the form look for the paragraph lines for "reason".

Your state might have a checkbox, it depends?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

Thank you!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

You're welcome, sorry if any of that was confusing, I did it from mobile website

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

2019 1040-X and its instruction caution to leave the dependent changes, lines 24-29 blank.

Neither is there a box to check stating, in an amended form, that someone can claim the taxpayer as a dependent.

My son-in-law failed to check the box to declare himself claimed as a dependent on our return.

As you describe in your message below, we could not efile. How can he amend his 2019? 1040-X appears to prohibit changes to dependent status for that year forward. Please help.

Meanwhile, I was not advised to mail in our return until he amended his. Do we go ahead and file it now, or what?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

Who said not to mail your return until he amends? You don't have to wait. Yes, mail yours now! You should have mailed it right away when your efile rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

Ok first you cannot EFILE his amendment ... it must be mailed.

And second ... you MUST mail in your 2019 return ... waiting for his amendment to process is not required.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

2019 1040-X and its instruction caution to leave the dependent changes, lines 24-29 blank.

Neither is there a box to check stating, in an amended form, that someone can claim the taxpayer as a dependent.

My son-in-law failed to check the box to declare himself claimed as a dependent on our return.

As you describe in your message below, we could not efile. How can he amend his 2019? 1040-X appears to prohibit changes to dependent status for that year forward. Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Changing my dependent status on my return

The ONLY thing on the 1040X for this change is the explanation on page 2 of the 1040X since it will usually not change anything on page 1 ... review the 1040X column B ... if anything else did change you must explain what happened in addition to the dependent question.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abcxyz13

New Member

Melinda10

New Member

Melinda10

New Member

Melinda10

New Member

wkassin

Level 2