- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Since my 1099-misc income is not taxable in California why are my state taxes increasing when...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since my 1099-misc income is not taxable in California why are my state taxes increasing when I enter the amount of the middle class tax relief amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since my 1099-misc income is not taxable in California why are my state taxes increasing when I enter the amount of the middle class tax relief amount?

Why is your income not taxable in California?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since my 1099-misc income is not taxable in California why are my state taxes increasing when I enter the amount of the middle class tax relief amount?

You are correct.

Taxable income

The MCTR payment is not taxable for California state income tax purposes. You do not need to claim the payment as income on your California income tax return. The MCTR payments may be considered taxable for federal purposes as indicated above.

If you determine it is not taxable on your federal return, then keep the document but remove or delete it from your federal return.

If it is taxable on your federal return, the when you get to the CA return you can subtract it out using the steps below.

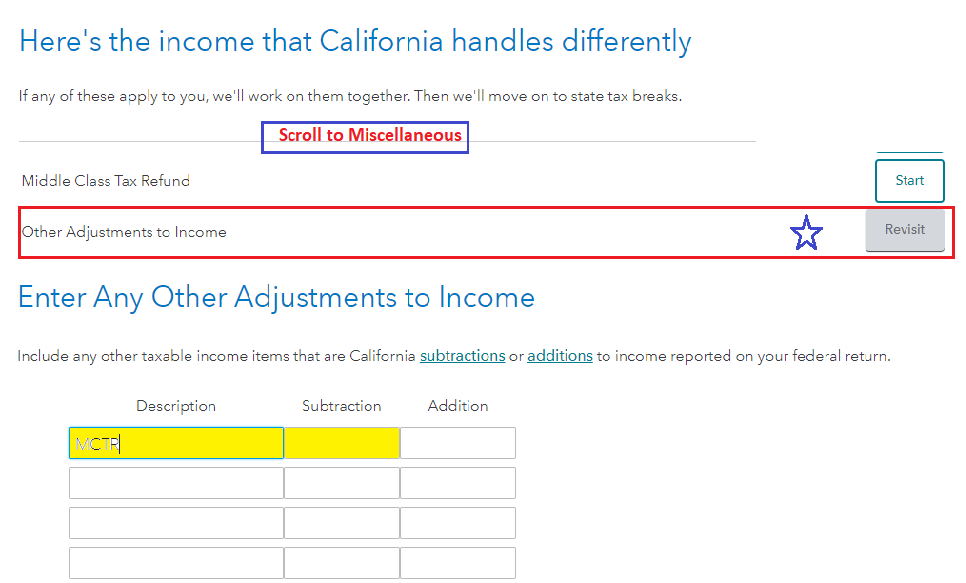

- Complete your CA return until you reach the screen 'Here's the income that CA handles differently'

- Scroll until you see Miscellaneous > continue scrolling to 'Other Adjustments to Income' > Start or Revisit

- Enter your description (MCTR) and enter the amount under the 'Subtraction' column

- Continue to complete your CA return (see image below)

[Edited: 01/24/2023 | 9:45a PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since my 1099-misc income is not taxable in California why are my state taxes increasing when I enter the amount of the middle class tax relief amount?

I did this, I will let you guys know if it worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since my 1099-misc income is not taxable in California why are my state taxes increasing when I enter the amount of the middle class tax relief amount?

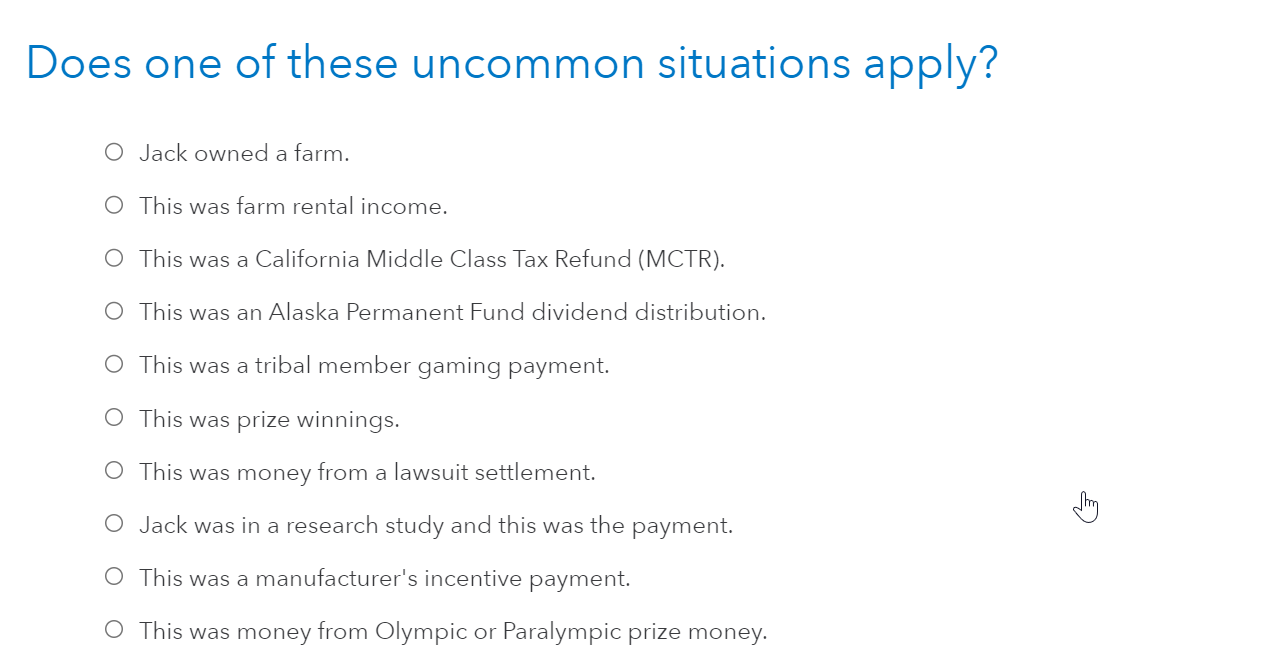

When entering the 1099-Misc in TurboTax, you will want to mark the box stating the 1099-MISC is for the MCTR. You can do this by following these steps:

- Click on Wage & Income

- Click Edit beside 1099-Misc

- Answer interview questions

- Under Question "Does one of these uncommon situations apply?" mark This was a California Middle-Class Tax Refund (MCTR)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kkrana

Level 1

RyanK

Level 2

user17545162733

New Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

rolfarber

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

timulltim

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill