- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You are correct.

Taxable income

The MCTR payment is not taxable for California state income tax purposes. You do not need to claim the payment as income on your California income tax return. The MCTR payments may be considered taxable for federal purposes as indicated above.

If you determine it is not taxable on your federal return, then keep the document but remove or delete it from your federal return.

If it is taxable on your federal return, the when you get to the CA return you can subtract it out using the steps below.

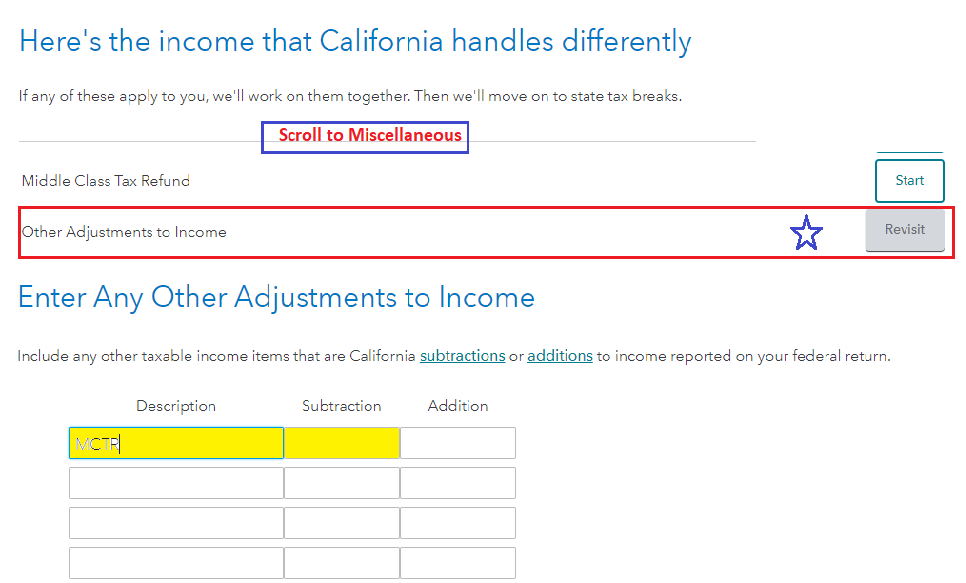

- Complete your CA return until you reach the screen 'Here's the income that CA handles differently'

- Scroll until you see Miscellaneous > continue scrolling to 'Other Adjustments to Income' > Start or Revisit

- Enter your description (MCTR) and enter the amount under the 'Subtraction' column

- Continue to complete your CA return (see image below)

[Edited: 01/24/2023 | 9:45a PST]

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 24, 2023

9:35 AM