- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

I am using TurboTax Home and Business.

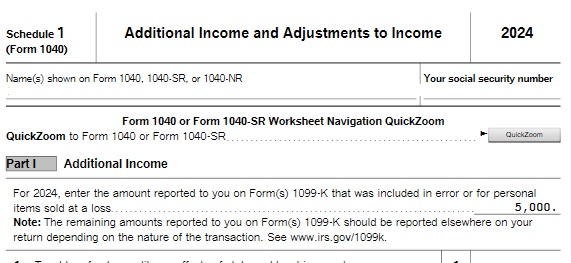

On Schedule 1, I need to enter an amount at the top of the schedule to offset a loss for personal items sold at a loss.

I have entered my 1099-k but cannot see how to enter the offsetting amount.

It seems that the top line cannot be edited.

Any insight on this would be appreciated. Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

You cannot deduct a loss for sale of personal property. What to do with Form 1099-K

However, You can use the procedure stated above to adjust the sale to a zero net gain.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

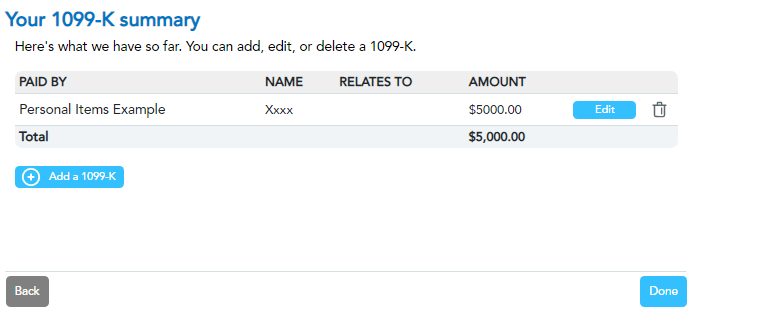

This line is informational only. It is coming from the amounts that you entered as personal items sold at a loss (not deductible). There is no need to enter any offset to indicate that you have a loss. If it's incorrect, and this is not what you received on your 1099-K, you can adjust the figure you entered in the 1099-K input. To change this, navigate to Federal Taxes > Wages & Income > I'll choose what I work on > 1099-MISC and Other Common Income > Income from Form 1099-K > Update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

The 1099-K show the gross sales amount and does not exclude shipping costs or cost of personal items sold.

Turbo Tax doe not have a function to on Sched 1, line z, to enter the shipping costs and cost of personal items.

As this was sold at a loss, I need to know what line Turbo Tax allows me to enter the costs which will zero out the amount on the 1099-K as there was zero net income from the sale of my personal items.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

From your last reply, Are you saying that I edit the 1099-K so that it shows zero, which would be the equivalent adding in my offsetting expenses. I may be misunderstanding at changing the 1099-K is something I am not familiar with.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

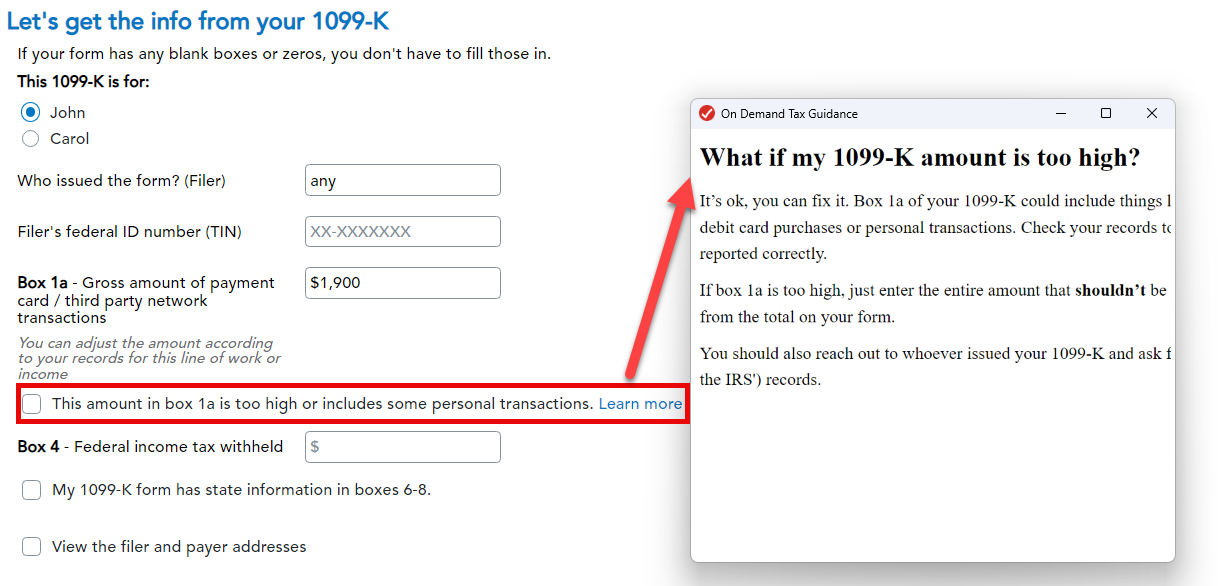

It looks like you are trying to enter this directly in the Forms mode of TurboTax Desktop.

You should make all entries in Step By Step

Posing in the FORMS mode will cause errors and revoke the accuracy guarantee.

Log into TurboTax

Search 1099-K

Jump to 1099-K

Enter the information including Box 1a

Just below that it says

[] This amount in Box 1a is too high, or includes some personal transactions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

Thank you for your input.

As this 1099-K was from Ebay, the amount shown on the form includes shipping and packaging costs.

These items were sold at a loss based on my original costs.

This should bring the 1099-K amount down to zero.

My confusion is how to accurately reflect this and where to do so and the net becomes a loss.

I have read that a loss cannot be claimed when selling personal items - which I am fine with - but I want to properly adjust so as to zero out the the amount as there are no net taxes to pay.

Sorry to ask so many questions but this is new to me for 2024.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

You cannot deduct a loss for sale of personal property. What to do with Form 1099-K

However, You can use the procedure stated above to adjust the sale to a zero net gain.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 1 - Entering adjustment to top line of form for personal items sold at a loss

I will go that route. Thank you for your time and insight.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

onelovelylavi

New Member

kare2k13

Level 4

ew19

New Member

ajayka

Level 2

JR500

Level 3