- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

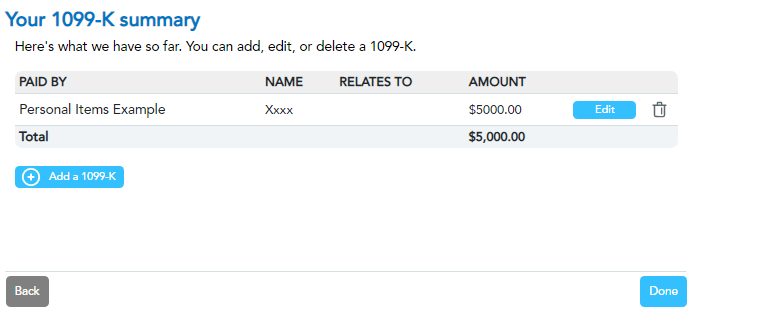

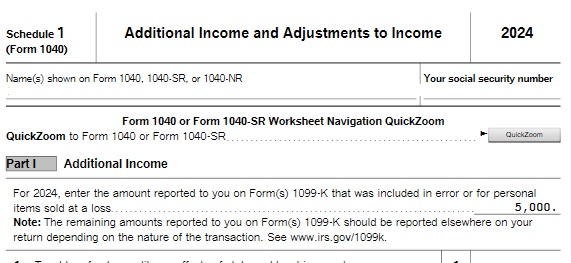

This line is informational only. It is coming from the amounts that you entered as personal items sold at a loss (not deductible). There is no need to enter any offset to indicate that you have a loss. If it's incorrect, and this is not what you received on your 1099-K, you can adjust the figure you entered in the 1099-K input. To change this, navigate to Federal Taxes > Wages & Income > I'll choose what I work on > 1099-MISC and Other Common Income > Income from Form 1099-K > Update.

April 7, 2025

6:05 AM