- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Reporting info on 1099B form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting info on 1099B form

I received a 1099B form from Ladenburg Thalmann Financial and Box 1c has the date sold, Box 1a has the number of shares sold, Box 1b has no "Date Acquired" info, Box 1d lists proceeds as $45.50 with a number 6**(Proceeds are reported as Gross Proceeds), Box 4 shows no income tax withheld, and Box 5: Non-Covered Securities-Code X (unknown Holding Period). There is also an asterisk in regards to Non-Covered Securities stating " The Subtotals and Grand Totals are provided as a courtesy; these values are not reported to the Internal Revenue Service. The Turbo Tax review says I need to enter a "Date Acquired" but I have no idea when I acquired the stock but I know that it was well over a year (more like maybe 5-10 years). What do I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting info on 1099B form

If you purchased the investment 5 - 10 years ago, enter any date you want - as long as it was at least more than1 year before selling it.

As long as the acquisition date was more than 1 year before the selling date, the tax treatment will be the same as a "Long-term" gain.

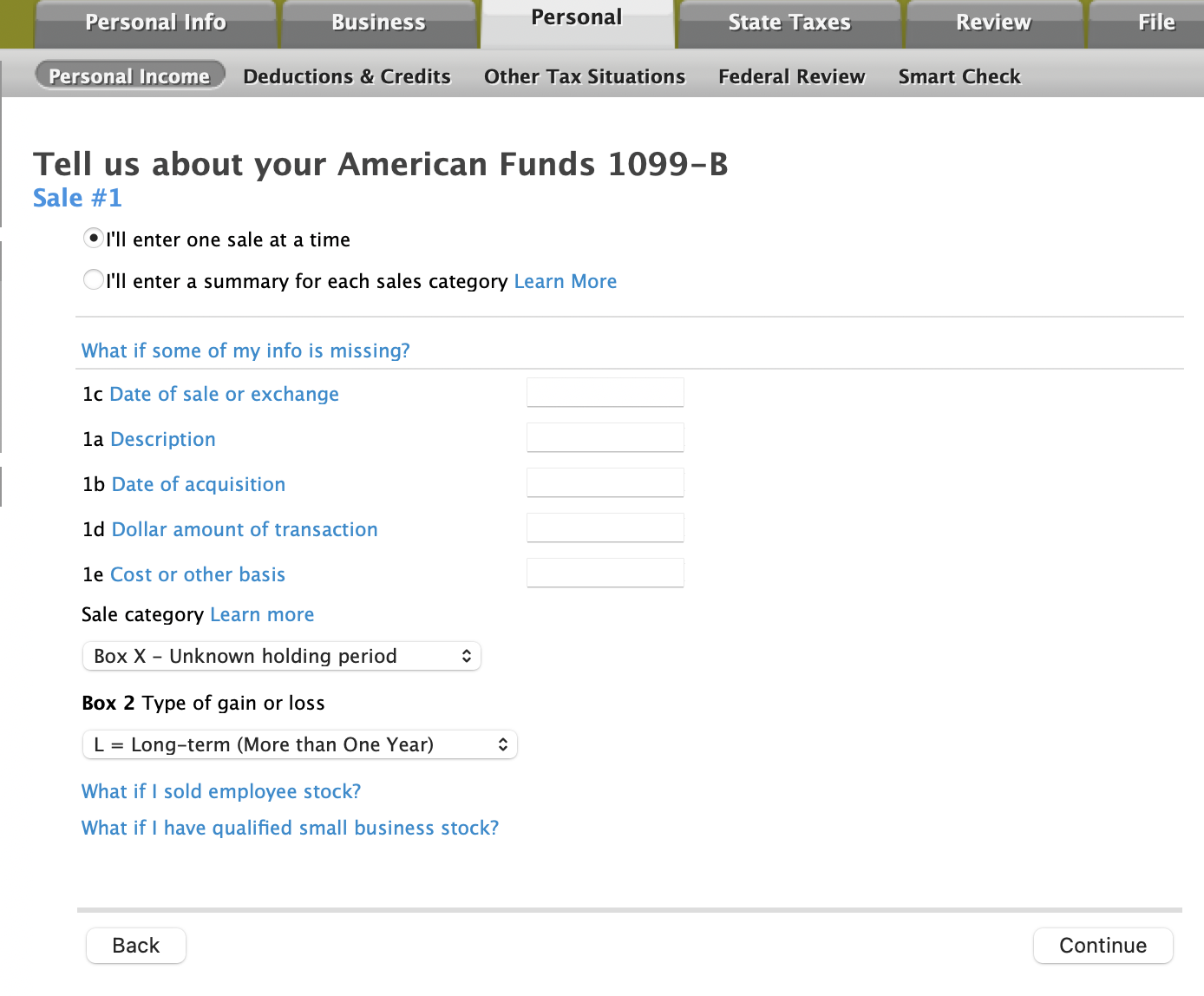

See the following sample screenshot for entering this in the "Stocks, Mutual Funds, Bonds and Other" interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting info on 1099B form

On the 1099B it will tell you if these stock transactions are long term or short term. If they are all long term I think you can enter various or VAR in the acquisition field and then you can select long term. Good luck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting info on 1099B form

If your broker doesn't provide certain information is is your responsibility to maintain it. The items in question are:

- 1b (date acquired),

- 1e (cost basis) and

- Box 2. (Long/Short Term Gain)

Entry 1b will determine if it is a long or short term transaction. If it is less than a year it is short term. If it is more than a year it is Long term. To the best of your recollection determine the date you acquired the investment.

Entry 1e is the cost basis. This is the amount you paid for the investment. You may be able to use Historical Stock Quote Prices - MarketWatch to determine the original value.

Entry Box 2 Once you know line 1b you will know if it is Long or Short term. Check the appropriate box.

There are seven possible "Box" designations that indicate the holding period (Long/Short Term) and the reporting status. You will use B or D depending on the long or short term condition.

Code A. This code indicates a short-term transaction for which the cost or other basis is being reported to the IRS. Use this code to report a transaction that the recipient will report on Schedule D (Form 1040), line 1a, or on Form 8949 with box A checked with totals being carried to Schedule D (Form 1040), line 1b.

Code B. This code indicates a short-term transaction for which the cost or other basis is not being reported to the IRS. Use this code to report a transaction that the recipient will report on Form 8949 with box B checked with totals being carried to Schedule D (Form 1040), line 2.

Code D. This code indicates a long-term transaction for which the cost or other basis is being reported to the IRS. Use this code to report a transaction that the recipient will report on Schedule D (Form 1040), line 8a, or on Form 8949 with box D checked with totals being carried to Schedule D (Form 1040), line 8b.

Code E. This code indicates a long-term transaction for which the cost or other basis is not being reported to the IRS. Use this code to report a transaction that the recipient will report on Form 8949 with box E checked, with totals being carried to Schedule D (Form 1040), line 9.

Code X. Use this code to report a transaction if you cannot determine whether the recipient should check box B or box E on Form 8949 because the holding period is unknown.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting info on 1099B form

I reported long-term capital gains on the sale of a condo. The code should be E, but turbotax defaults to only "F". Yet, when I access Forms it shows other codes, including E. I need to select E, not F.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cl020202

New Member

KBCPA1

Level 3

cakillorin7

New Member

rusras4

New Member

wolfgangzheng147

New Member