- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Reporting allowable losses and deductions from form 7203, interaction with other limitations

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

If I am a passive S-corp shareholder with prior year loss suspended by basis limitation, current year ordinary income, other net rental loss exceeding ordinary income, sec 1231 income and interest income, all the same entity, what is the correct way to report allowable losses and deductions from columns (c), form 7203? Furthermore, how do these allowable losses interact with other limitations, specifically the passive activity loss limitations?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

The first limitation is basis reported on IRS form 7203. Then apply the other limitations.

Instructions for Form 7203 page 1 states:

Limitations on Losses, Deductions, and Credits

There are potential limitations on corporate losses that you can deduct on your return. These limitations and the order in which you must apply them are as follows: the basis limitations (Form 7203), the at-risk limitations (Form 6198), the passive activity loss limitations (Form 8582), and the excess business loss limitations (Form 461).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

Could you confirm how much, if any, of total allowable losses (columns (c), form 7203) would be limited by passive activity loss rules in the case where current year ordinary income, other net rental loss (Exceeding ordinary income), sec 1231 and interest income all derive from the same entity, and no money is at risk?

As this is a passive activity, I understand that any loss allowed from stock basis, exceeding current year passive income, for each category, generates PAL carryover. In this case, the difference between the total allowed loss that goes to Sch E p2 (Ordinary + rental) and current year income (None, as other net rental loss exceeded ordinary) generates PAL carryover. Correct? @JamesG1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

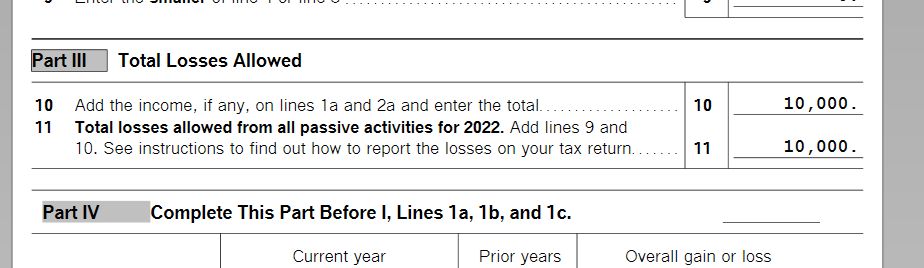

Since you are a passive shareholder, all the income from the investment is passive and falls under the passive activity loss rules. The total allowed loss from the basis limitations is limited to the current year's passive income. So, yes, if the current year's income doesn't cover the carryover losses from a previous year, the loss is carried over again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

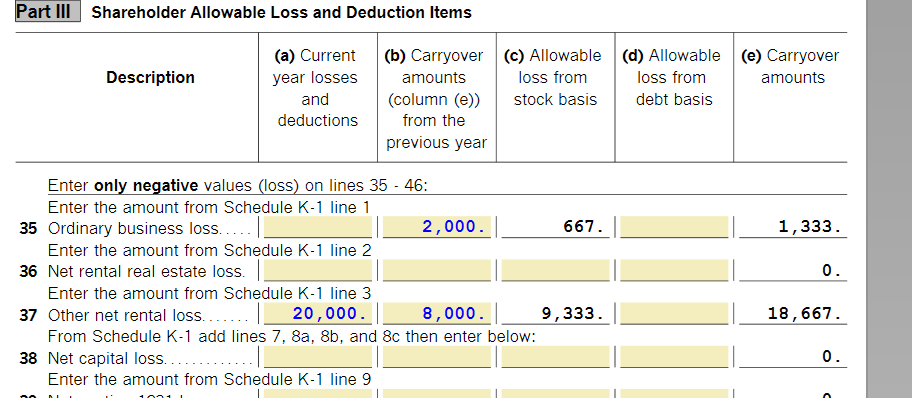

@AliciaP1 thank you. Perhaps an example would help. Assuming the figures below and no other passive income, what is the correct way to handle the following? Is 10,000 Allowed Stock Loss offset by 10,000 ordinary income, or is the 10,000 Allowed Stock Loss suspended as there is no net income to schedule E, or something else?

Passive Income Entity A

Ordinary 10,000

Other Net Rental -20,000

Allowed Stock Loss, Entity A (Form 7203, Column C)

Ordinary 2,000

Other Net Rental 8,000

Total Sch E 10,000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

I'm not sure I understand what you need to "handle" from this form. The Form 7203 is meant to calculate your basis(value) in the investment. When you enter your information from your K-1 and your loss carryovers, you can review this form to ensure it is pulling all the correct amounts you entered and that you agree with your basis calculation.

The form will carry the allowable losses up to Part I to calculate the basis amount at the end of the year and any basis loss limitations you will have to carry over to 2023. Both the Ordinary and Other Net Rental allowed stock losses will populate line 11. The income amounts should be showing on lines 3a and 3c and the ending basis is on line 15.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

@AliciaP1 I mean "Handle" in the sense of what to do with the information generated in form 7203. Specifically, what portion, if any, of the 10,000 in allowed loss from stock basis would be suspended by passive activity loss rules in the example I gave? How would it be reported — on schedule E, form 8582, and so on? Please note in the example there is a net of -10,000 loss to schedule E for the current year, even though there is 10,000 ordinary income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

The Form 7203 helps you determine the loss you are allowed to report as allowable when you enter your Schedule K-1 PAL carryovers. In order for the Form 7203 to calculate correctly you need to have already entered your Schedule K-1. Then, when you enter your beginning basis for the year, the form calculates the rest of the information and updates your basis loss limitation carryovers. This is the information you will use to input your loss carryovers for 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

@AliciaP1 Right: my question is what to do with the information in column C — in your example 667 and 9,333. As this allowed loss is passive, and there is no other passive income to offset it (Remember there was a net loss between Ordinary and Other Net Rental incomes) can you confirm that the total of 10,000 is further suspended under passive loss rules and reported on form 8582?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

Yes, the forms populate correctly when you enter your beginning basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

@AliciaP1 I am asking what, if anything, one would do with the amounts in column C in the scenario I described. In this video the preparer inputs those allowed loss amounts to schedule E page 2. Yet again, in my case, the allowed loss is passive, so I am asking to confirm that those amounts are further suspended and a PAL of 10,000 is generated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting allowable losses and deductions from form 7203, interaction with other limitations

Yes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

timcr7gk

New Member

dbeck619

New Member

StanlyDiamonds

Level 1

gaving031

New Member

hqat1

Level 2