- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

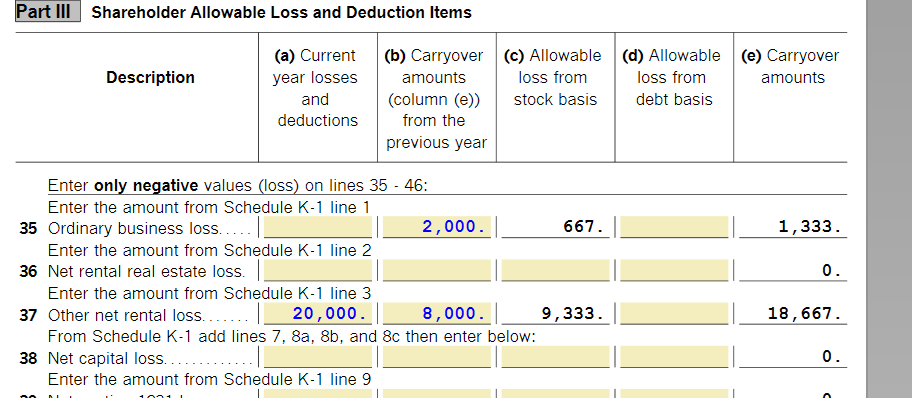

The Form 7203 helps you determine the loss you are allowed to report as allowable when you enter your Schedule K-1 PAL carryovers. In order for the Form 7203 to calculate correctly you need to have already entered your Schedule K-1. Then, when you enter your beginning basis for the year, the form calculates the rest of the information and updates your basis loss limitation carryovers. This is the information you will use to input your loss carryovers for 2023.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 12, 2023

9:58 AM