- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Report ISO Exercise and Hold for AMT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Report ISO Exercise and Hold for AMT

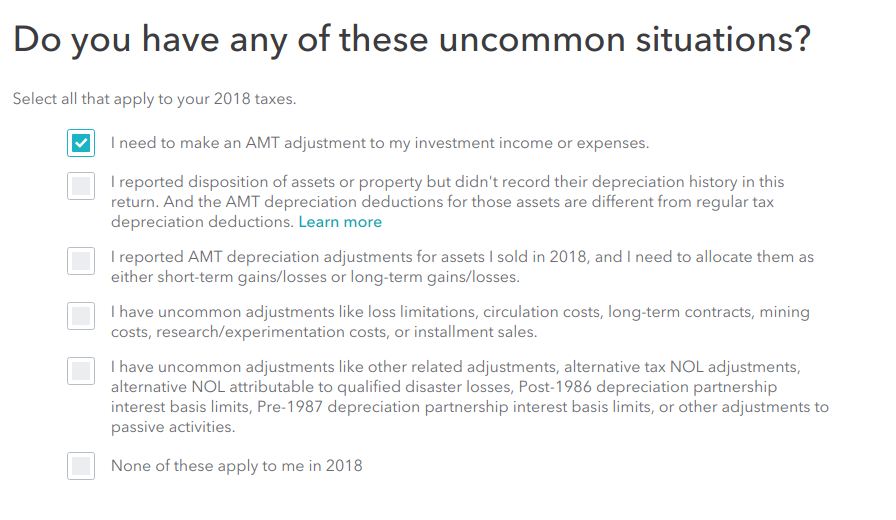

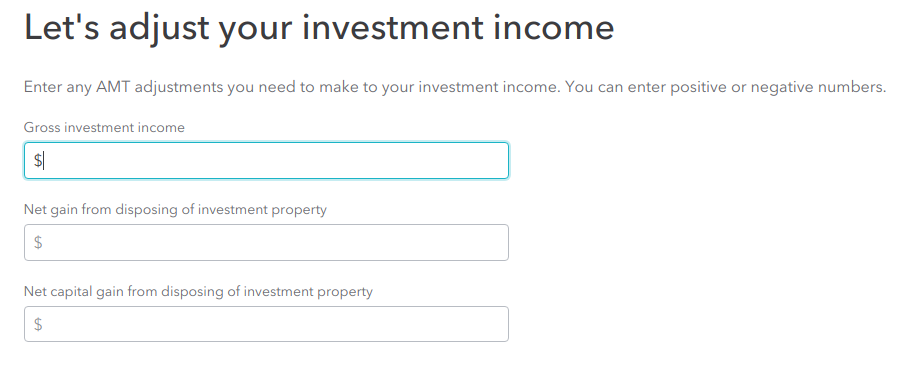

Hello, I have a question on how to report ISO exercise and hold for AMT. am using the web version of turbotax premier for 2018 tax. I am currently stuck at the follow step:

I don't know what to fill here...

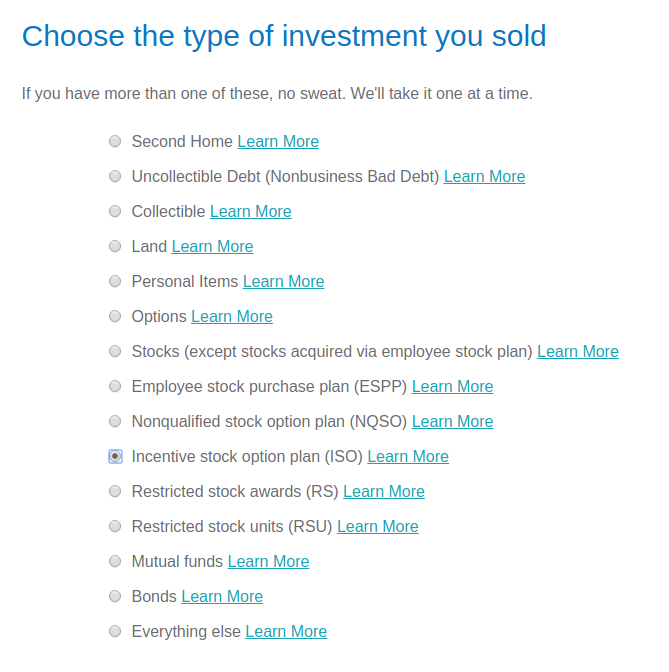

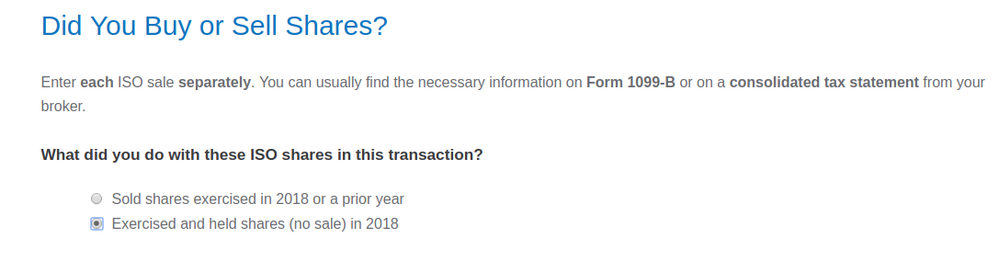

I was expecting it to be more intuitive, like how it was reported in the regular tax section, see below:

Please help! Thank you very much in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Report ISO Exercise and Hold for AMT

please read the link below

does that clear up how to approach? (espcially see the 1st of the 5 variations - does that cover your situation?)

https://turbotax.intuit.com/tax-tips/investments-and-taxes/incentive-stock-options/L4azWgfwy

why do you think you have an AMT adjustment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Report ISO Exercise and Hold for AMT

If you fill out your ISO exercise and hold information in the Wages and Income section of your return, TurboTax will automatically calculate AMT for you. Once you click that you held your exercise, it should ask if you received a form 3921 from your employer and you will then input your information (date option granted, date(s) exercised, exercise price per share, FMV per share on exercise date, and number of shares transferred). Turbo Tax will then calculate your additional income (FMV per share - exercise price per share x number of shares exercised). Once you continue on in your return, past wages and income and onto Other Tax Situations, it will show a calculation for AMT and let you know if you owe any or not. I agree, it's confusing when you click Other Tax Situations and they ask if you exercised ISOs, you click yes, and then none of the options are related to that; but then they don't tell you to go back and fill out that information in the Wages and Income section to get your AMT calculated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Report ISO Exercise and Hold for AMT

This is very helpful! One quick follow up - if there is no AMT due, does form 3921 still need to be filed with the return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Report ISO Exercise and Hold for AMT

@sp28b No, you do not have to file Form 3921 with your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RicN

Level 2

selbym

Level 2

in Education

Davidbike2

New Member

NancyWolfe

Level 2

b_benson1

New Member