- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Recovery Rebate Credit After Death (Possible ERROR)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

I have a family member that passed on 04/15/2020 and received $112.50 from the Recovery Act Stimulus based on the family members 2019 income prior to death. I am attempting to complete the family members taxes for 2020 am having difficulty surrounding the Recovery Rebate in TurboTax. After entering the amount of Recovery Act stimulus of $112.50 into the software, TurboTax insists on adding the balance of Stimulus payment due, $1200 for the first round and $600 for the second round, to the family member in the form of a refund even though the family member exceeded the 2019 income threshold, passed on 04/15/2020, and is ineligible for additional payments from the end of 2020. It also appears Turbotax is using this years income even though the software is aware the taxpayer passed. Am I missing something or is this a programming error that needs to be addressed asap?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

According to the rules of the Recovery Rebate Act, the taxpayer still qualified for the stimulus payments for 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

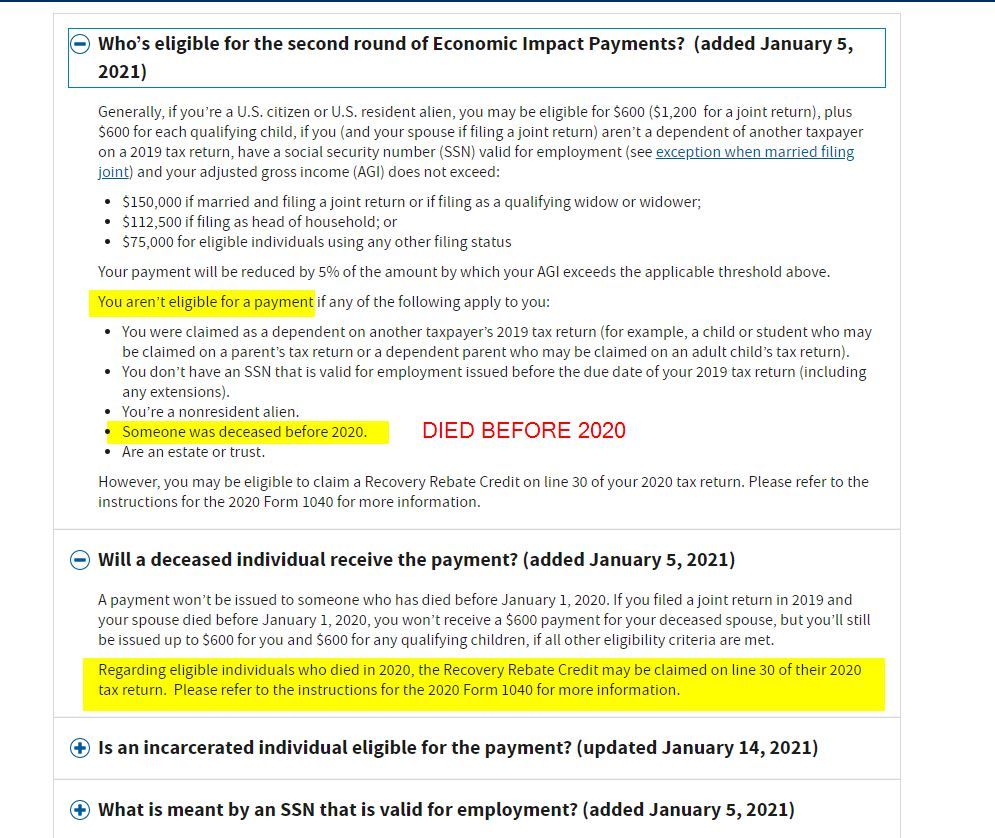

Yes! For deceased individuals see the first 2 questions under Eligibility. If they died in 2020 they still get it.

https://www.irs.gov/coronavirus/second-eip-faqs

And it is really based on the 2020 return. So they can qualify for more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

Almost forgot I have a screen shot of it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

From what I understand the income limit for the first and second round of payments was $99,000 filing individually. The individual I am referring to had 2019 AGI of $96750.00. Hence the indexed payment of $112.50 toward the complete phaseout at $99,000AGI I referenced previously. Apparently, the phase-out above $75,000 was $5 for every $100 above $75,000 AGI with a $0 at $99,000 AGI. I haven't seen anything that removes the phase-out from $75,000 to $99,000. Is this not accurate?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

Even if the individual passed in 2020, from what I understand the income limit for the first and second round of payments was $99,000 filing individually in 2019. The individual I am referring to had 2019 AGI of $96750.00. Hence the indexed payment of $112.50 toward the complete phaseout at $99,000AGI I referenced previously. Apparently, the phase-out above $75,000 was $5 for every $100 above $75,000 AGI with a $0 at $99,000 AGI. I haven't seen anything that removes the phase-out from $75,000 to $99,000. Is this not accurate?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

But now it is based on their 2020 return. What is their 2020 income? Forget 2018 & 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

Much less than the cutoff for this years round. Are you saying that the new round of stimulus just passed is retroactively bringing all those payments forward and basing eligibility on 2020 AGI regardless of the previous phase-out based on 2019 AGI?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

I don't know about the new 3rd one but the first 2 rounds are reconciled on your 2020 return and use 2020 income. Nothing is programmed in for the new one yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

So, if I understand you correctly....The stimulus payments scheduled to be paid in 2020 which were previously based on 2019 AGI with the AGI phase-out are now based on 2020 AGI with the 2019 phase-out eliminated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit After Death (Possible ERROR)

The phase out protocol is the same, but everything is based on 2020 AGI. So if 2020 AGI is above 75,000 then the phase out rules apply to the 2020 income. If the 2020 AGI is below $75,000 then the phase out rules are not applicable.

The third round eligibility is also based on the latest filed tax return. If a 2020 return is filed then the AGI on it applies, if not, a prior year (2019) AGI will apply.

Note: The phase out protocol for the third round is different. Complete phase out happens at 80,000.

Here is a link with more information on the stimulus payments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BUDOWMARK19

New Member

bamalexkates

New Member

spurlockp

New Member

shirley.davidson

New Member

Paschallatashia

New Member