- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Once you get into the inventory section of your business,...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

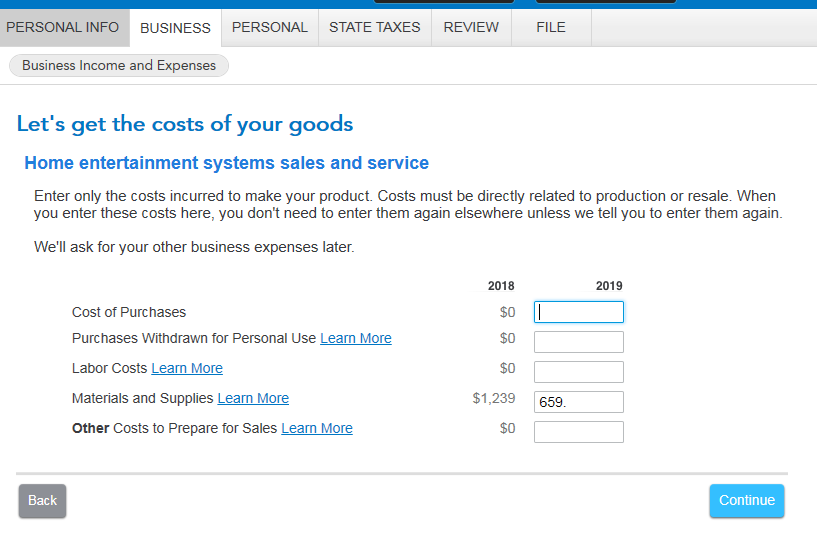

Once you get into the inventory section of your business, you'll put your cost of goods (purchases) on the screen below. The inventory section is on your home screen for your business (see second screenshot below).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

First, I don't see any screen shots in the answers given here.

Second, It really seems like the wrong way to fill out "Cost of goods sold" to say you have inventory, especially when you have sold the items you bought. In my case I have things I had to buy for commission sales (besides material costs like cement, pipe, connectors, wire, etc.), some of which I am reimbursed... which those payments show up in a 1099. So if I can't show I paid for this stuff, it's not being written off. And in the case of reimbursements, it is looking like I got paid for something I didn't have to buy in the first place.

BUT, here is how I found it (which should be a direct link instead).

Inventory to report?: Yes (Continue)

Cost Method?: Yes (Don't check mark the box)

Value of your inventory- Beginning: $0 End: $0 (Don't check mark the box) (Continue)

There is the place to enter Purchases for resale.

Why is this not just a link on the main section of business expenses? It would be more logical, and it seems like the exact thing people are asking you how to find.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

Oh, BTW... I do see this thread is from 2019, not 2020. I ended up here in a search for the answer and thought I'd add to it so if anyone searches as I did, perhaps this will help... unless you fix this in TT 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

"Why is this not just a link on the main section of business expenses? It would be more logical, and it seems like the exact thing people are asking you how to find."

The IRS lists Cost of Goods Sold separately from ordinary business expenses. We have to follow that IRS does. This also follows generally accepted accounting practices.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

question...

for this is takes 2 prior years. i didnt purchase in 19, or 20... i purchased the stuff in 2021 and it is an expense for me tax year 2021. but i cant add it as an expense. i purchased for my direct sales for events. and i received money from sales through square. it is being counted as income- but it is being reimbursed for the products i purchased. how do i enter that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

I'm not sure I understand your question. It seems like you want to know where to enter your inventory. Or, are you saying that even though you follow the instructions below, your purchases are being counted as income?

Please see the instructions below for adding your inventory:

- On the Tax Timeline, select "Business".

- Click continue then select "I'll choose what I work on".

- Click update/start next to "Business Income and Expenses".

- Select "Edit" next to your business name (or add your business information here if you haven't already).

- Scroll down to "Inventory / Cost of Goods Sold" and click "Start" to begin entering your inventory.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

If I enter it as inventory it does nothing. It doesn't count it as an expense for the year and then asks questions about about 2019 and 2020 in which I didn't have any expenses for inventory. I started in Sept 2020 and didn't accumulate inventory. But I made purchases for vendor events in 2020 and when I sold them (paid retail, sold retail) I accepted payment through Square reader. But it is counting Square payments and income. How do I negate that as income since it wasn't additional income but reimbursement?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

Entering your inventory will not show as an expense on your Schedule C.

Inventory is used to determine the Costs of Good Sold. Your beginning inventory will be whatever your ending inventory number was on December 31, 2020. The formula is beginning inventory plus purchases minus ending inventory. This gives you the cost of goods sold. The Cost of Goods Sold is subtracted from your gross income. It is not additional income. Costs of Goods Sold are not taxable.

It is correct to report Square payments for products purchased as income. Costs of Goods Sold is the expense for the purchase of the product. Square payment should be credited to inventory or the appropriate expense account.

To figure Cost of Goods Sold in Self-Employed

- Go to Inventory/Cost of Goods Sold and click Start or Update.

- Say Yes, I have inventory to report.

- Answer the question about how you value your inventory.

- Enter the inventory at the beginning and end of the year.

- Enter on the next screen the costs that you had for the year in purchasing or making your inventory.

- The cost of goods sold is figured automatically and put on the second page of your Schedule C. It is equal to Purchases for the year + beginning inventory – ending inventory.

- That number goes to page 1 of your Schedule C, on line 4.

- Line 4 gets subtracted from line 1, gross receipts,

- This equals your gross profit, which is line 5 of your Schedule C.

After the Inventory is entered look at Page 1 of Schedule C, Line 4. This will be the net result of the Costs of Goods Sold.

Part I Income

- Line 1 is your Gross Receipts.

- Line 2 would be any returns or allowances that you have

- Line 3 is the difference between Line 2 and Line 1

- Line 4 is the Cost of Goods Sold

- Line 5 is the difference between Line 4 and Line 3.

- Line 6 enter any other income you might have

- Line 7 is your Gross Income.

The Cost of Goods Sold acts as a wash of your costs from income. Your expenses are then subtracted from the Gross Income. Line 31 is the net profit/loss from the business. If Line 31 shows a profit, this is the taxable amount. If Line 31 is a loss, there is no taxable consequence from the busines.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

What if i do not know my inventory numbers from last year to this year at all? I do know what everything cost me that i sold, though. last year i just entered what i paid for items sold,this year it shows inventory this and that but i do not know the answer to that or how i could calculate it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

@AUZHO If you didn't enter an ending inventory last year, then this year's beginning inventory would be zero. You can look on line 41 of last year's schedule C to see what you entered for inventory.

Your ending inventory for this year would be the cost of merchandise you had available for sale at December 31, 2021. If you don't have an exact figure for that, you can estimate the cost, as it will just delay the expensing of it until 2022. So, the cost of goods sold as it relates to inventory is just a timing expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

last year i filed using a CPA. Can i still find my schedule C on turbo tax? if so, how?

I have an exact figure of what my cost was for the items sold in 2021. I do not have an ending inventory, i sold everything i had left and i am not continuing reselling as it is not worth my time, in my opinion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is cost of goods sold in TurboTax Self-Employed?

No, you could not find your schedule C on TurboTax if you did not prepare your return using it. However, you CPA was required by law to give you a copy of your return. Also, he can furnish one to you now if you request it.

You should just enter zero for your ending inventory since you don't have one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

margomustang

New Member

yibanksproperties

New Member

tomdavey

New Member

tomdavey

New Member

EdT72

New Member