- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

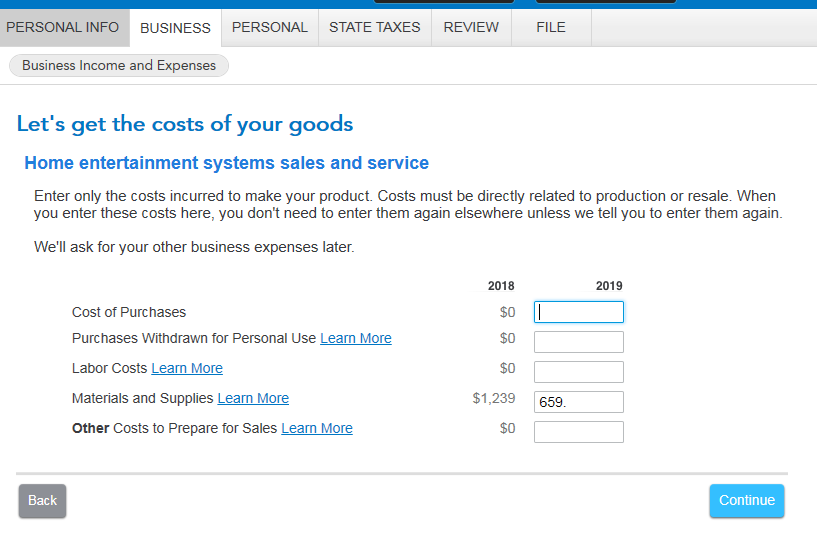

First, I don't see any screen shots in the answers given here.

Second, It really seems like the wrong way to fill out "Cost of goods sold" to say you have inventory, especially when you have sold the items you bought. In my case I have things I had to buy for commission sales (besides material costs like cement, pipe, connectors, wire, etc.), some of which I am reimbursed... which those payments show up in a 1099. So if I can't show I paid for this stuff, it's not being written off. And in the case of reimbursements, it is looking like I got paid for something I didn't have to buy in the first place.

BUT, here is how I found it (which should be a direct link instead).

Inventory to report?: Yes (Continue)

Cost Method?: Yes (Don't check mark the box)

Value of your inventory- Beginning: $0 End: $0 (Don't check mark the box) (Continue)

There is the place to enter Purchases for resale.

Why is this not just a link on the main section of business expenses? It would be more logical, and it seems like the exact thing people are asking you how to find.