- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

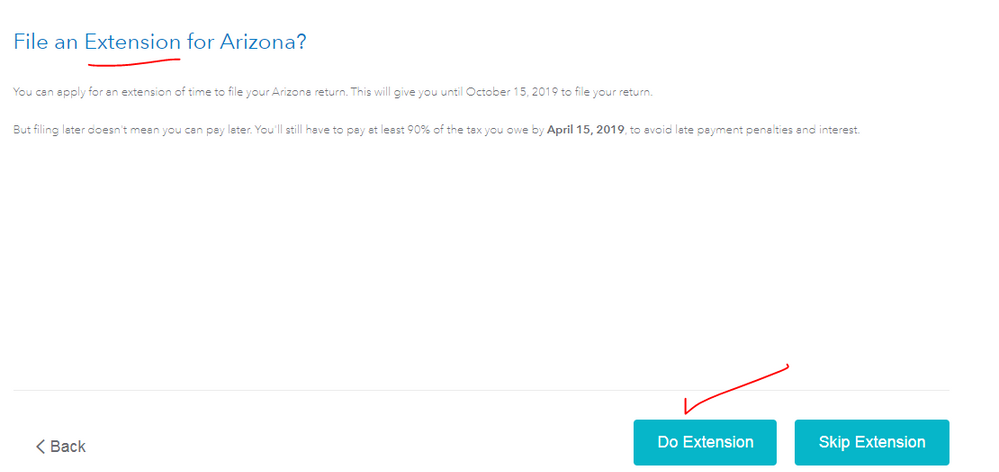

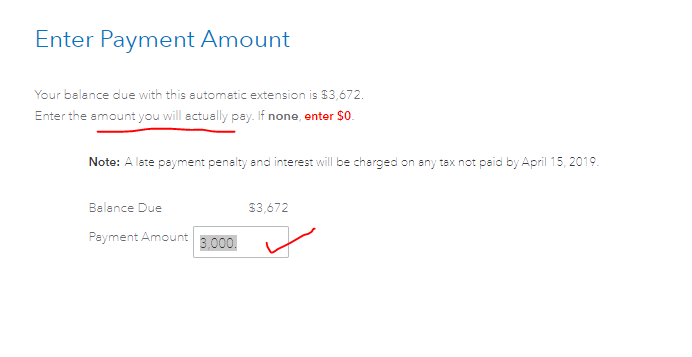

Ok ... weird as it may seem ... the AZ extension payment is in the FILE EXTENSION section ... if you did not complete this section originally then you must do so now even though you will not actually mail in any extension or payment now ... this is just to record the payment you did make earlier.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

1) If you made an extension payment for only one state, you can just enter that one state's extension payment in the Federal Taxes section<<<Deductions&Credits<<<Other Income Taxes section (for those using the Online SE version, or desktop H&B version, it's in the Personal taxes section ).

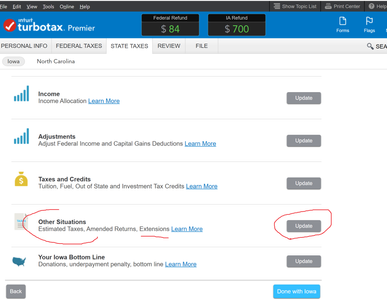

2) If you made extension payments to two or more states, you enter the total for all the states in the same spot as #1 (And select "Multiple States" from the end of the list of states). Then, after you go thru each of the states interview, there should be a menu with "Other Situations" in which you can enter just the amount you paid for that state (See Pic below)

_______________

_____________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

Thank you for the response. Yes, I made extension payments for multiple states and entered the total as "Multiple States", however, when I go to each State and go to the review section, there is no option similar to the pic you are showing. I went back through the entire state process again, and at the end it simply bounces back to the full list of states without option. I'm using the online version of TT Premier. Any other suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

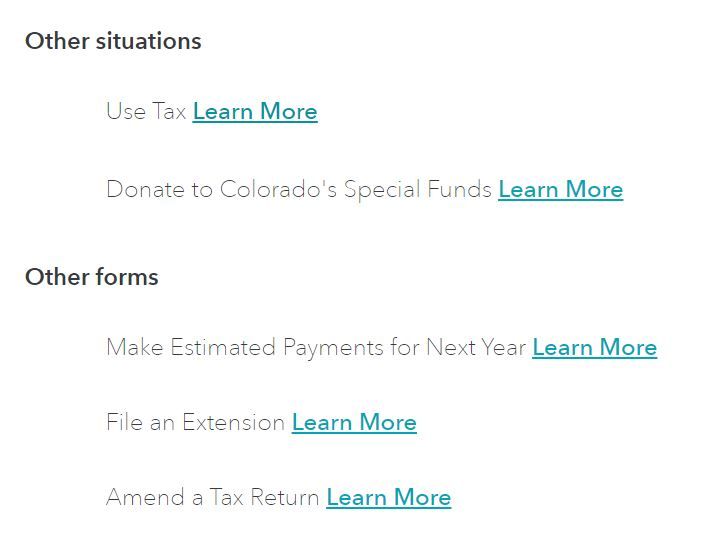

I dug deeper on this. Arizona doesn't have such a screen. MI, CO and CA all have something similar, however, in the online version, the Other Situations doesn't have an option for tax extension payments. Here is a picture of what it shows. I'm lost as to what to do next....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

Ok ... weird as it may seem ... the AZ extension payment is in the FILE EXTENSION section ... if you did not complete this section originally then you must do so now even though you will not actually mail in any extension or payment now ... this is just to record the payment you did make earlier.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

______________________

I don't have the AZ software, but I suspect that you have to go thru the "File an Extension" interview.

You won't really be filing an extension, but should be given a chance to enter what you paid in there somewhere.

I'll poke some others and see if they have AZ..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

Looks like Critter got it....we were responding at the same time.

...but Colorado Special Funds? in your picture for AZ?

confusing, but maybe you've got the gist of it anyhow.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

Until the online version shuts down in October, I use my fake returns to open up any state program I wish... had to go thru the system 3 times to find it 😉 after making sure I had an AZ balance due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

Critter and SteamTrain....thank you both for your help. I went through AZ and yes, you have to say you are filing the extension to record the payment. Seems odd to me but that worked. I will go through my remaining State returns and check the behavior of those. As for the image I posted that shows Colorado while talking about Arizona, sorry for the confusion as I have CO, MI and CA also to file and the AZ return didn't have that type of Other Situations screen. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my state tax return, where do I enter the payment I made with the extension I filed earlier in the year?

Over the past several years, TTX appears to have been slowly standardizing the state menu screens to be more consistent with one another...but apparently they are not done yet. One thing I have noticed, is that you must go fully thru the state interview at least once before you get to see the state menu page, similar to the one I first showed above. SO if one jumps into the state section the very first time, they don't get to see that menu right away.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

techbgood

Level 1

tulip0479

New Member

gigi0480

New Member

jeffhoward001

New Member

michael_dunne

New Member