- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

1) If you made an extension payment for only one state, you can just enter that one state's extension payment in the Federal Taxes section<<<Deductions&Credits<<<Other Income Taxes section (for those using the Online SE version, or desktop H&B version, it's in the Personal taxes section ).

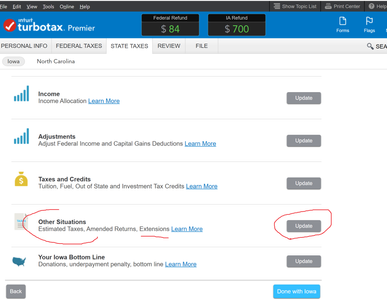

2) If you made extension payments to two or more states, you enter the total for all the states in the same spot as #1 (And select "Multiple States" from the end of the list of states). Then, after you go thru each of the states interview, there should be a menu with "Other Situations" in which you can enter just the amount you paid for that state (See Pic below)

_______________

_____________

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

September 21, 2019

5:11 AM