- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Official COVID-19 (Coronavirus) stimulus payment thread

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Prior to 2017 my AGI was always less than $75K. Last year I had a weird situation where my AGI was over $100K due to an inheritance received from a deceased relative. This year I'm back to an AGI even less than $50K. I just filed my taxes today. Can I assume the government has already determined from my 2018 return I'm ineligible for the $1200 stimulus check, or is there a way to alert them to look at my 2019 taxes as a more realistic estimate of my regular income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

@claudiagarcia714 wrote:

Does anyone know why I would only receive $1200 and not the extra $500 for my 14 year old daughter? I just got it this morning but only $1200.

Thanks

Contact the IRS about the missing payment when you receive their letter .

https://www.irs.gov/coronavirus/economic-impact-payment-information-center

For security reasons, the IRS plans to mail a letter about the economic impact payment to the taxpayer’s last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If a taxpayer is unsure they’re receiving a legitimate letter, the IRS urges taxpayers to visit IRS.gov first to protect against scam artists.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

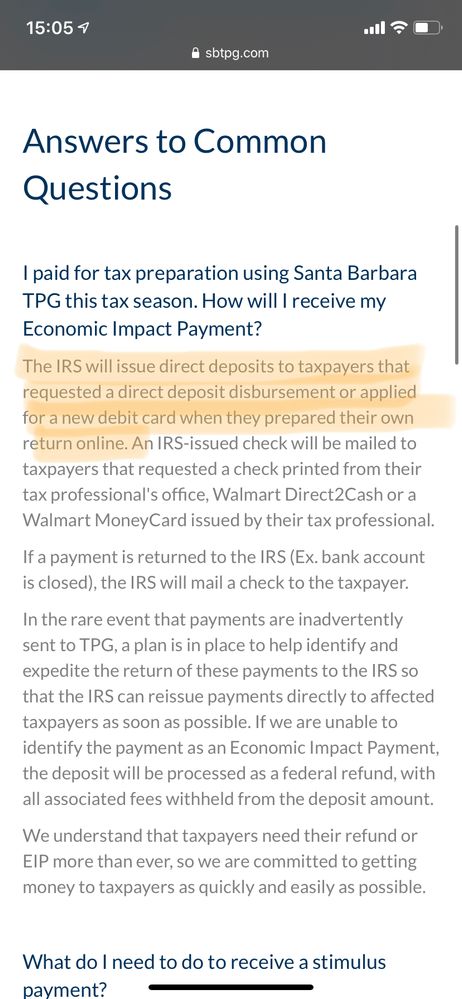

Irs should have those bank accounts if for some reason its sent to SBTG rhey will try to gather your information and send back to IRS to reissue if for some reason they cant send back to IRS they will deposit as a refund and charge fees . Visit SBTG page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

The irs doesn't have Sbt account info they have your info. Santa Barbara uses software that pulls the fee out. It just like when you have a wage assignment your whole check doesn't go to that places account they intercect and take their money. But it is actually deposited into the account on the turbo card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

@DoninGA what bank did yours come thru ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I understand the irs doesnt sbtg info i understand that sbtg is third party they took their fees deposited the balance in my checking account their been alot confusing if those direct deposits concerning account if if irs would have which they should their on your tax documents if you requested DD

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I haven't got mine yet but on my tax return it has the same number as my turbo cards direct deposit. Meaning the irs has are banking info

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

It is tubotax card vise it green dot card

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I'm taking it no one has seen any movement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Ok I'll take that as a no

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Nothing in Illinois. Hopefully tonight.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

If you used the refund advancement feature with a prepaid card from TurboTax:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I received my refund direct deposit via SBTPC in turbo tax because I had my preparation fees deducted from my federal return. Does this affect my stimulus payment processing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I have no income and did not file in 2018 or 2019. I submitted my info using the TurboTax registration tool...do I *also* need to file on the IRS portal? Or should I?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DA_New

Returning Member

Shannone_beall

Level 2

debr45

New Member

megareader

New Member

BanArt

Level 2