- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Official COVID-19 (Coronavirus) stimulus payment thread

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

IF someone on SS benefits who is normally not required to file has DEPENDENTS under the age of 17 (grandparents raising grandchildren is all too common) then they DO need to either file a 2019 "simple" return when that option is available OR file a 2020 return next year to get the extra credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

At this time there is no way to file a "simple" return and if you have no dependents to claim and you have SS benefits you do NOT need to file anything ... see this article :

Press reports from yesterday are the direct deposits are now expected to occur between April 9 and April 14 for taxpayers with those on social security (and no tax return) to follow in the two weeks after that..

The checks will then be issued BASED ON YOUR INCOME beginning April 24. They will be processed in $10,000 earnings increments weekly. So those with incomes below $10,000 would receive then beginning April 24, those with $20,000 earnings would be expected to receive them the week of May 1, etc.

this is the best article I've read on the plan from a reputable source

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

How do I determine if the IRS has my account information so they can send a deposit directly to my Credit Union account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

The IRS will have your account information if you filed a 2018 or 2019 tax return and it included your banking information. If you are receiving SS or RR benefits the IRS will use the banking information associated with those accounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Please update the stimulus portal to allow people who have already filed their taxes to update their direct deposit information so that we can get our Stimulus money faster. I am not usually required to file taxes, however, I was instructed to do so by the IRS before this portal went live, and I was not given the option to input my Direct Deposit information on the website itself and thusly did not do so. By the time i realized it was an option, the deed was already done and my information was accepted and i was told i could not fix it, not even via amended returns.

I’ve been looking around and trying for days to find a way to update my direct deposit info because it will without a doubt take forever for my check to arrive in the mail and I and many others do not have that sort of time. The IRS website lead many of us to believe that the portal they were building would let us update our direct deposit information, not lock those of us who were unable to submit it in the first place out of getting our money directly deposited. if the portal cannot be updated, who can i speak to to relay my direct deposit information to the IRS for me? TurboTax is directly connected to the IRS. Surely there is a way they can submit the information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

TT is simply a DIY program to complete and submit a completed return ... NOTHING ELSE. They are not part of the IRS system anymore than any other tax program including the professional ones. Unless the IRS opens this "portal" or give specific directions to the income tax program companies there is nothing anyone can do at this time.

Also ... the "Economic Impact Payments" as they prefer to be called will be sent out over a period of months not just a couple of days ... patience will be needed during this time of craziness.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Not sure what site you think you are posting on but this is NOT the IRS and they are the ones to implement the "PORTAL" when and if they ever do ... watch their site for information as available : https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

Per the IRS :

The IRS does not have my direct deposit information. What can I do?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

@Critter wrote:

Not sure what site you think you are posting on but this is NOT the IRS and they are the ones to implement the "PORTAL" when and if they ever do ... watch their site for information as available : https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

Per the IRS :

The IRS does not have my direct deposit information. What can I do?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

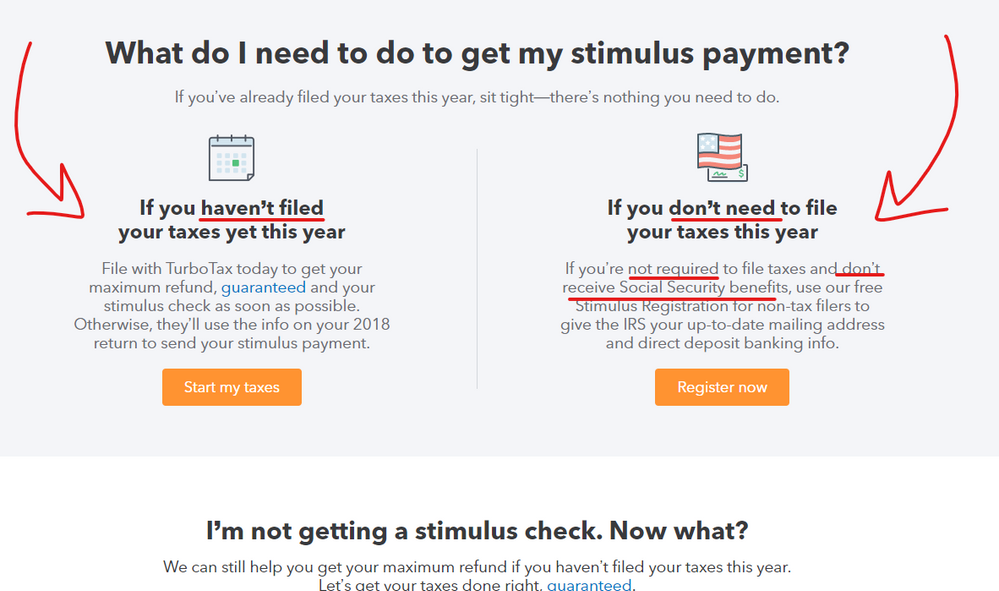

They can register here on the TT website - https://turbotax.intuit.com/stimulus-check/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Interesting ... so you are filing a fake $1 income return so you can enter the DD info ... glad they came out with this free option as fast as they did ... but folks really need to read the screens carefully so they take the correct path ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

And this doesn't help folks who have already filed and need to make changes ... that will have to be done thru the IRS portal system when it becomes available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

q: Will Intuit/TurboTax program be updated in the next two weeks to show the IRS a direct deposit account for the purposes of economic impact payments for additional case of no amount due/owed?

background: My 2019 and 2018 returns show neither an amount due or an amount owed. Current software will therefore not show a routing number/checking number on the 1040 (shows "xxxxxxxx"). [Please don't say there is no reason to file in this case - there is.]

Basically, will you be updating the TurboxTax software/program shortly to accommodate new circumstances or relying on the Treasury's impromptu, input-your-info website, if/whenever that comes along?

Holding off filing for 2019 for a short while = why I'm asking. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

@Petrichor wrote:

q: Will Intuit/TurboTax program be updated in the next two weeks to show the IRS a direct deposit account for the purposes of economic impact payments for additional case of no amount due/owed?

background: My 2019 and 2018 returns show neither an amount due or an amount owed. Current software will therefore not show a routing number/checking number on the 1040 (shows "xxxxxxxx"). [Please don't say there is no reason to file in this case - there is.]

Basically, will you be updating the TurboxTax software/program shortly to accommodate new circumstances or relying on the Treasury's impromptu, input-your-info website, if/whenever that comes along?

Holding off filing for 2019 for a short while = why I'm asking. Thanks!

Can't answer for TurboTax but since the US Treasury is going to provide that function, I would say that TurboTax is Not going to change their software to accommodate this need.

IRS website for information - https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

The IRS does not have my direct deposit information. What can I do?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

If you WILL or are REQUIRED to file a 2019 return and your 2018 DD info is incorrect then you MUST wait for the IRS portal to become operational.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

How do get my direct deposit info to them for the stimulus check. I have owed the last few years and dont know if they have my info

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

IF you have already successfully efiled then all you can do is WAIT for the IRS portal to make the DD change ... that is your ONLY option WHEN it is available : https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

The IRS does not have my direct deposit information. What can I do?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DA_New

Returning Member

Shannone_beall

Level 2

debr45

New Member

megareader

New Member

BanArt

Level 2