- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Not Able to import Etrade 1099 since its a large file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

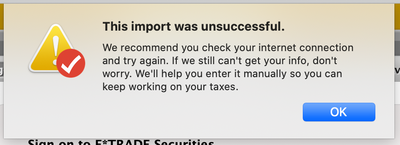

I am trying to import 1099 from Etrade but Turbotax is giving error " check your connection....". I think its because it is a large file. Is there any way to import it without manually entering transactions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

You may need to check your brokerage to see if they are allowing third-party access. Although the following Help Article is for Schwab, it is possible that your brokerage has restricted TurboTax's access to your statements unless you grant consent, and you might need to do something similar to what is described here How can I fix my 1099 import issue?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

Hi, i checked there is no such access needs to be given from etrade side to enable third party access, as i was able to import the form last year.

I am still getting the same error !

Are they working on getting these resolved ?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

Please follow the instructions in this TurboTax FAQ to contact customer support for assistance with the e-trade import: What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

I called the "live expert", & was really disappointed again, according to them this ISSUE is resolved, but clearly its NOT, looks like turbo tax may not be acknowledging the issue ?

There troubleshooting is restart computer, clear cache(this doesn't make sense as i am not using a browser) , its downloaded version of Turbotax premier !!

There response is, I am 'refusing to manually type' those 5000 transactions - (this is ridiculous )!! So, they can't help me !! But here we thought, turbotax premier would be able to import 1099B !!!

Can someone serious about resolving this issue please respond !!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

any update on this? i am having the same issue (i think it might be because my 1099B is over 5,000 transactions...)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

Unfortunately the 3,000 record limit cannot currently be changed.

However, you can quickly enter this manually. Your brokerage statements should include a summary of your transactions, grouped by sales category.

There are seven possible "Box" designations that indicate the holding period (Long/Short Term) and the reporting status. These are the only ones you have to summarize.

Code A. This code indicates a short-term transaction for which the cost or other basis is being reported to the IRS. Use this code to report a transaction that the recipient will report on Schedule D (Form 1040), line 1a, or on Form 8949 with box A checked with totals being carried to Schedule D (Form 1040), line 1b.

Code B. This code indicates a short-term transaction for which the cost or other basis is not being reported to the IRS. Use this code to report a transaction that the recipient will report on Form 8949 with box B checked with totals being carried to Schedule D (Form 1040), line 2.

Box C. Report on a Part I with box C checked all short-term transactions for which you can't check box A or B because you didn't receive a Form 1099-B (or substitute statement).

Code D. This code indicates a long-term transaction for which the cost or other basis is being reported to the IRS. Use this code to report a transaction that the recipient will report on Schedule D (Form 1040), line 8a, or on Form 8949 with box D checked with totals being carried to Schedule D (Form 1040), line 8b.

Code E. This code indicates a long-term transaction for which the cost or other basis is not being reported to the IRS. Use this code to report a transaction that the recipient will report on Form 8949 with box E checked, with totals being carried to Schedule D (Form 1040), line 9.

Box F. Report on a Part II with box F checked all long-term transactions for which you can't check box D or E because you didn't receive a Form 1099-B (or substitute statement).

Code X. Use this code to report a transaction if you cannot determine whether the recipient should check box B or box E on Form 8949 because the holding period is unknown.

Open or continue your return (if it's not already open) and search inside TurboTax for the phrase stock sales.

- Select the Jump to link in the search results.

- Answer Yes to both Did you sell stocks, mutual funds, bonds, or other investments? and Did or will you receive a 1099-B form or brokerage statement for these sales?

- If you land on Here are all your 1099-B sales, select Add sales from a different brokerage. Then answer Yes to Did or will you receive a 1099-B form or brokerage statement for these sales?

- When asked how you want to enter your 1099-B, select I'll type it in myself.

- Select or enter your brokerage on the next screen and continue.

- On the following screen (Tell us about...), answer the questions until you reach the next screen. Select the second option, Let's enter a summary instead, and select Continue.

- You'll now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your 1099-B for the amounts and category. When finished, select Continue.

When you are done, you'll eventually come to the Here's a summary of your broker sales screen where you can edit, delete, or enter more sales.

You will have to mail a copy of your 1099-B to the IRS. TurboTax will produce a Form 8453. You print the Form 8453 and attach the brokerage statement(s) to it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

"Unfortunately the 3,000 record limit cannot currently be changed."

Please clarify what the $100+ total charge for using TurboTax is for if I have to enter data manually? How is your product better than Credit Karma that charges $0? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

I agree with you ,turbo tax should be able to handle any size file. Another thing is I tried to enter a summary and when i put the proceeds into the box it said the number was too long, which was 37 million, said too many numbers, so what's up with this, I am very frustrated ,I have used turbo tax for years and never had a problem, please TURBO TAX fix this problem. I would think that if it is not resolved ,there will be far less people using turbo tax next year, and a lot of people asking for their money back this year. jmo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

i had the same issue as you with the number too long, so if you have to enter 37 million you need to split it up in two or three lines, basically split it up into several lines and just make sure overall the lines tie to your total

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

and for whats its worth, after my experience this year with turbo tax i see no reason to pay $65 for premier going forward when i can do it for free with many other vendors if i were to mail in my 1099b,,,main reason i've been paying for TT for years is because of the import function and if you can't handle more than 3000 transactions or numbers larger than 15million than it defeats the purpose...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

has anyone used Investotek software to take your ihfo from etrade and import into turbo tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

If import does not go smooth, I will suggest to manually enter info. For import, there are a limit on how many transactions TurboTax can handle. See blue links below. Here are the steps:

In TurboTax online,

- Sign into your account, select Pick up where you left off

- At the right upper corner, in the search box, type in 1099b and Enter

- Select Jump to 1099b

- Follow prompts

- On-screen, "Let's import your tax info, select I'll type it myself

- Follow prompts to continue

For more information, click here:

how many stock transactions TT can handle

You would receive a Form 1099-B if you have sold your stocks and bonds transactions during the year. The transactions will generate either a long term or short term capital gain or loss depends on how long the stocks are being held. The amount will be reported on line 7 of your Form 1040 along with a Schedule D and Form 8949.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

Should TT improve the products? 2000 records and $10,000,000 accumulated total are not enough for people even with small amount of stock trading. I am really disappointed by TT this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not Able to import Etrade 1099 since its a large file.

Adtp85, as of today March 12,2021,I was on phone with a supervisor from Turbo Tax,She was very nice and tried to help me ,I was surprised to find out ,that she was not aware of people having problems with importing large files from etrade. She checked with her peer group and was told as of now they were not doing anything about changing their software to allow bigger transactions over 10 million.They told me to manually enter all trades. That is not acceptible,seems to me that they could change their software to accomidate every persons needs. I have used Turbo Tax for years ,but if this does not get resloved,why would I buy TT anymore.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

madhutalluri

New Member

Uncle_Solo

Returning Member

sprajesh

Returning Member

nitagro

New Member

varghese

New Member