- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: No, you can use TurboTax Online products to report the ca...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

No, you can use TurboTax Online products to report the capitals gains on the sell of crytocurrency.

Here is how to enter:

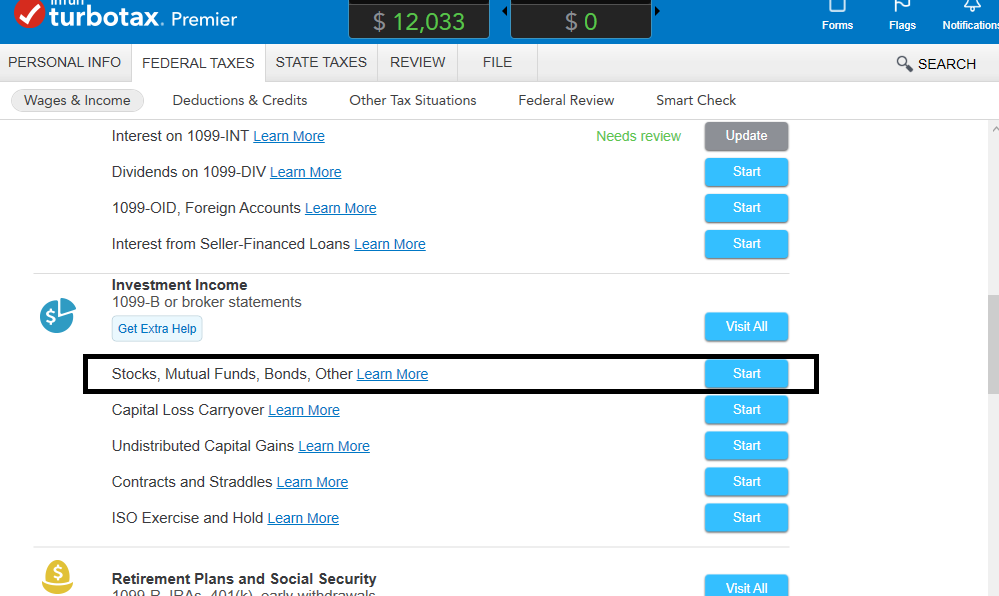

Income and Expenses

Scroll to Investment Income

Click show more

Select Stocks, Mutual Funds, Bonds, Other

Did you sell any investments in 2017? click "yes"

Did you get a 1099-B or a brokerage statement for these sales? click "no"

Choose the type of investment you sold, check "everything else" and "continue"

Describe as cryptocurrency, add profits and date of sale

For more information: Taxes on Cryptocurrency

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

I am using the Premier 2019 desktop version to file my 2019 taxes. But I don't see where I can enter my cryptocurrency transactions? The video and instructions here are for online version only!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

The premier version does support schedule D. I opened up my premier. Here is the investment income under Wages and Income.

Screen, Did you sell any investments? Select YES, I sold investments.

Did you get a 1099-B or a brokerage statement for these sales? click no

Choose the type of investment you sold, select everything else and continue

Describe as cryptocurrency, add net proceeds and date of sale

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

Turbotax partnered with Coinbase, but I don't know who else.

Only the ONLINE version allows crypto transaction import.

Of course you can always add each transaction manually.

If you can obtain a form 8949 or similar document (i.e spreadsheet) that can be printed, you can summarize and use the mail-in election.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

do we enter the bitcoin transactions the same way for tax year 2020? thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

Yes -- Please see this TurboTax Help article for details in reporting cryptocurrency: How do I report Bitcoin or other cryptocurrency as a capital gain?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

do you know where i can enter a negative # on form 1040 line 10a where it says from schedule 1, line 22?

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I wish to file cryptocurrency taxes this year. Do I need to buy the desktop/downloadable version of Premier edition to upload the cap gains report from cointrackinginfo?

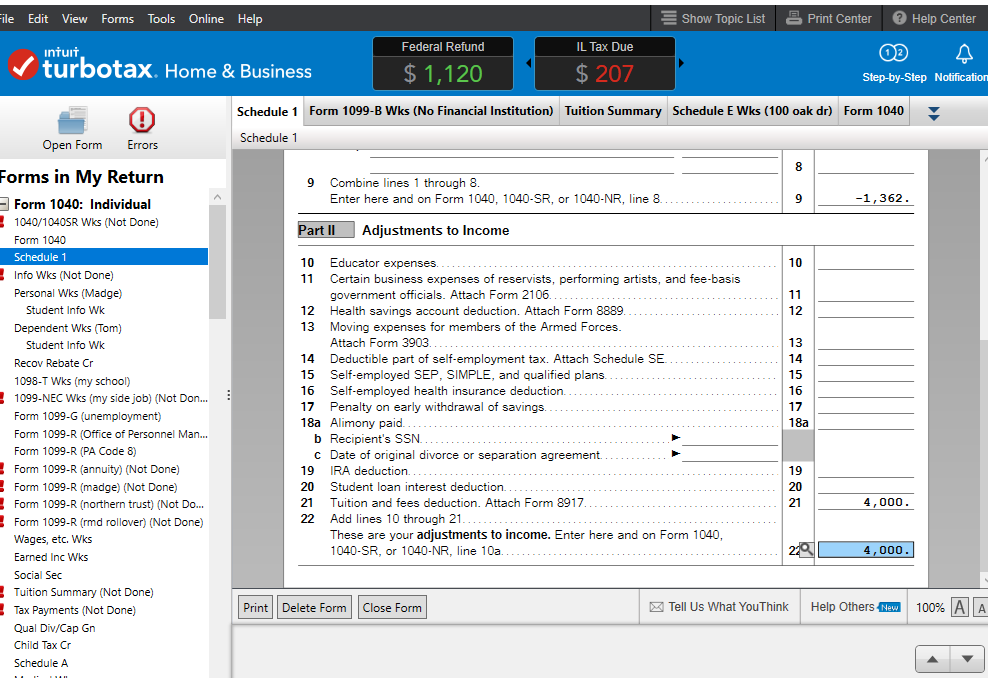

@6760stan These are Adjustments to Income, which are shown as positive numbers, although they are Deductions from Income. (screenshot).

If you can give more information, we will try to help you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Idealsol

New Member

user17550208594

New Member

user17550208594

New Member

user17548719818

Level 1

VAer

Level 4