- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: New Business in 2020 - build out costs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Business in 2020 - build out costs

I need more help. I am in over my head . Opened a fitness business in the lower park for my house in September. I know enough but not enough as I have questions. Spent $7728 to redo my lower level - I was told this is a capital asset and it needed to be depreciated. The system assigned 39 years life and calculated $58.00 - I can't recreate this amount. I am not depreciating the "space" or designated % of this area. Should I? If I do, I need to find the cost basis, adjusted cost basis and market value?

I also have equipment costs totaling 11,300.00. $5,578.00 of the $11,300 is for a treadmill that qualifies for depreciation. The remaining 5721 for weights, weight rack, balance chair, band system & ropes. Can I expense this remaining amount? There is also furniture purchased ---leather chair, 2 seat sofa. OR do I expense those items $200 or less and depreciated everything else above that amount?

Thank You in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Business in 2020 - build out costs

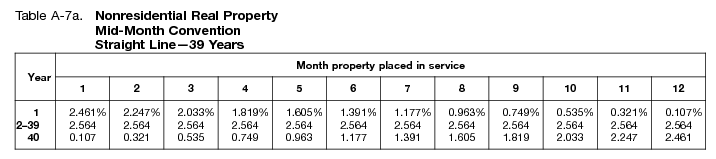

Your improvements are being depreciated on a straight line basis over 39 years beginning in September. The percentage is 0.749%.

The IRS allows you to expense any item costing $2,500 or less. Anything above that can be entered as an asset and written off using Section 179.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jstan78

New Member

joe-kyrox

New Member

user17522541929

New Member

SterlingSoul

New Member

kfrodcrafts

New Member