- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

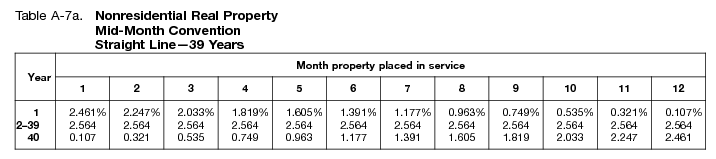

Your improvements are being depreciated on a straight line basis over 39 years beginning in September. The percentage is 0.749%.

The IRS allows you to expense any item costing $2,500 or less. Anything above that can be entered as an asset and written off using Section 179.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

May 2, 2021

12:23 PM

231 Views