- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc sectio...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

Getting the same error. I downloaded my 1099-B from TDA and saved it as a PDF to my desktop. I then uploaded it and I am getting rejected for "An XML document that represents a binary attachment must have a valid reference to an attached file". This is ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

Make sure all PDF files have unique file names and they don't have any special characters and spaces in the name.

e.g. MorganStanley.pdf

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

What is the way to attach my 1099B to my return as a PDF? How do you do that? I didn't find in my TT Premier 2020 any options to attach my 1099B to my return as a PDF.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

If you are unable to attach a .pdf to your tax return for the statement of detail, you should follow the instructions below.

If you are e-filing your tax return, then mail your statements along with Form 8453 to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

If you need a blank Form 8453, you can download this pdf, enter your address information and check the box for Form 8949 (this form is really just a cover sheet).

This will eliminate the need for the attachment and still meet IRS requirements for summarized transactions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

In this topic people is just discussing issues AFTER(!!!) attaching. So somehow they managed to attach PDF to their return. The question - HOW??? I'm using TT Premier 2020 CD version and didn't find the way. I'm asking because mailing paper "statement of detail" is not an option for me - I have more then 5000 pages in it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

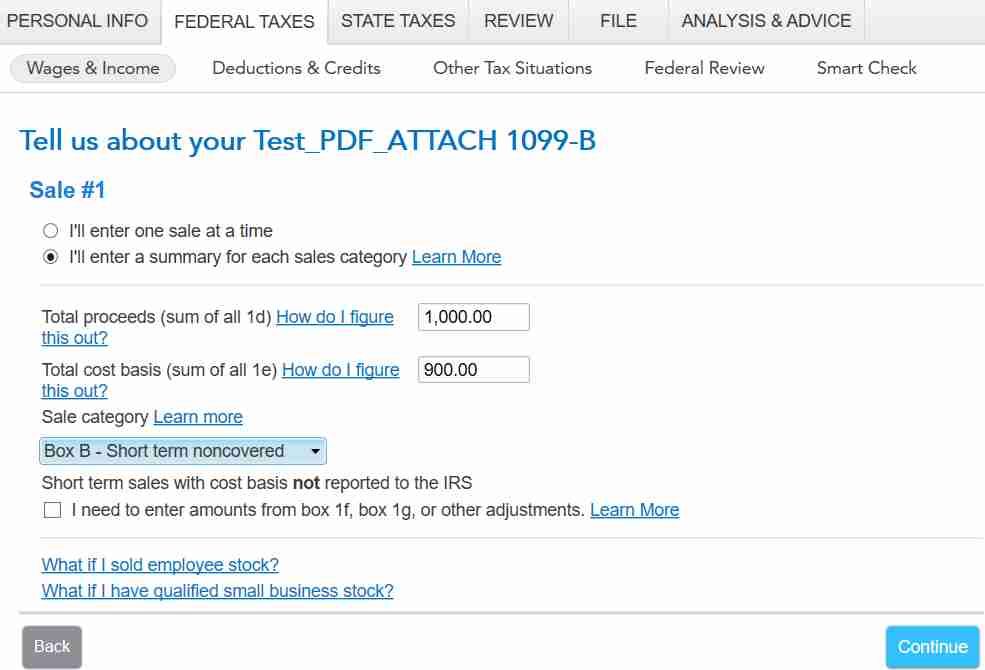

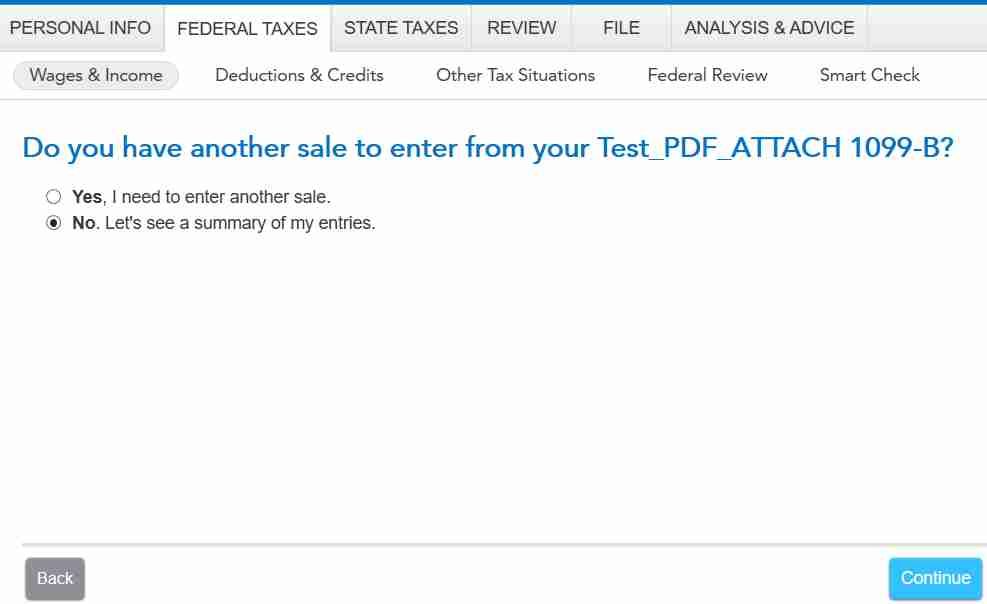

The prompt to enter the pdf attachment will appear automatically if you enter noncovered transactions. You will not need to submit the pdf if you have only covered transactions.

To get it to come up again, delete the noncovered transaction summary and then add it back again.

Non-covered securities are any securities purchased or acquired before the above effective dates. Transactions involving assets purchased and held prior to these effective dates can still be reported as they have been in the past, meaning that brokers may not provide detailed cost basis reporting to the IRS on the sales of "non-covered" securities. They may decide to report only your gross proceeds. For these situations, it is your responsibility to report the proper cost basis on non-covered securities to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

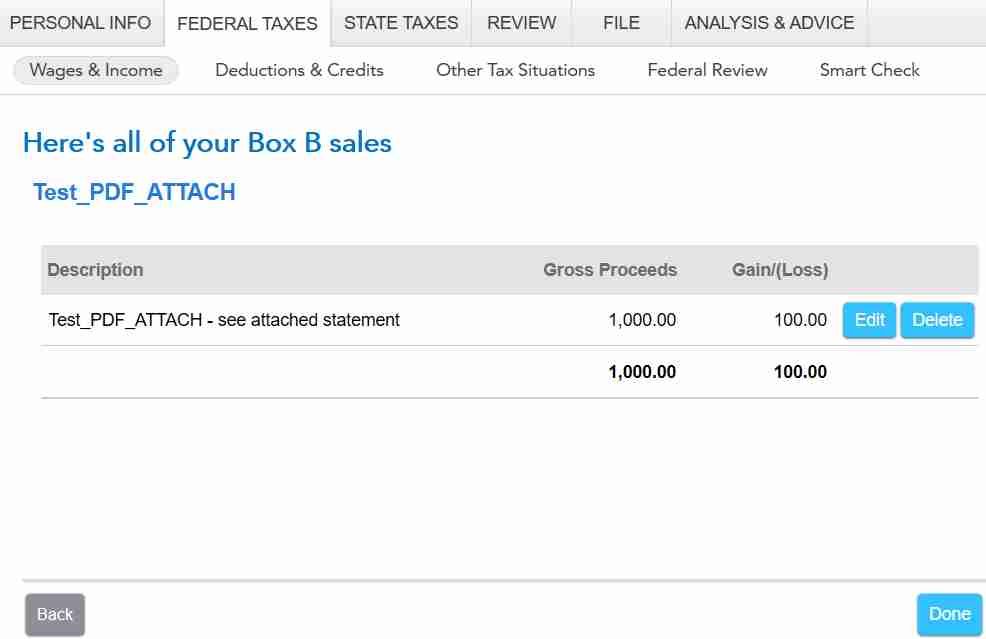

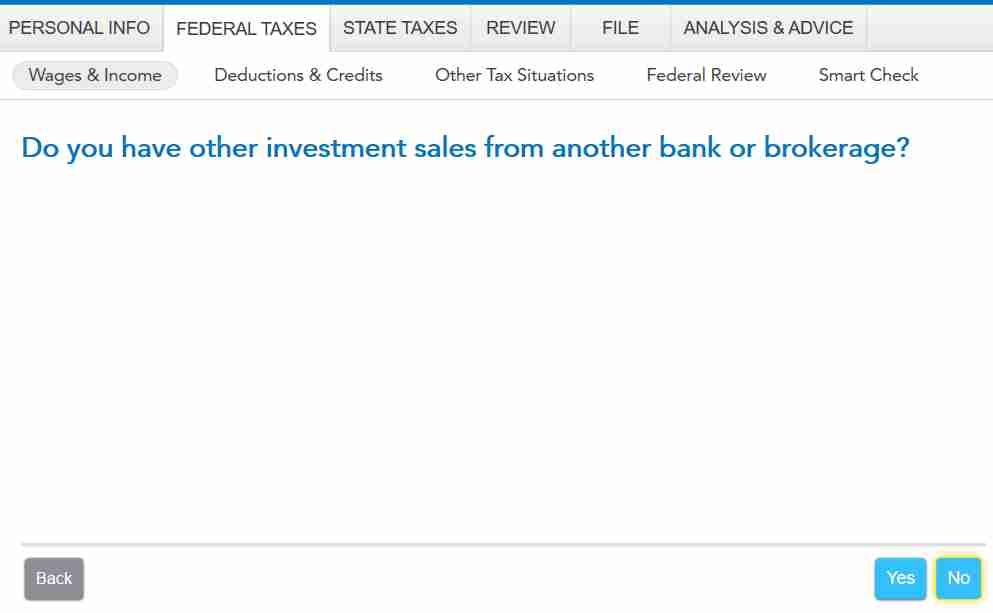

I tried to enter "summary for non-covered sales" - no luck with finding "attachment prompt":

So,only "mailing instructions". Next screen get me back to list of brokerages.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

@Aleksandr If you enter a Summary in Lieu of Individual Transactions, you don't need to attach a copy of your 1099-B to your tax return.

You will be instructed in your Filing Instructions to mail Form 8949 with your 1099-B if:

- The sales category for one or more summaries is something other than Box A (short-term covered) or Box D (long-term covered); or

- The Box A and/or Box D summary includes adjustments (typically listed in boxes 1f or 1g on your broker statement).

Click this link for more info on Form 8949.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

Mailing any kind "statement of detail" is not an option for me - I have huge amount(tens of thousands) of sales with adjustments and a lot of non-covered sales(I should send to IRS a big shoe box of paper).

I have only 2 option:

1) Report "summaries", make "total summary" adjustments for some of them and attach 1099B.

2) Aggregate tens of thousands sales into several "individual" sales in each sale category. Make all necessary adjustments to them.Make sure sums of those "individual" sales and their adjustments correspond 1099B. In this case no need to attach 1099B and send any "statement of detail", but I'm not sure it is 100% working option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need to attach my 1099B to my return as a PDF, I followed the prompts in the stock etc section just to receive a rejection stating my binary attachment needs a reverence?

based on posts here on this forum, TurboTax gives this prompt to some users and not others.

It is a mystery.

TurboTax has not published anything about such a feature which other tax software already has had for a long time..

The "experts" are clueless, so they respond with the answer to some other question, not yours, or with a wrong answer.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17605923060

Level 2

LMTaxBreaker

Level 2

sakethuk2

Level 2

sherman-mike

New Member

user17598801544

Level 1