- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Need Help with Substitute W-2 and Foreign Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

Hello,

I have a few questions regarding filling out a Substitute W-2 along with earning foreign income from China while living in the USA for the 2020 tax year.

Background: For the 2020 tax year, I lived in the USA while earning wages from my employer in China. I have been advised by Turbotax advisers to fill out a Substitute W-2 since China doesn't do W-2s. I also don't qualify for the Income Exclusion, but I am reducing my taxes using the Foreign Tax Credit.

Questions:

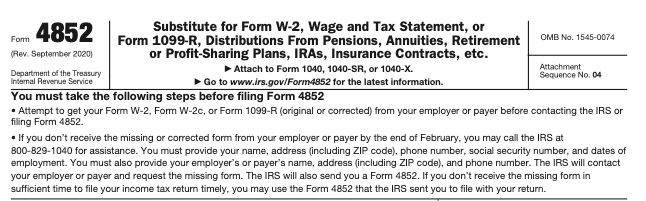

Since I do the Form 4852 now, I assume I put my wages that I earned from China on the 4852 form, correct?

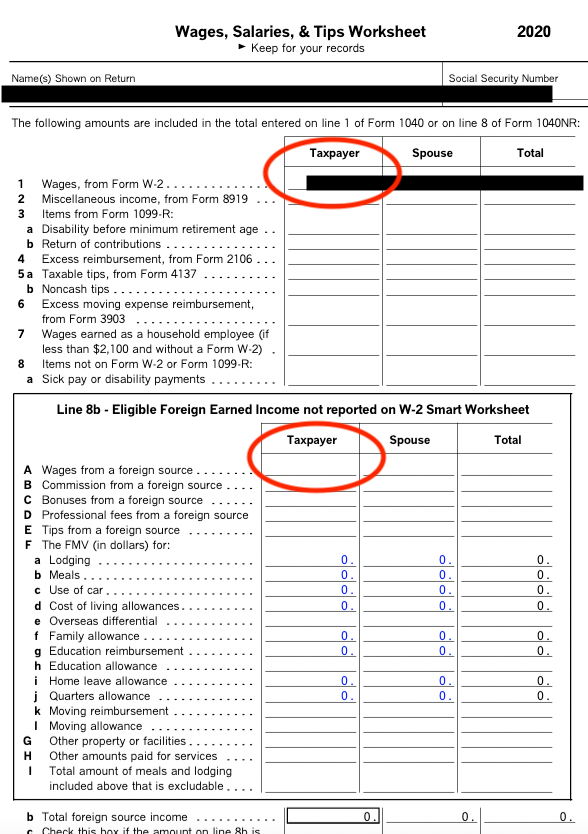

Additionally, in the "Wages, etc. Wks" in Turbotax, there is Line 1 which is for my wages earned from China, correct?

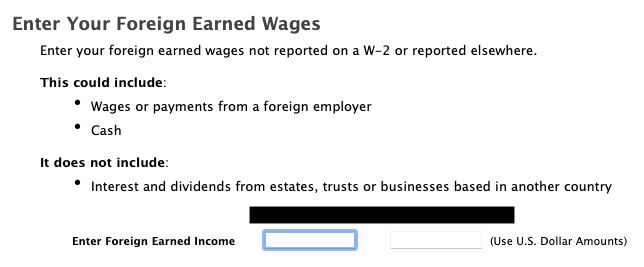

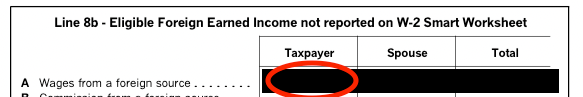

Furthermore, in the "Wages, etc. Wks" in Turbotax, if I put my wages in Line 8b section A from China here as well, it will effectively double my wages. This doesn't seem correct. I assume I just put my wages in Line 1 and leave Line 8b section A blank, correct?

For the taxes I paid on my China wages, I report them only when trying to take the Foreign Tax Credit, correct? I do not report the Chinese taxes as well on the Form 4852 (Substitute W-2), correct?

Lastly, on the Form 4852, it states that if I cannot get a W-2, I have to call the IRS at [phone number removed] and explain the situation to them. Then the IRS will send the Form 4852 to me. Is this necessary to contact the IRS or is Turbotax handling this part for me since Turbotax creates the Form 4852 for me?

Thanks in advance for your help!

I have also uploaded the images to this message...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

Please clarify why you are claiming a Foreign Tax Credit on income that is being earned in the United States?

Your income earned in the United States should only be taxed to the United States (and the state where the work is performed).

Please clarify the nature of your employment in the United States and the reason for taxes being paid to China on work performed in the United States.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

I was earned money from my Chinese employer in RMB and paid taxes to the Chinese government while physically being located in the USA for 2020. I was essentially remote working.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

This income should be treated as self-employment income as there is no social security or medicare taxes being withheld or paid on it as you have suggested reporting it.

Wages or salary would be subject to withholding or self-employment income would be subject to self-employment tax on the net income for the year.

Using the substitute W2 approach does not address collection of the employee or the employer share of social security or medicare tax liability on your earnings.

Typically earnings paid for services performed in the United States would not be subject to income taxes being paid to China.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

But I was not self employed. I was legally employed with a Chinese work permit for many years and finished my contract in China this past September. I was living in China for multiple years and always was able to claim the Foreign Exclusion. I know this is not the case for the 2020 tax year, but I know that it is not self employment income because I was a legal employee of my Chinese employer and have also been advised from other Turbotax colleagues that this is not the case since I am performing duties for my Chinese employer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

As an employee, you are responsible for the employee share of the social security and medicare wages.

You will need to file Form 8919 to report the uncollected Social Security and Medicare tax on your wages.

I would only enter income on 8b (A) and not on 1 as your wages do not come from Form W2.

You do not report the Chinese taxes on the Substitute W2 Form 4852. You will claim them on Form 1116 as General category income taxes paid.

TurboTax does not contact the IRS on your behalf with Form 4852 - the form will go with your tax return.

Your return may need to be printed and mailed with this form.

You employer's arrangement is irregular - employers doing business in the US, even foreign employers are required to register and get Employer Identification Tax ID Numbers if they have employees in this country and comply with employment tax laws.

You are not subject to withholding tax to a foreign country on income earned in the United States.

The IRS could deny your Foreign Tax Credit as the tax is not legally owed to China.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

Hi @JeffreyR77 ,

Hmmm... this gets a bit more and more confusing for me.

So perhaps I can make it a bit clearer. I actually had to move back to the US for the 2020 tax year due to a critical health condition that required me to move immediately. I was not actually working in the 2020 tax year. I was actually collecting long-term sick leave pay until my contract ended with my Chinese employer in September 2020 and I had to pay Chinese taxes on those sick-leave payments.

Perhaps you can guide me better with this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

Yes, thank you this is very helpful. If your earnings were subject to US Social Security and Medicare last year, than you should proceed as I indicated above with the Form 8919, these benefits are subject to Social Security and Medicare taxes that have not been paid. If you were covered previously by a Chinese system and not required to pay Social Security and Medicare, then your sick leave is not subject to Social Security or Medicare tax and you can ignore the Form 8919 instructions for 2020. Your income in either situation is taxable and should be reported as instructed earlier. Your situation is still irregular; but understandable now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

Hi @JeffreyR77 ,

I was previously covered by the Chinese system for this. This means that I do not have to pay SS and Medicare and I will ignore the 8919 form.

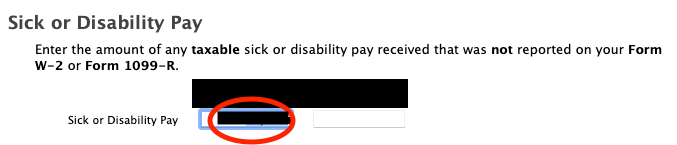

I have reported this income, but now I see a place under "Miscellaneous Income ==> Less Common Income" as

"Sick or Disability Pay". Should I report this income here? Or perhaps should I report it as "Other Taxable Income" (plus a description)?

I also assume that my income is not considered Self Employment Income as per my above described situation, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

You could do that; however, Sick Pay is different in the US. You are asked if you paid the premiums, your employer paid the premiums, etc.

In some cases, Sick Pay is non-taxable; can be paid by the government, an employer, or a third-party insurance company. Usually reported on a W-2 or a 1099-G, which you don't have.

I would recommend you report as 'Other Reportable Income' with a description and take the Foreign Tax Credit.

Net out is Taxable Income that you paid Foreign Taxes On.

Keep documentation with your tax return.

Click this link for more info on Sick Pay.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

Understood.

I have already done the Foreign Tax Credit.

One more question... wouldn't it make most sense to declare my foreign wages in the "Wages, etc. Wks" under Line 8b (A)? This then puts my income as "Wages from a Foreign Source" and it shows it on my 1040 Line 1. I believe it makes more sense to do it here than as "Other Reportable Income". I also added the description of this income to the Foreign Tax Credit Form.

Additionally, I have done a scenario where I put it in "Other Reportable Income" and my refund is less than before. Why is that? I assume because I am not declaring this as Foreign Income, but rather something else? Can you please explain this potentially?

It still feels more correct to declare as "Wages from a Foreign Source" since they technically are. I am putting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

No,

Do not use form 4852.

You can't enter your foreign income in the W-2 section of TurboTax. TurboTax is asking you to complete Form 4852 because you entered the income in the W-2 section and checked the box that says you "need to complete a substitute form." Form 4852 is the substitute W-2 form. ... It's not for foreign income. It's meant if your domestic employer did not give you a W-2 when you should have received one.

Follow the steps provided in this thread by IreneS to enter the foreign income in TurboTax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

navyas

Returning Member

fastesthorse

Level 2

ThomasMcLeod

New Member

rmsaliba

New Member

MauraF

New Member