- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Help with Substitute W-2 and Foreign Income

Hello,

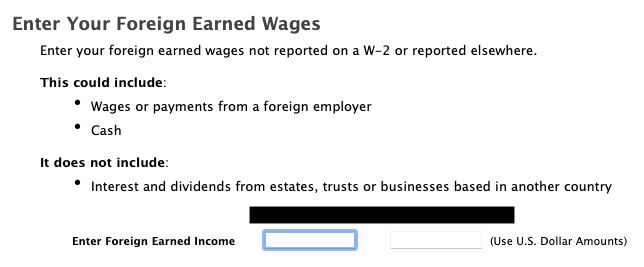

I have a few questions regarding filling out a Substitute W-2 along with earning foreign income from China while living in the USA for the 2020 tax year.

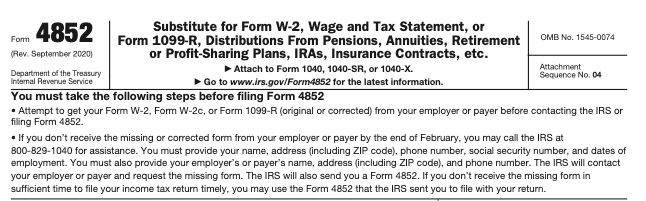

Background: For the 2020 tax year, I lived in the USA while earning wages from my employer in China. I have been advised by Turbotax advisers to fill out a Substitute W-2 since China doesn't do W-2s. I also don't qualify for the Income Exclusion, but I am reducing my taxes using the Foreign Tax Credit.

Questions:

Since I do the Form 4852 now, I assume I put my wages that I earned from China on the 4852 form, correct?

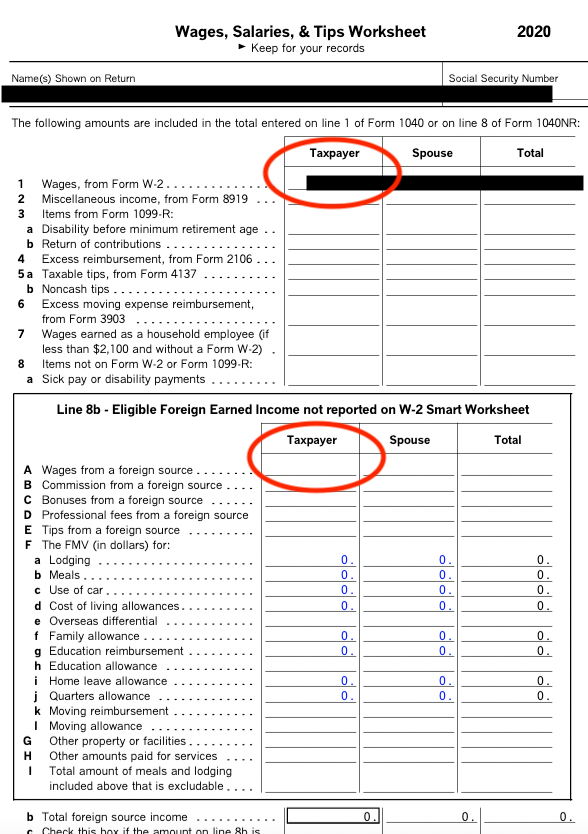

Additionally, in the "Wages, etc. Wks" in Turbotax, there is Line 1 which is for my wages earned from China, correct?

Furthermore, in the "Wages, etc. Wks" in Turbotax, if I put my wages in Line 8b section A from China here as well, it will effectively double my wages. This doesn't seem correct. I assume I just put my wages in Line 1 and leave Line 8b section A blank, correct?

For the taxes I paid on my China wages, I report them only when trying to take the Foreign Tax Credit, correct? I do not report the Chinese taxes as well on the Form 4852 (Substitute W-2), correct?

Lastly, on the Form 4852, it states that if I cannot get a W-2, I have to call the IRS at [phone number removed] and explain the situation to them. Then the IRS will send the Form 4852 to me. Is this necessary to contact the IRS or is Turbotax handling this part for me since Turbotax creates the Form 4852 for me?

Thanks in advance for your help!

I have also uploaded the images to this message...