- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Understood.

I have already done the Foreign Tax Credit.

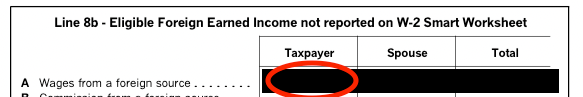

One more question... wouldn't it make most sense to declare my foreign wages in the "Wages, etc. Wks" under Line 8b (A)? This then puts my income as "Wages from a Foreign Source" and it shows it on my 1040 Line 1. I believe it makes more sense to do it here than as "Other Reportable Income". I also added the description of this income to the Foreign Tax Credit Form.

Additionally, I have done a scenario where I put it in "Other Reportable Income" and my refund is less than before. Why is that? I assume because I am not declaring this as Foreign Income, but rather something else? Can you please explain this potentially?

It still feels more correct to declare as "Wages from a Foreign Source" since they technically are. I am putting