- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My husband lives in Illnois and gets social security, I live in michigan, do I have to file 2...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband lives in Illnois and gets social security, I live in michigan, do I have to file 2 state returns? How do I file separate ones for state if I need to file 2?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband lives in Illnois and gets social security, I live in michigan, do I have to file 2 state returns? How do I file separate ones for state if I need to file 2?

That depends. If you are Married Filing Jointly, but residents of different states, you could file separate state returns.

Since Illinois does not tax retirement income, your husband may not need to file an Illinois return, unless he has other types of income.

Michigan does not tax Social Security, but does tax other types of retirement income. However, Michigan does not allow Married Filing Separately unless your Federal return was also Married Filing Separately.

Check with Michigan Dept. of Revenue if you need more specific info.

Click the link for detailed instructions on Filing Separate State Returns in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband lives in Illnois and gets social security, I live in michigan, do I have to file 2 state returns? How do I file separate ones for state if I need to file 2?

can you enlighten us on the reason your husband lives in a different state. illinois does not tax social security.

illinois says

If you filed a joint federal return and one spouse is an Illinois resident while the other spouse is a

nonresident or a part-year resident, you may file separate Illinois returns. If you file a joint Illinois return, you will

both be taxed as resident.

nichigan is different

If you are considered married for federal tax purposes, you must

file your Michigan return using either the married filing jointly

or married filing separately filing status. This applies to all

couples who are married under the laws of the State of Michigan

or under the laws of another state. If you filed a joint federal

income tax return, you must file a joint Michigan income tax

return. If you and your spouse filed separate federal returns, you

may file separate or joint Michigan returns

Michigan also doesn't tax Social security.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband lives in Illnois and gets social security, I live in michigan, do I have to file 2 state returns? How do I file separate ones for state if I need to file 2?

If you are filing a joint federal return, then IL requires a state return. Here are the IL filing requirements for a retired person:

a retired Illinois resident who filed a federal return, you must file Form IL-1040. However, certain types of retirement income ( e.g., pension, Social Security, railroad retirement, governmental deferred compensation) may be subtracted from your Illinois income. For more information, see the instructions for Line 5 and Publication 120, Retirement Income.

As a nonresident, you can file form NR to remove your wages.

MI is very clear. If you file a joint federal return, you are filing a joint state return. The instructions are on the bottom of page 3, tops of page 4 in this MI Filing Instructions Link.

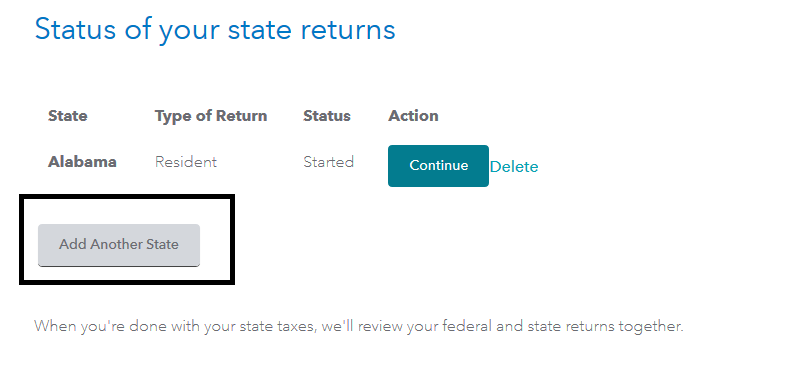

You can file both states with your federal. When you are in the state program, select the box that says Add Another State.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CTEboy65

Level 1

sallyawalk

Level 2

Kodiak5717

Level 1

msmoldy

Level 2

Muldoon0054

Returning Member