- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If you are filing a joint federal return, then IL requires a state return. Here are the IL filing requirements for a retired person:

a retired Illinois resident who filed a federal return, you must file Form IL-1040. However, certain types of retirement income ( e.g., pension, Social Security, railroad retirement, governmental deferred compensation) may be subtracted from your Illinois income. For more information, see the instructions for Line 5 and Publication 120, Retirement Income.

As a nonresident, you can file form NR to remove your wages.

MI is very clear. If you file a joint federal return, you are filing a joint state return. The instructions are on the bottom of page 3, tops of page 4 in this MI Filing Instructions Link.

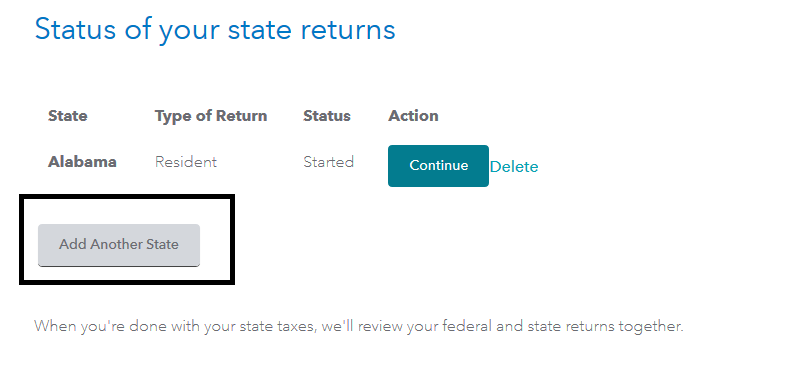

You can file both states with your federal. When you are in the state program, select the box that says Add Another State.

**Mark the post that answers your question by clicking on "Mark as Best Answer"