If it is a one time thing that is not related to your normal job, that was not done in the previous year and not to be done again in a future year and for which you did not have a profit motive, then it should be taxed as "other" income as opposed to self-employment income. It is OK if it was reported on a Form 1099-NEC, just make sure you answer the questions about it after you enter the Form in TurboTax. It will be reported on schedule 1 in TurboTax if it is not self-employment income, otherwise it will appear on Schedule C.

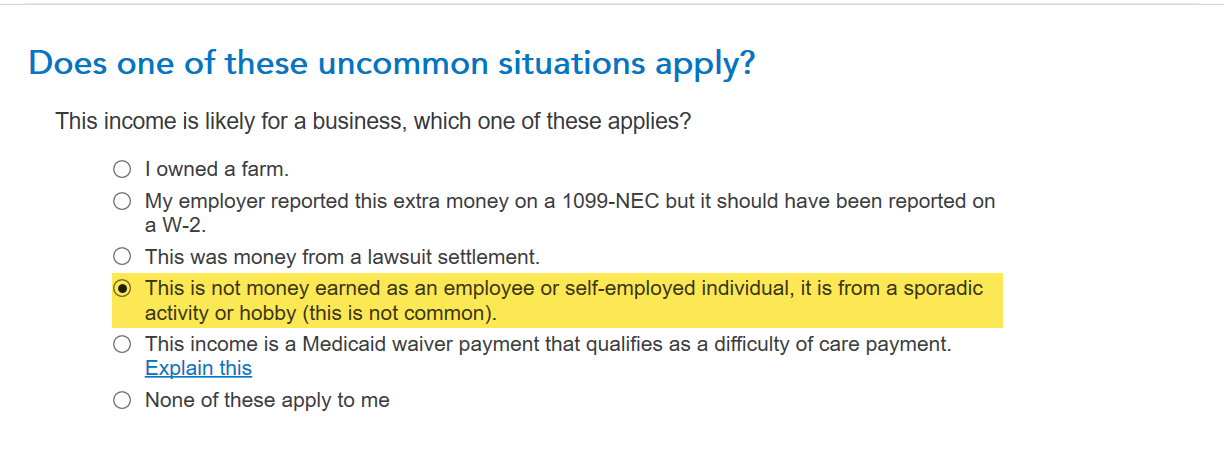

You should enter it in the Wages and Income section of TurboTax, then Other Common Income, then Income from Form 1099-NEC If it is not self-employment income. On the screen that says Does one of these uncommon situations apply? choose the option that says This in not money earned as an employee or self-employed individual, etc...:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"