- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: mutual fund losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mutual fund losses

I'm reporting a fortune in losses on my 1099B for 2020. Does this lower my income for the year for tax purposes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mutual fund losses

Yes, if you have more capital losses than gains, you can use up to $3,000 a year to offset ordinary income on federal income taxes, and carry over the rest to future years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mutual fund losses

thanks. How do i report this info in TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mutual fund losses

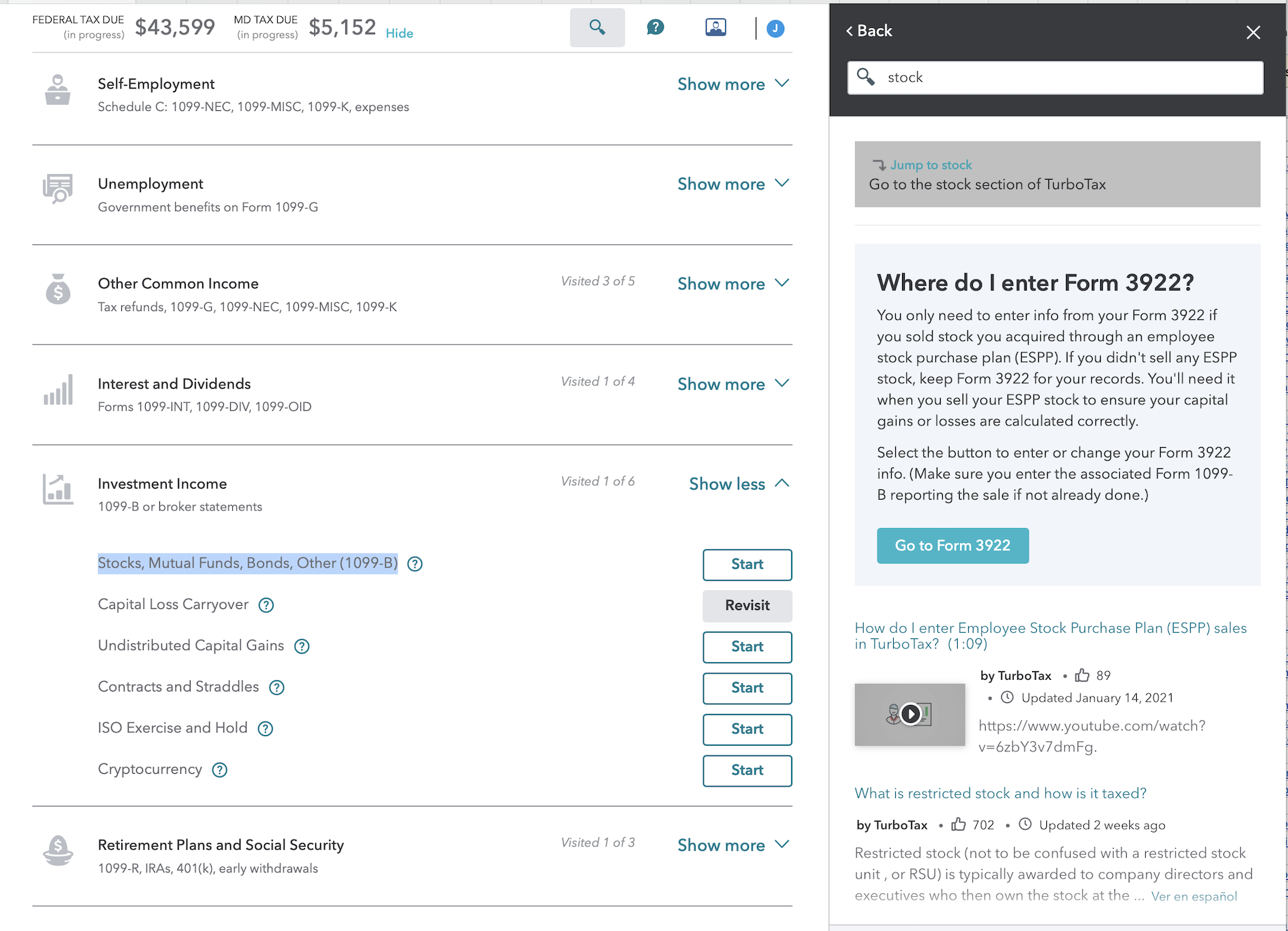

All you need to do is enter the 1099-B information in the Stocks, Mutual Funds, Bonds and Other interview of Investment income.

Turbotax will calculate and apply the losses as appropriate, to include updating your loss carry-forward balance.

See the following screenshot for aid in navigation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RunningManAloha

Level 2

zeitlins

New Member

TaxPlethora

Level 1

user17722209171

Level 1

MPMTCP

New Member