- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Michigan MI 2210 does not allow for correction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan MI 2210 does not allow for correction

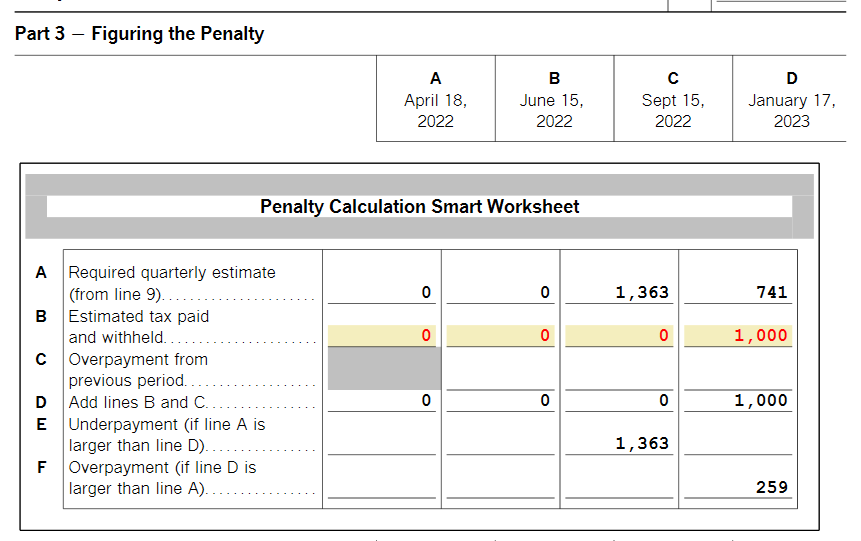

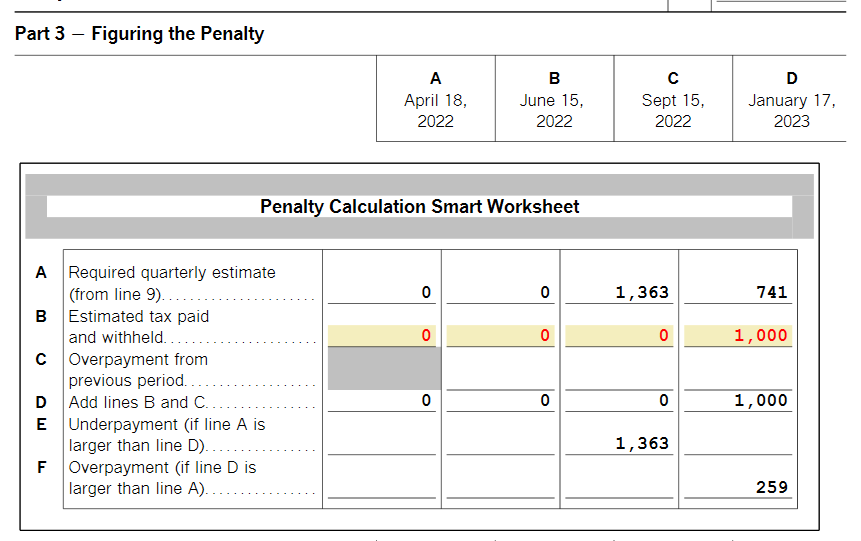

My income and the taxes I paid varied through the year. The Federal tax part of the program had me enter the different earnings by quarter along with taxes paid by quarter. This did not translate over to the Michigan forms so it has me paying a penalty for not paying my taxes on time. I did pay my taxes on time but the program makes an automatic calculation based on averaging and will not allow me to input the actual timing of my withholding and estimated tax payments. This results in it showing I owe a penalty. TT does not allow any corrections to the withholding figures -- only automatically inserting the average. The only way I can figure out how to correct this is to do my Michigan taxes on paper. Very unhappy with Turbo Tax. What good is the state return portion if it's incorrect?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan MI 2210 does not allow for correction

If you are using TurboTax CD/Download you can use Forms mode to annualize your withholding.

- Tap Forms in the top right corner

- Find Form MI-2210 in the left column and tap to open the form

- Go to line B (Estimated tax paid and withheld) on the Penalty Calculation Smart Worksheet

- Highlight the first box and rIght click and select Override or Ctlr-D

- Change the amount in the box to what you want it to be

- Do this for the other four boxes

- Tap Step-by-Step where Forms used to be to return to the interview mode

How do I switch from TurboTax Online to TurboTax CD/Download?

Overrides will prevent you from e-filing and will void the TurboTax 100% Accurate Calculation Guarantee.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan MI 2210 does not allow for correction

You should continue to e-file your MI return. The MI State Department of Revenue is going to perform their own calculations based on information they have in their system then match to the submitted return and will notify you of any corrections.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan MI 2210 does not allow for correction

First of all, we never e-file our state tax return -- no need to pay more money than necessary. So if I'm mailing our return, we might as well completely it correctly, which TT is not able to do for us. It is clearly an issue that TT averages withholding over the year and does not allow for adjustment. In the first quarter 2022, our withholding was $1000 more than the average, plus we paid estimated taxes. No way do we owe an underpayment penalty and no way are we going to wait for the state to make the correction.

Very unsatisfactory answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan MI 2210 does not allow for correction

If you are using TurboTax CD/Download you can use Forms mode to annualize your withholding.

- Tap Forms in the top right corner

- Find Form MI-2210 in the left column and tap to open the form

- Go to line B (Estimated tax paid and withheld) on the Penalty Calculation Smart Worksheet

- Highlight the first box and rIght click and select Override or Ctlr-D

- Change the amount in the box to what you want it to be

- Do this for the other four boxes

- Tap Step-by-Step where Forms used to be to return to the interview mode

How do I switch from TurboTax Online to TurboTax CD/Download?

Overrides will prevent you from e-filing and will void the TurboTax 100% Accurate Calculation Guarantee.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan MI 2210 does not allow for correction

Thanks, Ernie -- that did the trick: no more penalty showing. And since we don't e-file our state taxes anyway, it works just fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Michigan MI 2210 does not allow for correction

The advice from @Cynthiad66 to continue to e-file failed me. I had same issue in 2023 (a withholding payment in only one quarter that TurboTax averaged over four quarters). I continued to e-file my MI return in 2023 with a penalty I did not owe. The Michigan Department of Treasury never notified me of any corrections.

The TurboTax Federal Form 2210 has a "Tax Withheld Smart Worksheet". This solves the problem for the Federal filing.

The MI Form 2210 has no "Tax Withheld Smart Worksheet". Why not? Can it be incorporated using the same technique as the Federal 2210? The Michigan Department of Treasury does not force taxpayers to consider one-fourth of withholdings paid on each due date if they can document the dates the tax was withheld (see their instructions, page 4 in 2024 MI-2210).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Martellejb

New Member

Dunface

New Member

mysemite

Level 1

benjacoll2409

New Member

james-armand159

New Member