- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Medical Expenses Worksheet Question (Line 2b)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

This is my second year on an ACA policy, but the first year where I might be able to itemize my deductions. I'm able to reconcile everything that TT is doing (TT desktop on Windows) other than the Medical Expenses Worksheet. I'm reasonably sure that it's user error, but I just cannot find a way to make the numbers add up, so would be grateful for any assistance.

From my 2022 1095-A Annual Totals:

- Column A: $8,713.32

- Column B: $10,567.20

- Column C: $4,935.00

From my 2022 Form 8962 Annual Totals:

- Column (a): $8,713

- Column (b): $10,567

- Column (c): $5,034

- Column (d): $5,533

- Column (e): $5,533

- Column (f): $4,935

- Line 24 - Total Premium Tax Credit: $5,533

- Line 25 - Advance Payment of PTC: $4,935

- Line 26 - Net Premium Tax Credit: $598

Medical Expenses Worksheet

- Line 2b: $3,179

Total annual premiums actually paid: $3,946

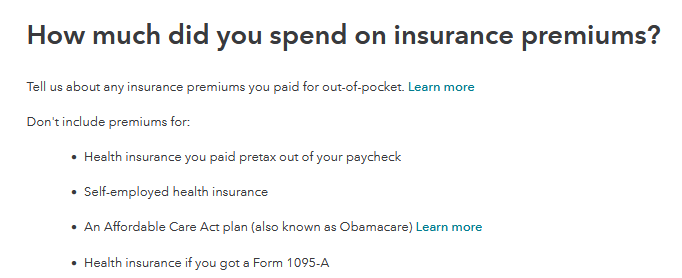

In my first pass at the questions, I included the $3,946, since I didn't know that TT was doing some behind-the-scenes calculations. That gave me a total health insurances premium number that was far too high. However, if I don't include it, it seems to me that the number that TT has calculated for Line 2b in the Medical Expenses Worksheet is too low.

I can't make sense of these numbers. Help, please? Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

I figured it out, although there is still a $1 discrepancy. I can live with that.

There were three issues, one an accounting error on my part, the second an extra credit card fee that the insurance company was charging me for paying my bill by credit card (a fee that I cannot include in my premium paid), and the third a premium tax credit.

I reported in my initial post that my total annual premium paid was $3,946. I made a mistake in one of the monthly premiums that I was tracking. My premium assistance was reduced in April, 2022, due to the updated AGI from my tax return. I had mistakenly moved that reduction to March, 2022, meaning that my figure for March was incorrect, over by $133. Adjusting that reduced my annual premium paid to $3,813.

The second issue was a monthly $2.92 credit fee, an annual total of $35.04. Removing that left me with an annual actual premium paid of $3,778.

Finally, when calculating the premium tax credit, the figure was $598.00, essentially a refund of premiums paid. I can't include that in my annual actual premium paid figure, so removing that leaves me with an annual actual premium paid of $3,180, rounded to the nearest dollar.

The figure that TT used in the Medical Expenses Worksheet was $3,179, a difference of $1. I don't know where that $1 came from, but I'm okay with not knowing that. I think (I hope) I finally understand how this works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

TurboTax will indeed include information from your Form 1095-A form into your Medical Deductions information. Do not enter your premiums again in the deduction section.

The total of your Premium Tax Credit will be subtracted out of the total cost of the policy. Your actual payments of $3,946 are credited with the additional Premium Tax Credit that is applied on your return, since your estimated Advanced Premium Tax Credit was low.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

I figured it out, although there is still a $1 discrepancy. I can live with that.

There were three issues, one an accounting error on my part, the second an extra credit card fee that the insurance company was charging me for paying my bill by credit card (a fee that I cannot include in my premium paid), and the third a premium tax credit.

I reported in my initial post that my total annual premium paid was $3,946. I made a mistake in one of the monthly premiums that I was tracking. My premium assistance was reduced in April, 2022, due to the updated AGI from my tax return. I had mistakenly moved that reduction to March, 2022, meaning that my figure for March was incorrect, over by $133. Adjusting that reduced my annual premium paid to $3,813.

The second issue was a monthly $2.92 credit fee, an annual total of $35.04. Removing that left me with an annual actual premium paid of $3,778.

Finally, when calculating the premium tax credit, the figure was $598.00, essentially a refund of premiums paid. I can't include that in my annual actual premium paid figure, so removing that leaves me with an annual actual premium paid of $3,180, rounded to the nearest dollar.

The figure that TT used in the Medical Expenses Worksheet was $3,179, a difference of $1. I don't know where that $1 came from, but I'm okay with not knowing that. I think (I hope) I finally understand how this works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

I have a similar issue but different. On my form 8962 line 29 excess advance PTC repayment I have an amount of $950. This amount is added into my tax owed on Form 1040.

My question: IS this excess repayment of $950 added to my actual personal payments of $3795 to arrive at a Line 2b of $4745 on the Medical Worksheet???

TT does not show this actual calculation anywhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

Can you clarify if your using TurboTax Desktop or Online?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

Desktop

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

You can view your medical worksheet on TurboTax Desktop by click forms in the upper right corner. From forms mode, you review the medical worksheet. Line 2b should match your premium paid listed on the 1095-A minus any premium tax credit received.

For more information see the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

It does NOT match the 1095B 1095-A numbers. That is my issue. The only way I can get to the same number listed on line 2b is to add my actual payments (1095b 1095-A, Column A less Column B) plus the amount shown on Schedule 2 Line 1a (Excess Advance Premium tax credit repayment (from form 8962). However Turbotax does NOT show this calculation anywhere. I assume this is how Line 2b is derived, but would like confirmation. Please see my original post for details.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

1095-B does NOT get entered into TurboTax. Only 1095-A forms get entered. Delete any entries that were not on 1095-A. Keep the 1095-B with your tax records. @Movie-Nut

How to delete forms in TurboTax Online

How to delete forms in TurboTax Desktop

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

My Mistake. I meant 1095A not 1095B in all my previous posts on this issue. If I can I will edit them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

Yes, the excess premium tax credit is added to the premiums you paid to arrive at the number on line 2b on the Medical Expenses worksheet. In Desktop versions in forms mode right click on the line (box) and select "Data Source". A pop-up box will appear showing the source/calculation for the item.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

Thanks, that was my assumption, but now I can see the math that supported my assumption.

Thanks, again.

Larry

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

I think I figured out where your $1 discrepancy might be from. TurboTax rounds up (or down) EACH month from your 1095-A entries to arrive at the figures it plops into form 8962. This rounding caused my calculations and TurboTax's calculations to be different by $5 when I was peering into the math of the Medical Expenses Worksheet and the value TT generated for that line 2b value. In your case, I'm guessing, but it could be that the rounding by TT creates a $1 difference for you if your method of calculating involved no rounding and used actuals from your 1095-A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medical Expenses Worksheet Question (Line 2b)

You are correct, I was able to do the same math

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nex

Level 2

user17539892623

Returning Member

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

tcondon21

Returning Member

srobinet1

Returning Member