- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Major tax reform and major changes in the tax forms have...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

Major tax reform and major changes in the tax forms have also resulted in changes to the tax software.

WHY DO I HAVE TO PAY? I WANT THE FREE EDITION

The information that you can enter in Free Edition is pretty limited now. Thanks to the new tax laws, there are no more simple Form 1040EZ or 1040A's. Everything goes on a little “postcard-size” Form 1040 that has six extra "schedules" with it, and if you need any of those schedules, you are not able to use the Free Edition. Using the standard deduction instead of itemizing does NOT mean you will not need any of those schedules.

https://www.irs.gov/forms-pubs/about-form-1040

If you qualify to use it, there is another free version of the software:

Try Free File:

You qualify if your income was $34,000 or less, or $66,000 or less if active duty military, or if you qualify for Earned Income Credit

https://ttlc.intuit.com/questions/1900583-what-is-turbotax-free-file-program

Note: If you do not qualify to use Free File then you will have to upgrade to Deluxe or higher in the paid versions of the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

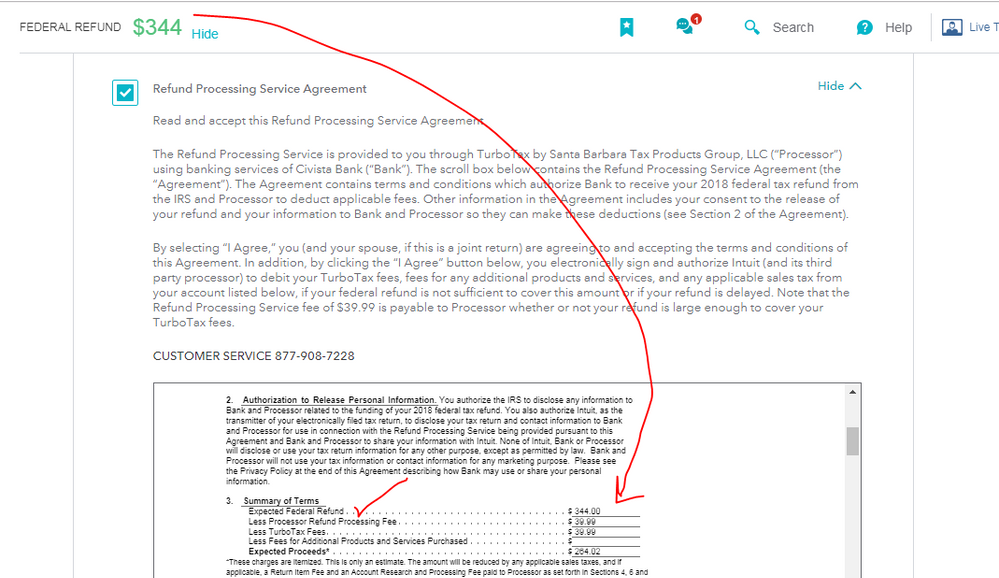

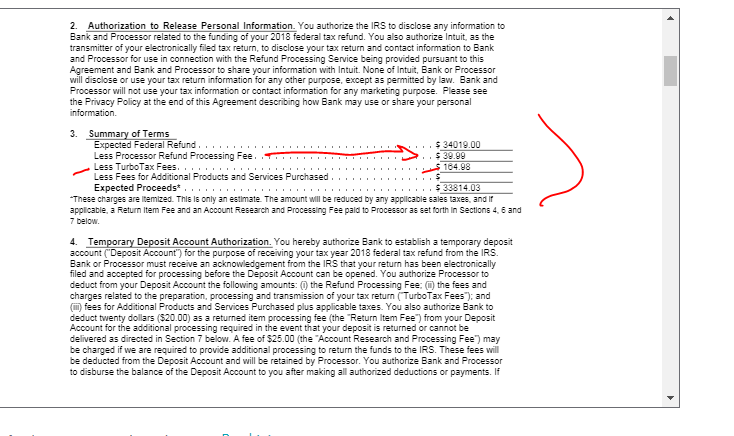

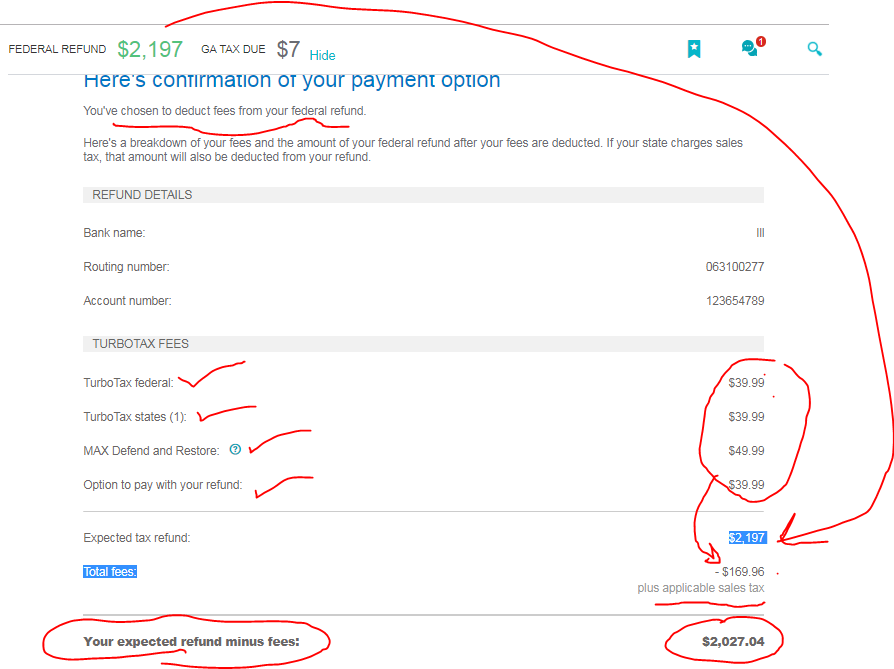

And none of the extra fees for using the Deluxe Edition are made known until the very end when you are ready to file not up front and to me this is criminal and dishonest. It should be added up front so you know they plan to take twice as much with all the extra fees. Whatever happened to transparency and customer value. Instead they weave a web of lies and deceit to be known only at the very end....just criminal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

@Mex01 wrote:

And none of the extra fees for using the Deluxe Edition are made known until the very end when you are ready to file not up front and to me this is criminal and dishonest. It should be added up front so you know they plan to take twice as much with all the extra fees. Whatever happened to transparency and customer value. Instead they weave a web of lies and deceit to be known only at the very end....just criminal.

When you make a entry that requires a form that requires an upgrade you are alerted at that time that an upgrade is necessary. You can (or should) review the forms that yiu might need and which version supports those forms before starting.

Each version and the forms supported are right on the webpage for selecting the online versions.

https://turbotax.intuit.com/personal-taxes/online/

(Use details for the exact forms in each version)

https://turbotax.intuit.com/personal-taxes/online/deluxe.jsp#tax-forms

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

You can quit posting to this forum ... no one is going to read your rants especially since the costs are revealed every step of the way. You have to agree with the upgrade and the cost is revealed.

If you have not paid or registered the account you CAN clear the return and start over. If you did register you can abandon this account and start again in a new account in the free version OR try out one of the FREE FILE options thru the IRS ...https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

Actually no they are not and just the $40 fee was there until the very end when it comes up with the fees to file the fees for the bank to deduct the cost of the deluxe fee and then the fee to send the rest of the refund to your account. You are obviously either an employee or an admin here so why don't you leave it to the the others who have also been duped into this thing too. I've been looking through the posts and am not nearly the only one who was duped into this. Turbo tax see you later!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

You figure if a million people in the US use this service and half get duped into this sort of thing...bingo...that's quite a large amount for someone who came here to file for free #1 and second not be taken advantage of by hidden fees and the truth is the truth or haven't you forgotten about that? Now I'm just ranting and done posting for stupid people because of stupid things like this. So what now I know and will use someone else next time and that's the end of that....dumb ass!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

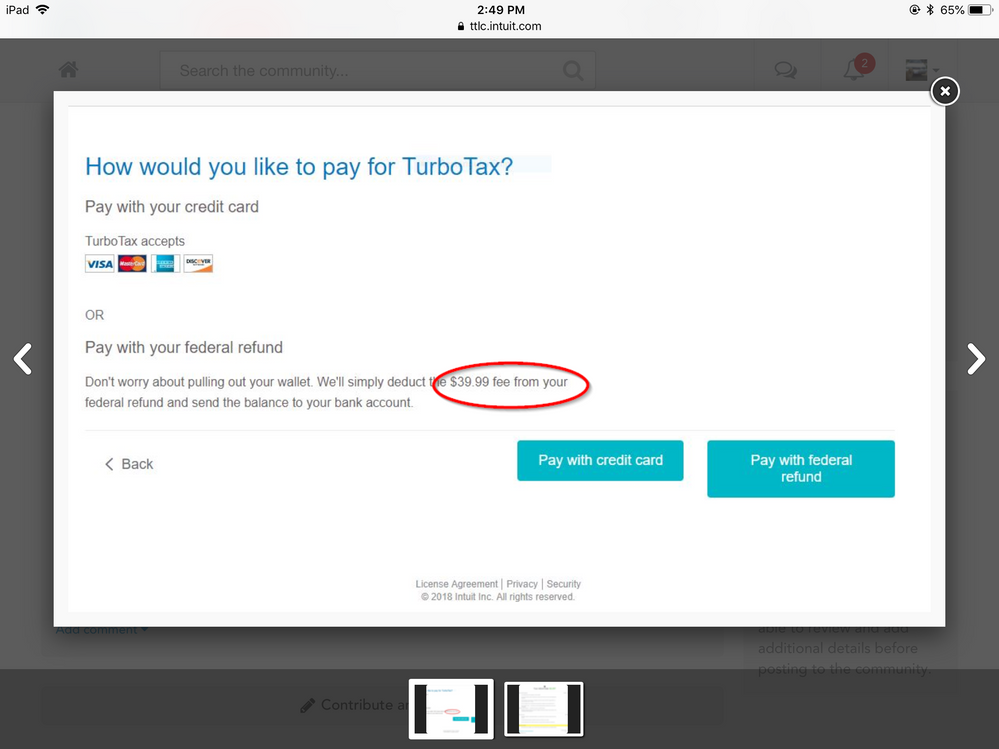

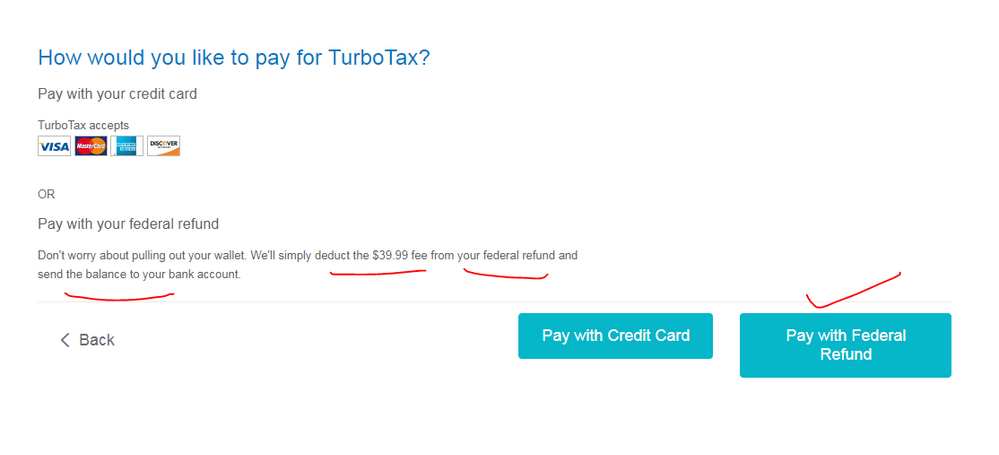

The extra 39.99 Refund Processing Service charge (44.99 in California) at the end is optional. You don't have to select that option. You can avoid it by paying the fees upfront with a credit card. It is not required to get Direct Deposit. Just read the screens more slowly and watch what you click on. It can be easy to click on the wrong button.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

You missed my point I didn't realize there was a $39.99 charge to begin with and didn't want to pay for it right then so I figured it may as well come out of the return but they then charged me more for not paying for it right away. All these things were not made known to me. I didn't realize the extra $ was on top off the $39.99 already being charged. It's really my fault for being so naive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

And again, you have to be at least 18 to use the refund processing service which means you are old enough to sign a contract and read all the screens ... you had to get by at least 4 and you had to agree to the extra fee twice. If at any time prior to filing you want to change your mind that is also an option. You have no one to blame but yourself for not reading the instructions ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

The charges are not upfront, and you don't get any alert that you have to use the deluxe addition. I think any charges should be given to you upfront, not at the end when it's time to file and your basically stuck unless you want to start all over!! They charge $40.00 to take the payment out of your return, they are already getting paid for the service and then charge more, lesson learned there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

What if you're qualified to be free they still need you to upgrade to the deleux? How much interest can you do on 1099 pre year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

@xmonniex If you have more than $1500 on an 1099INT you do not have a "simple" return and have to upgrade.

Or—-Use this IRS site for other ways to file for free. There are 8 free software versions available from the IRS Free File site

https://apps.irs.gov/app/freeFile/

Or—if you live in certain states you may be eligible to use the new IRS Direct File

( AZ, CA, FL, MA, NH, NV, NY, SD, TN, TX, WA, WY )

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being charged for the deluxe edition, I have a simple return?

@xmonniex Are you asking about how much interest you can have in the Free Edition? Under 1,500 interest and Dividends. If you have $1,500 interest or dividends you have to file it on Schedule B and upgrade to Deluxe.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

josephmarcieadam

Level 2

user17550208594

New Member

user17550208594

New Member

decoflair

Level 1

user17524923356

Level 2