- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Late taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

I failed to file my 2019 taxes by October 15th. How can I file online with Turbo Tax Deluxe?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

The 2019 tax return can now only be printed and mailed since e-filing has closed for 2019.

See this TurboTax support FAQ for printing a tax return for mailing - https://ttlc.intuit.com/community/printing/help/how-do-i-print-and-mail-my-return-in-turbotax-online...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

You can't. If you missed the deadline you will not be able now to use the online software or e-file 2019.

But you can download the 2019 desktop software to a full PC or Mac and finish it on desktop software so that you can print, sign and mail it in.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

Note: The desktop software you need to prepare the prior year return must be installed/downloaded to a full PC or Mac. It cannot be used on a mobile device.

If you are getting a refund, there is not a penalty for filing past the deadline. If you owe taxes, the interest/penalties will be calculated by the IRS based on how much you owe and when they receive your return and payment. The IRS will bill you for this; it will not be calculated by TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

If you already started your tax return in TurboTax Online, you can e-file it until October 31. If you have not yet started it, you will have to use the CD/Download TurboTax software. I don't know how much longer you will be able to e-file with the CD/Download software, but certainly not after October 31.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

@rjs Has there been a change? It's always been Oct 15 last day to efile unless you got rejected. Calendar still say Oct 15

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

@VolvoGirl wrote:

@rjs Has there been a change? It's always been Oct 15 last day to efile unless you got rejected. Calendar still say Oct 15

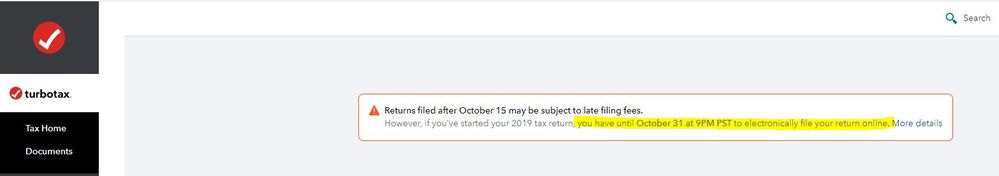

For TTO you can e-file a tax return up through October 31 for tax returns created on or before October 15. TTO returns can only be printed and mailed if created after 10/15. Verified with Moderator.

Banner on TTO when signed on -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

Thanks for the update. That's new this year, right? It wasn't true prior? Cause of Covid-19?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late taxes

As far as I know is was not valid in a prior year. If due to Covid, don't know.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

b3eb4caceb65

New Member

giad429273

New Member

joelrose909

New Member

ldane123

New Member

4ed832e35043

New Member